Business Case Study

Enhanced Customer Experience in Insurance?: Impact of Agentforce on FNOL Processes

Salesforce

Salesforce Development Salesforce Implementation Salesforce Integration AppExchange App Development Salesforce Consulting Hire a Salesforce Developer Salesforce Managed Services Salesforce Data Cloud Services Agentforce Services Salesforce QuickStart PackagesServiceNow

ServiceNow Consulting ServicesServiceNow Implementation ServicesServiceNow Managed ServicesDownload E-Guide

Download E-Guide

Register to read the complete guide as PDF on your email.

Download Customer Success Story

Download Customer Success Story

Submit your details below to get a detailed success story delivered to your inbox as a PDF.

Download Case Study

Download Case Study

Register to read the complete solution and benefits of this Case Study as a PDF on your email.

Download Whitepaper

Download Whitepaper

Register to Get the Whitepaper Delivered Straight to Your Email.

Download Industry Report

Download Industry Report

Register to Get the Industry Report Delivered Straight to Your Email.

Table of Contents

Salesforce Financial Services Cloud is a specialized CRM platform designed to empower financial institutions and optimize their operations. It is built on the robust foundation of Salesforce’s core CRM infrastructure. FSC brings together client data and interactions from various business touchpoints, regions, and channels to offer a unified view of customer relationships.

The solution caters to a huge range of providers including banking, wealth management, insurance, asset management, etc. Financial Services Cloud easily blends industry-specific functionalities with the powerful capabilities of Salesforce Sales Cloud and Service Cloud.

Moreover, the platform enables financial institutions to integrate data from a range of sources—including core banking systems, portfolio management tools, and financial planning software—into one scalable and secure environment.

Administrators can also tailor workflows, processes, and data models to align with their organization’s needs, aligning it with Salesforce’s commitment to security, scalability, and customization. By streamlining implementation and automating routine tasks, Financial Services Cloud allows teams to concentrate on client-centric activities while maintaining compliance and operational agility.

Salesforce Financial Services Cloud isn’t just a CRM—it’s a game-changer for financial institutions looking to deepen client relationships and streamline operations. By unifying customer data, automating routine tasks, and integrating seamlessly with core banking and financial tools, it allows firms to work smarter, not harder.

Salesforce Financial Services Cloud is designed to meet the diverse needs of financial institutions by providing tailored solutions. Its robust offerings, add-ons, and industry-specific features help organizations streamline workflows and deliver personalized financial services. Here’s a detailed look at how it contributes to specific sectors within the financial industry.

It equips retail banks with a unified customer view, enabling personalized services and enhancing operational efficiency.

The Financial Cloud enhances relationship management and operational efficiency for commercial banks by centralizing client interactions.

FSC streamlines the loan lifecycle from application to closing, enhancing efficiency in the mortgage and lending sector.

Here is how this solution from Salesforce efficiently manages complex client relationships and transactions for corporate investment banks:

Financial Cloud enhances customer relationship management and operational efficiency for insurance agencies.

The platform improves client engagement and financial planning for life and annuity insurance providers.

Enhanced Customer Experience in Insurance?: Impact of Agentforce on FNOL Processes

Improved FNOL Process time & Response time by

Claim adjuster’s productivity improved by

Customer satisfaction increased by

Financial Cloud streamlines benefits administration and enhances communication between employers and employees.

This Salesforce solution for Wealth Management provides comprehensive portfolio management and personalized investment strategies for wealth management firms.

Salesforce for financial services optimizes investment strategies and client relationships for asset management firms.

By offering tailored solutions across these sectors, Salesforce Financial Services Cloud empowers financial institutions to streamline workflows, enhance client engagement, and maintain compliance, ultimately driving growth and operational excellence.

→ Discover how a global financial services company achieved operational excellence and high-end security with Salesforce. [Download Now]

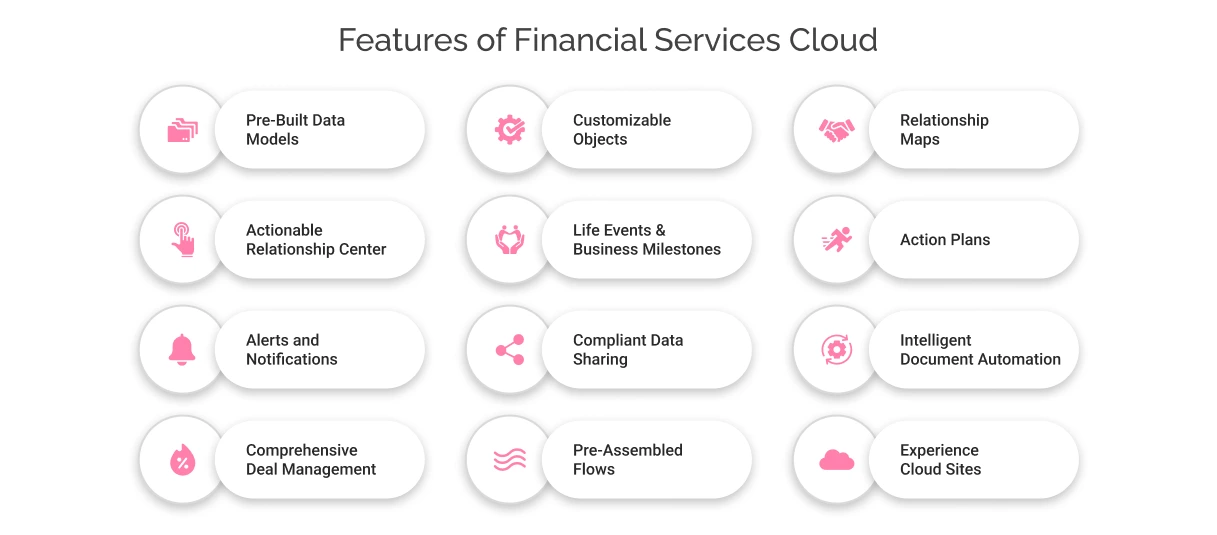

Salesforce Financial Services Cloud goes beyond a one-size-fits-all approach. It equips financial institutions with features designed to boost efficiency, enhance customer engagement, and empower informed decision-making across multiple roles and departments. Here’s a closer look:

Salesforce FSC provides pre-configured data models tailored to the financial industry, covering Wealth and Asset Management, Banking, and Insurance. These models are designed to handle industry-specific data types, relationships, and workflows, significantly reducing the need for custom development.

By leveraging these models, financial institutions can ensure best practices, improve data management, and accelerate implementation while maintaining regulatory compliance.

FSC extends the standard Salesforce Sales and Service Cloud objects with industry-specific packaged objects. This allows firms to tailor the platform by adding custom fields, workflows, and automation that reflect their internal processes.

Financial institutions can create bespoke solutions that align with their business needs, enhancing operational efficiency and decision-making with this flexibility. But when requirements move into areas like product logic, advisory automation, or regulated financial workflows, Salesforce development for Financial Services Cloud becomes essential to support those capabilities at scale.

Understanding complex client networks is crucial in financial services. FSC’s Relationship Maps visually represent client connections, linking businesses, legal entities, households, and other relevant entities.

By mapping these relationships, advisors can gain deeper insights into client ecosystems, identify cross-selling opportunities, and build more personalized engagement strategies.

The Actionable Relationship Center (ARC) serves as a centralized interface for managing client interactions. By aggregating all relevant data into a single, easy-to-navigate dashboard, ARC allows advisors to access comprehensive client profiles, monitor interactions, and take proactive actions.

This enhanced visibility enables more informed decision-making, fostering stronger client relationships and improving service responsiveness.

Life events and business milestones often trigger significant financial decisions. FSC helps advisors track these critical moments, such as career changes, major investments, and retirement planning. By providing a structured view of these events, advisors can offer timely and relevant financial guidance, positioning themselves as trusted partners. This approach enhances client retention, satisfaction, and revenue growth through personalized financial planning.

To ensure process consistency and efficiency, FSC provides Action Plans that automate task assignments and deadlines for routine activities, such as client onboarding, compliance verification, and portfolio reviews. These automated workflows help financial institutions maintain regulatory compliance, reduce manual errors, and enhance productivity. Advisors can focus on higher-value tasks, improving client outcomes and operational efficiency.

In the fast-paced financial industry, timely information is essential. FSC’s alert system delivers real-time notifications about key client activities, such as large transactions, policy renewals, and address changes.

These alerts enable advisors to respond proactively, mitigate risks, and maintain strong client relationships. Financial professionals can offer more responsive and effective client support by staying informed.

Regulatory compliance is a top priority for financial institutions. FSC provides advanced data-sharing controls that allow organizations to configure role-based access to sensitive client information.

These security measures help firms comply with regulations such as GDPR and CCPA, reducing the risk of data breaches and unauthorized access. FSC enhances data privacy, security, and legal compliance by ensuring only authorized personnel can view and modify data.

Managing financial documents manually can be time-consuming and error-prone. FSC’s Intelligent Document Automation streamlines document processing by automating the management of consent forms, disclosure documents, and authorization requests.

This reduces paperwork, accelerates approvals, and ensures compliance with industry regulations. Financial advisors can focus more on client engagement rather than administrative tasks, improving overall productivity.

Successful deal management requires transparency, collaboration, and control. FSC enables sales teams to manage all aspects of financial deals through role-based data-sharing options. This feature ensures that sensitive deal-related information remains accessible only to authorized stakeholders while facilitating seamless collaboration. Institutions can accelerate deal cycles, minimize risk, and optimize deal outcomes with better deal tracking and oversight.

FSC includes industry-specific pre-assembled flows that automate key processes, enhancing efficiency and customer experience:

FSC enhances client engagement through self-service portals that empower both customers and financial professionals:

To fully leverage these FSC features, it’s recommended to hire Salesforce Financial Services Cloud developers with expertise in building and scaling FSC solutions.

As the financial sector embraces digital transformation, safeguarding every aspect of customer data remains a top priority. However, not all tools offer the highest level of security. Salesforce Financial Services Cloud stands out by providing a robust security architecture and comprehensive safeguards, ensuring the protection of sensitive financial information.

Financial Services Cloud is designed with enterprise-grade security features designed to meet the stringent requirements of the financial sector:

I. Comprehensive Encryption

II. Granular Access Controls

Role-based permissions ensure that employees only access data relevant to their role. For example, a financial advisor might access client portfolios, while customer support staff can only see contact and order-related information. This reduces the risk of unauthorised access.

Multi-Factor Authentication (MFA) is enforced to block unauthorized logins, even if the passwords are compromised.

Financial institutions operate under stringent regulatory frameworks and compliance with security and privacy standards, which are non-negotiable. This Salesforce product simplifies this process by adhering to globally recognized certifications, including ISO 27001, SOC 1/2/3, and PCI DSS, ensuring organisations meet critical security benchmarks.

Additionally, it provides data residency options, allowing businesses to store and process data in specific regions to comply with laws like GDPR and CCPA. Furthermore, a comprehensive audit trail tracks all data access and modifications, enabling seamless compliance reporting and demonstrating accountability in case of audits.

For organizations handling highly sensitive financial data, Salesforce Shield offers additional security features to protect against sophisticated threats. Platform Encryption extends encryption capabilities to include attachments and metadata, ensuring complete data protection.

Event Monitoring provides real-time visibility into system activity, detecting anomalies such as unusual login attempts or bulk data exports, which could indicate a security breach. This allows security teams to respond promptly to potential threats. Additionally, Data Masking prevents accidental exposure of sensitive information by obscuring it in user interfaces and reports, reducing the risk of data leaks.

While this cloud offers robust security features, organizations must take an active role in safeguarding data. Security is a shared responsibility that requires proper configuration, continuous monitoring, and employee awareness. Features like MFA and field encryption must be correctly implemented and regularly updated to ensure effectiveness. Employee training is equally critical, as phishing attacks and weak password practices remain significant threats.

Organizations should educate their teams on security best practices, such as recognising phishing attempts and using strong, unique passwords. Additionally, integrating the financial cloud with external security tools like Splunk enables proactive threat detection, allowing businesses to respond swiftly to potential security incidents.

Despite its robust security measures, no system is entirely immune to risks. Insider threats remain a concern, as malicious actors with legitimate access can exploit sensitive data. Organisations should enforce strict access controls and conduct regular security audits to mitigate this.

Additionally, third-party integrations can introduce vulnerabilities, making it essential to vet all connected applications to prevent security loopholes carefully. Since the cybersecurity landscape constantly evolves, it becomes crucial for organizations to update their security policies and stay ahead of emerging threats. A proactive approach to security ensures FSC remains a safe and reliable platform for financial institutions.

By employing these comprehensive safeguards, Salesforce Financial Services Cloud empowers you to prioritize the security of your client data, fostering trust, ensuring compliance, and enabling you to focus on delivering exceptional financial services with peace of mind.

To better understand how the cloud can be customized to meet the specific security and compliance needs of your financial organization, you can access guides and references that provide valuable insights, best practices, and real-world use cases. These resources will help you comprehend the full range of possibilities available to you!

If you are looking for a reliable Financial Service Cloud Implementation Services, then get in touch with our experts and schedule a call today!

Salesforce Financial Services Cloud is a standalone solution for financial services providers. But when integrated with other products like Experience Cloud, Data Cloud, Revenue Intelligence, etc., it can do wonders.

Here’s how integrating FSC with these products can work for businesses:

By connecting the financial services platform with Experience Cloud, financial institutions enable secure access to client data for external users—be it partners or customers. This approach fosters transparency and boosts engagement by offering a centralized platform where clients can conveniently view their financial information.

Ultimately, this integration increases transparency by providing real-time access to critical financial information, streamlining communication between advisors and clients, and improving customer trust and satisfaction.

When the platform is integrated with CRM Analytics, financial advisors gain a powerful tool for customer intelligence. The inclusion of Einstein Discovery enables the creation of automated AI models, uncovering hidden patterns within customer data and offering more profound insights into client behavior.

This integration empowers financial institutions to make informed decisions based on data-driven insights, enabling advisors to deliver highly personalized services and fostering improved customer engagement and service delivery.

Connecting the platform with Data Cloud allows financial institutions to merge client data from multiple channels—interaction, behavioral, and transactional—into a unified view. This comprehensive approach ensures that institutions have a well-rounded understanding of their clients.

The integration deepens customer understanding, breaks down data silos to improve operational efficiency, and supports more targeted and effective service delivery across the board.

By merging the financial services platform with Revenue Intelligence, institutions can use predictive analytics to identify customers at risk of churning or those likely to add assets. This predictive approach enables proactive engagement, ensuring that customers receive the most relevant products and services.

This integration drives revenue growth by targeting customers with personalized offerings and improves customer retention through proactive engagement strategies that address client needs before dissatisfaction occurs.

Integrating with Salesforce Scheduler empowers financial institutions to deliver a personalized customer experience by scheduling appointments with precision. This ensures that clients meet with the right advisor at the optimal time, enhancing engagement and satisfaction.

This integration enhances the overall customer experience by ensuring timely and personalized interactions, boosting operational efficiency and reducing administrative burdens.

Pairing the financial services platform with Salesforce Shield adds a robust layer of security. This integration is designed to protect sensitive client data with comprehensive security tools, ensuring data integrity and regulatory compliance.

By reinforcing data security and ensuring compliance with regulatory standards, this integration minimizes the risk of data breaches and non-compliance penalties, thereby protecting client trust and the institution’s reputation.

Integrating FSC with Marketing Cloud Account Engagement (formerly Pardot) provides a full suite of marketing automation tools that enable financial institutions to manage campaigns effectively. This integration allows for personalized customer interactions and streamlined marketing operations.

This integration enhances customer engagement by delivering personalized marketing messages and improves operational efficiency by reducing manual marketing tasks, ultimately leading to higher conversion rates.

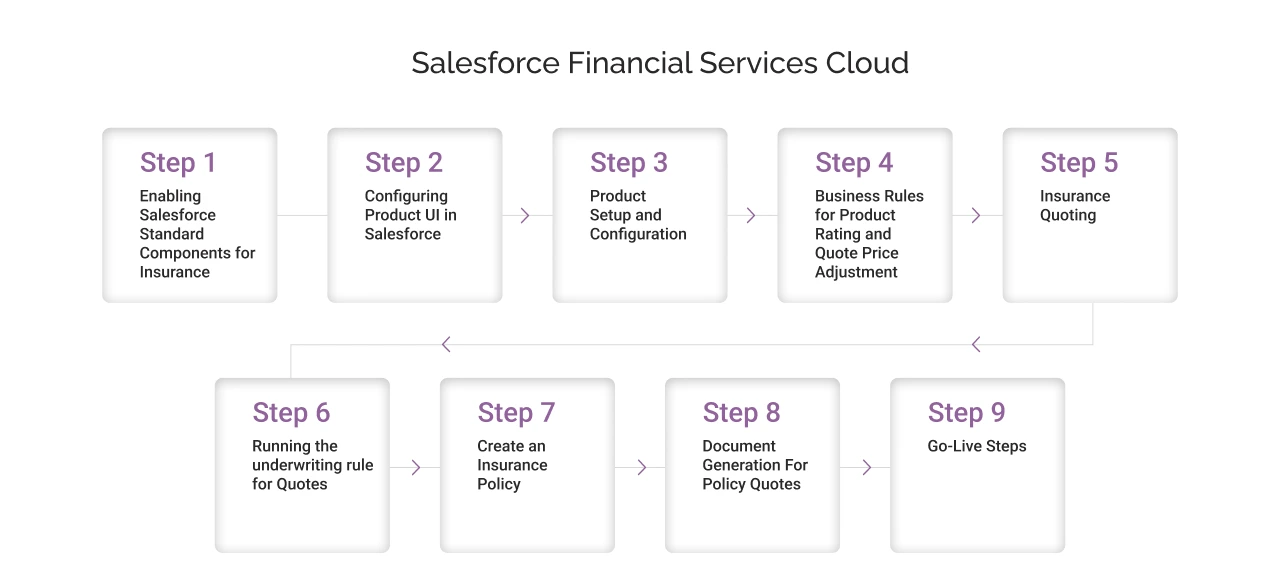

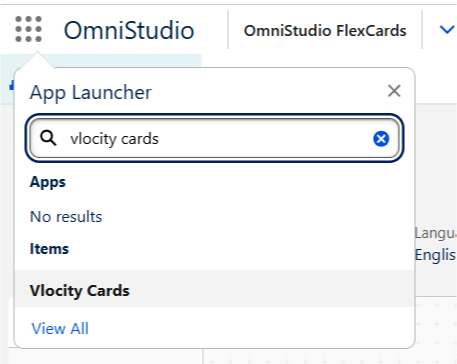

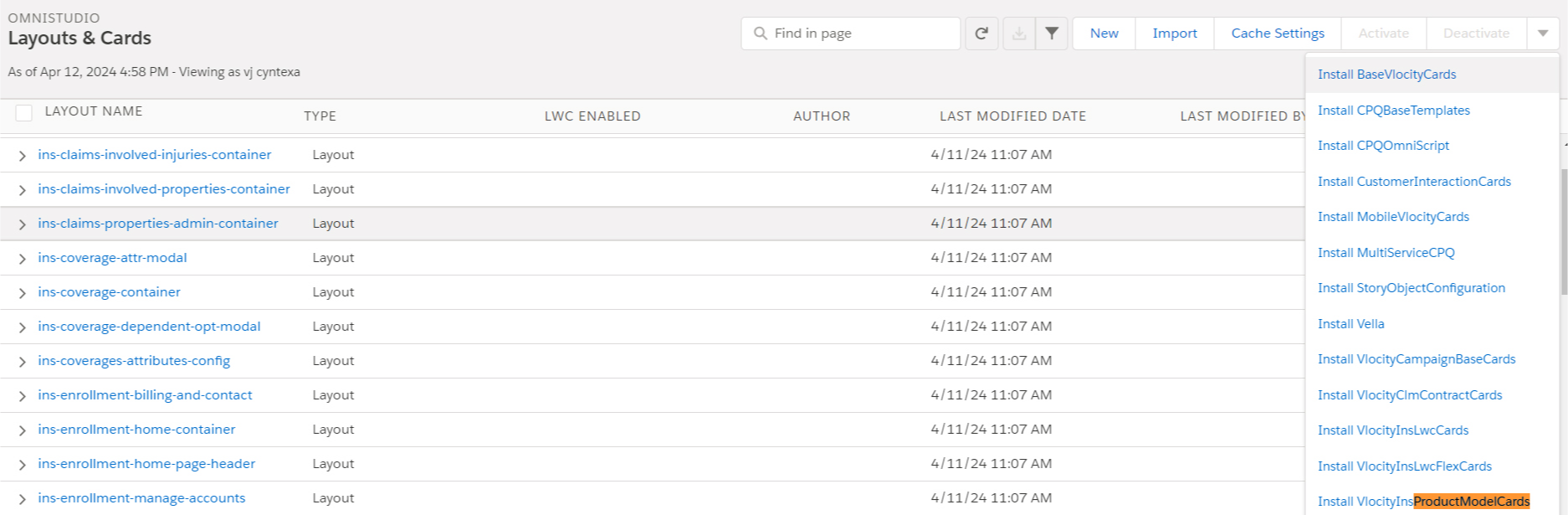

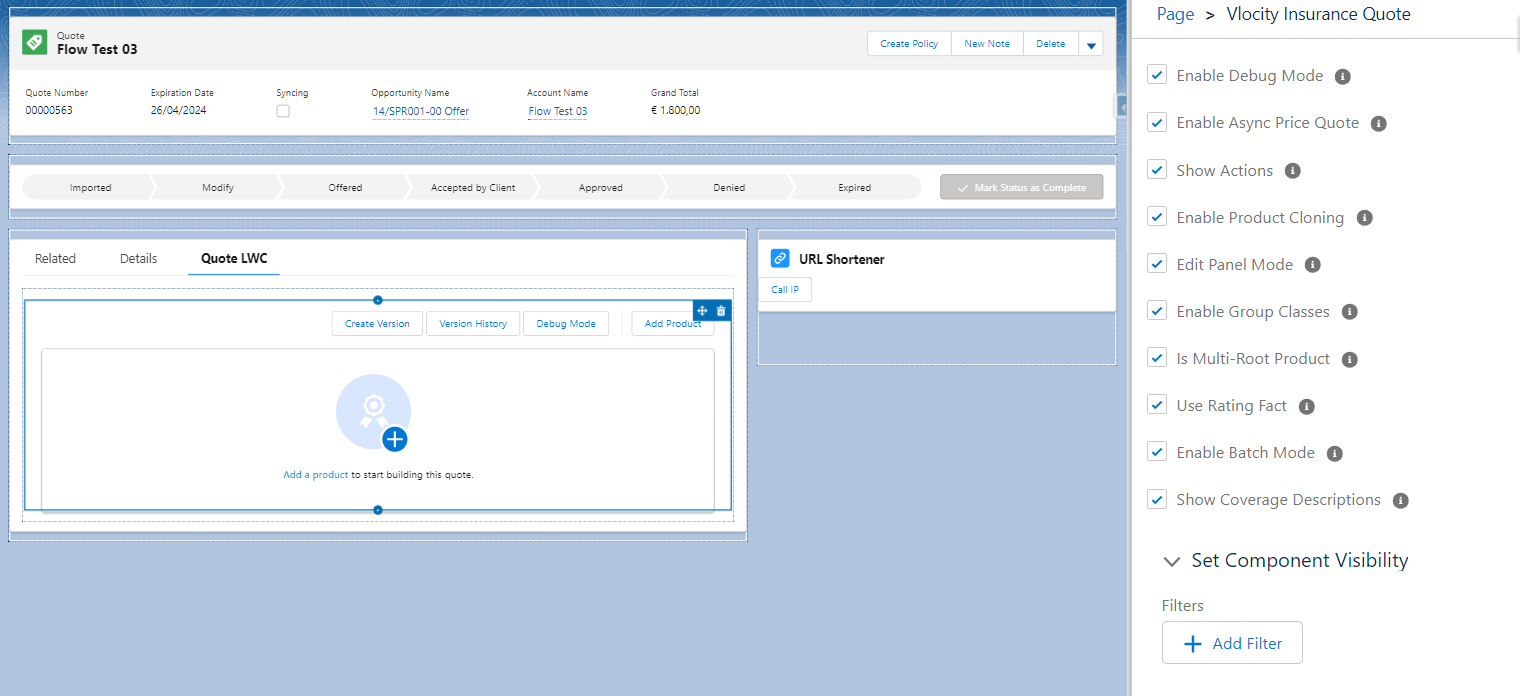

Before configuring insurance products in Financial Services Cloud (FSC), the following packages must be enabled:

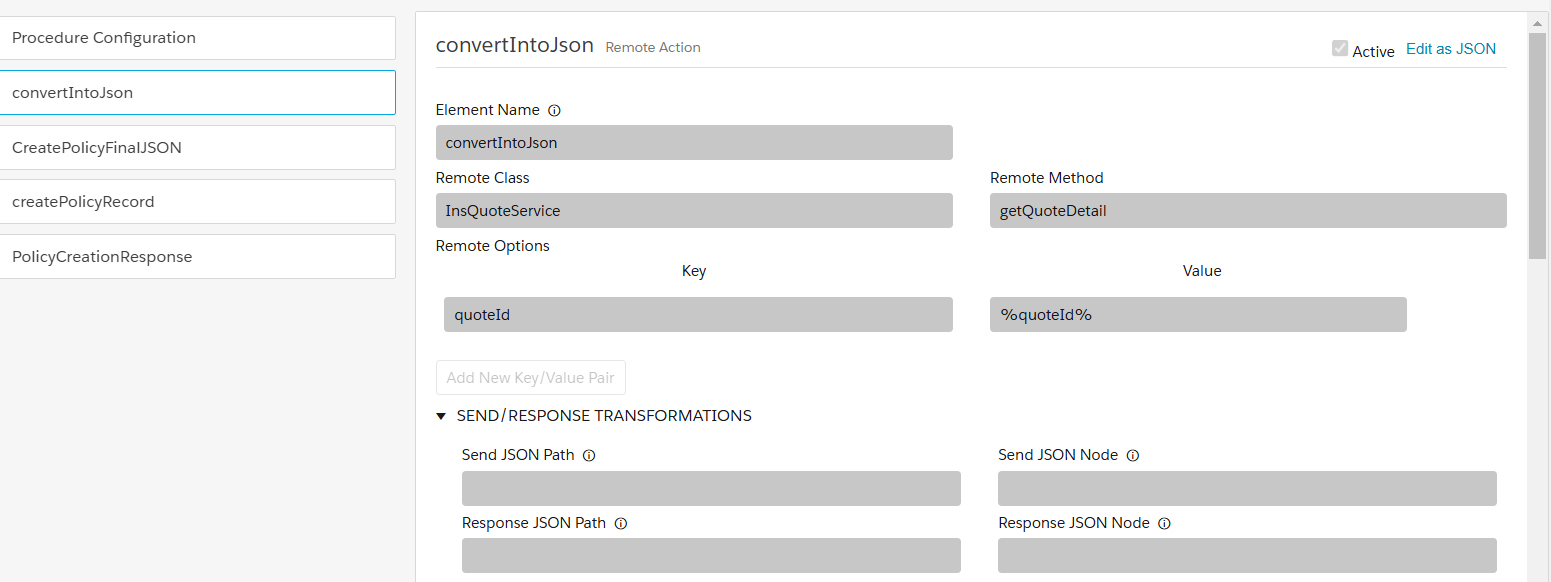

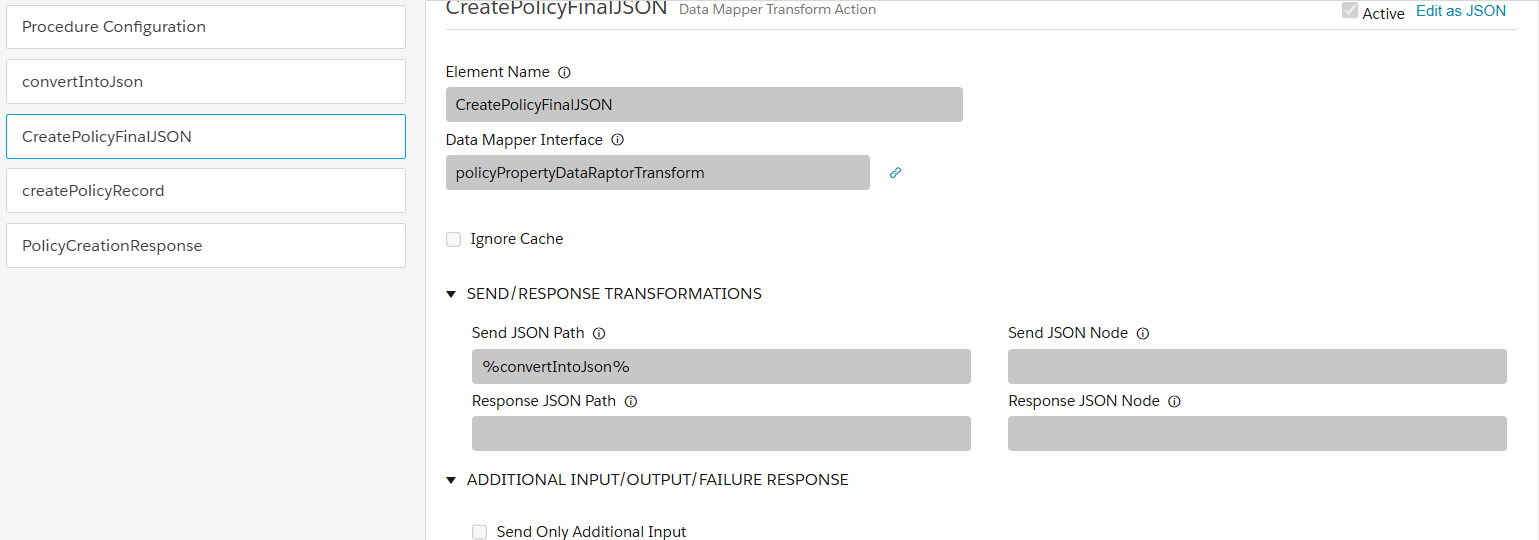

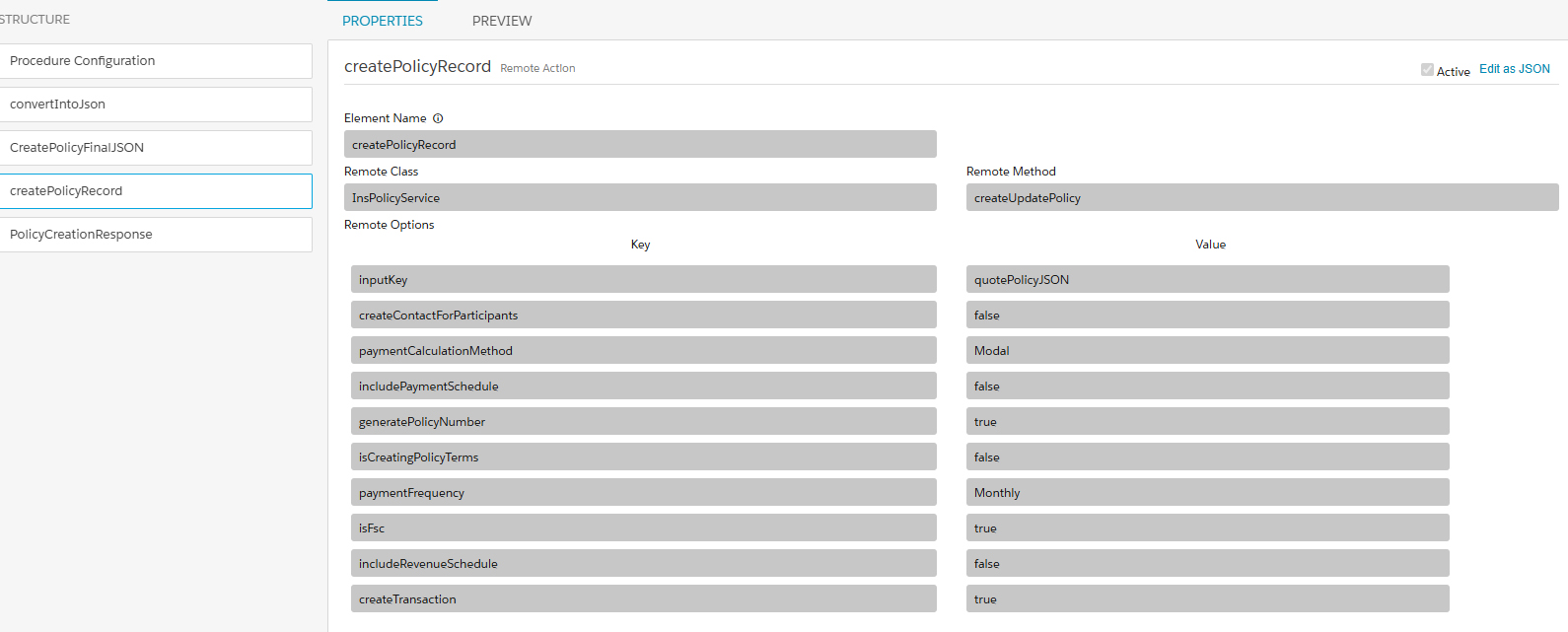

The following are the guided steps for successfully implementing Salesforce Financial Services Cloud:

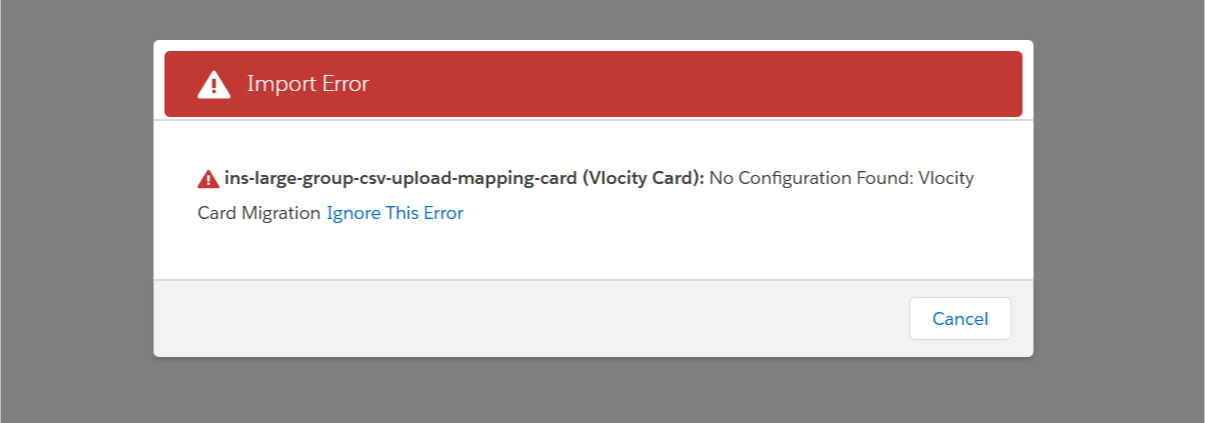

Note: Common Installation Error: VlocityInsProductModelCards

If you encounter errors while installing VlocityInsProductModelCards, follow these steps:

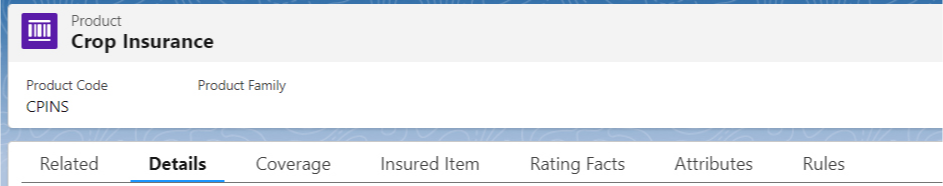

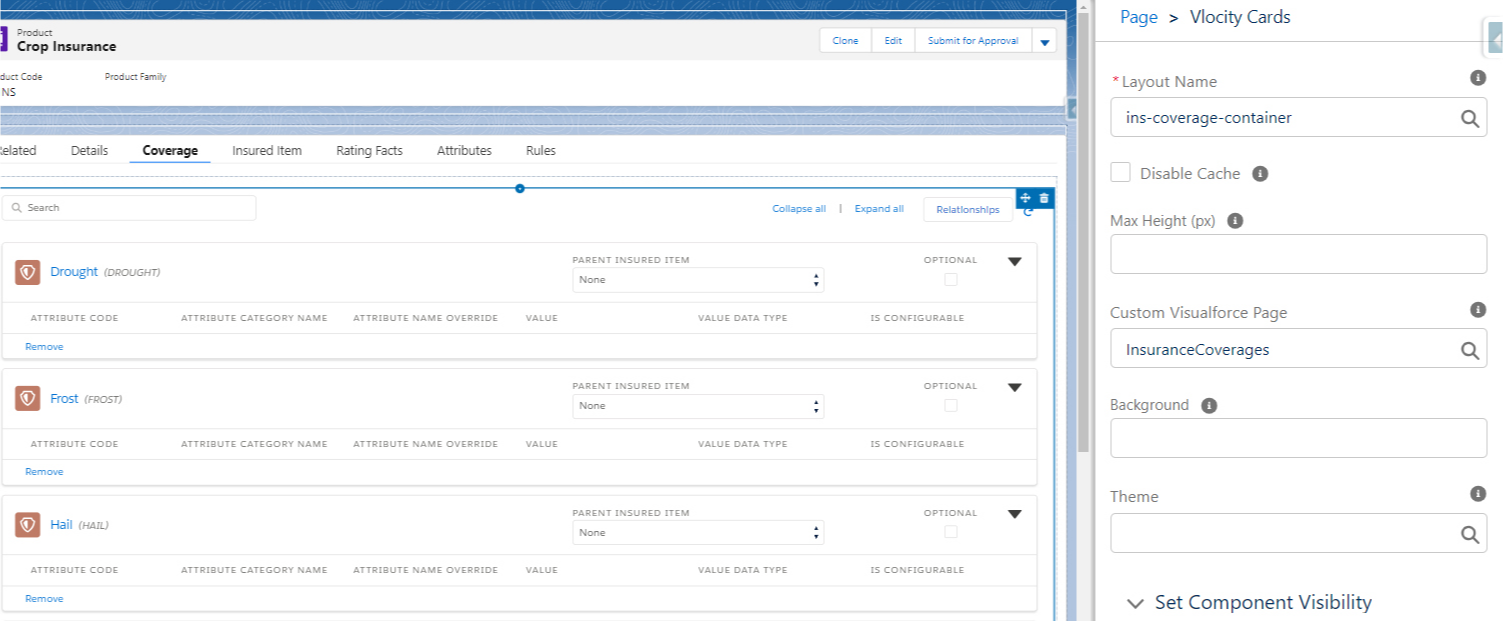

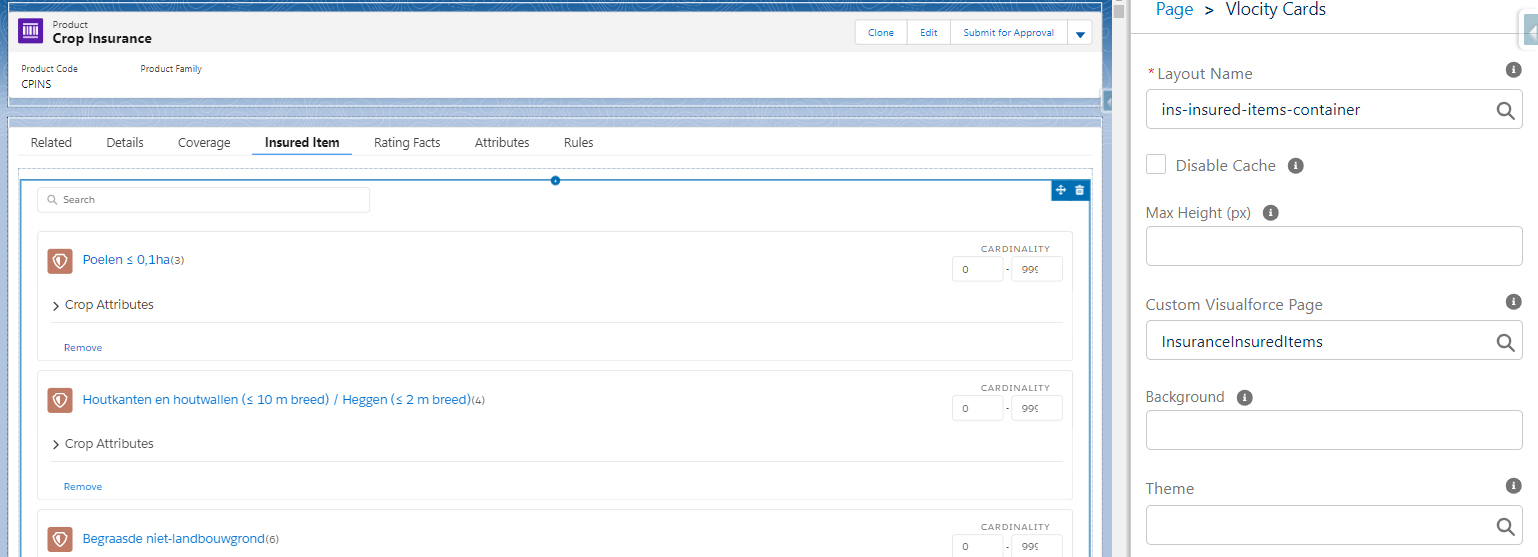

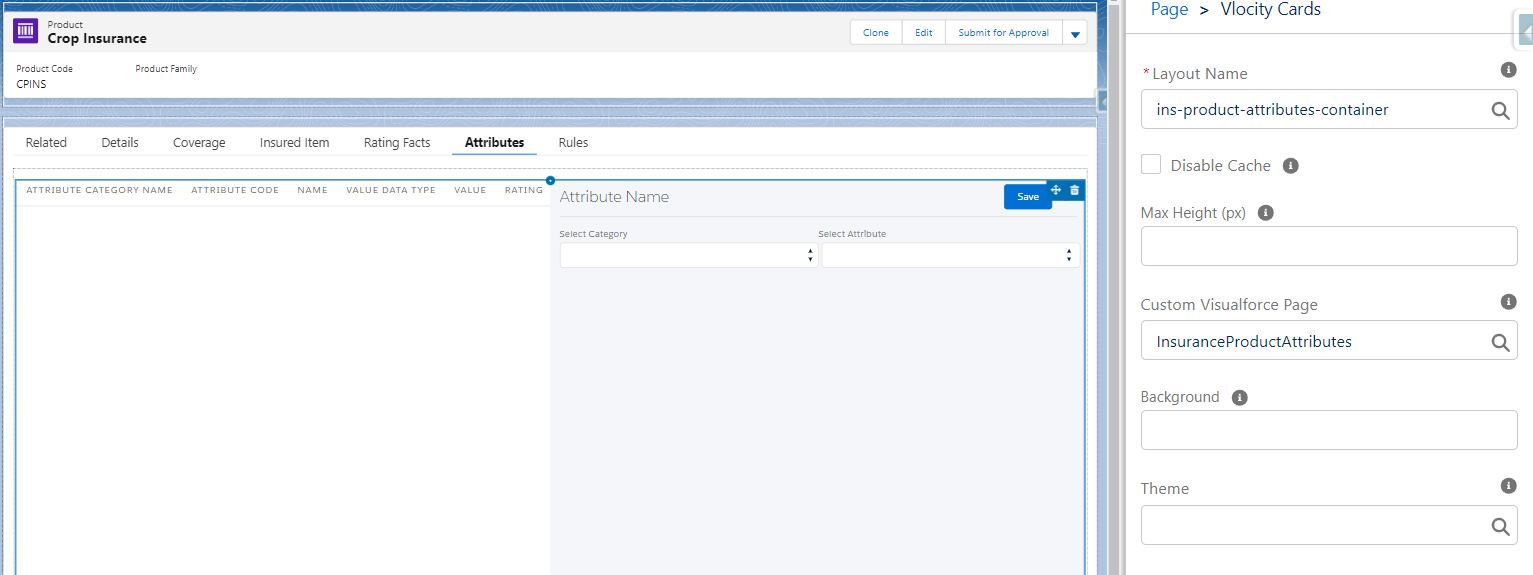

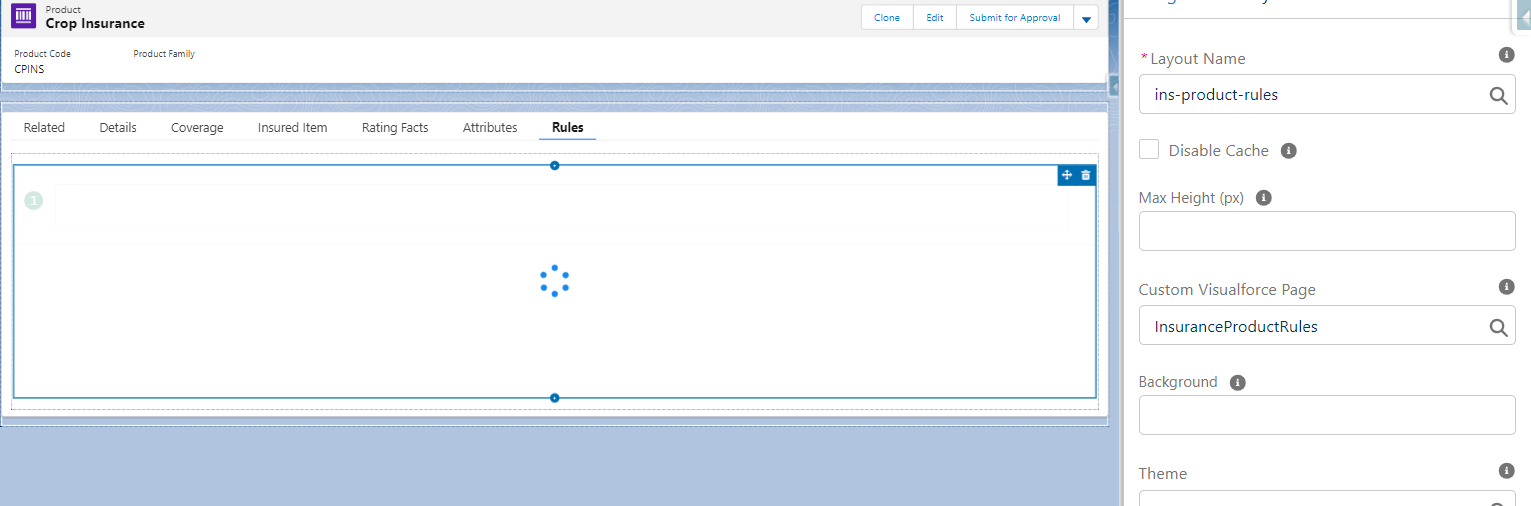

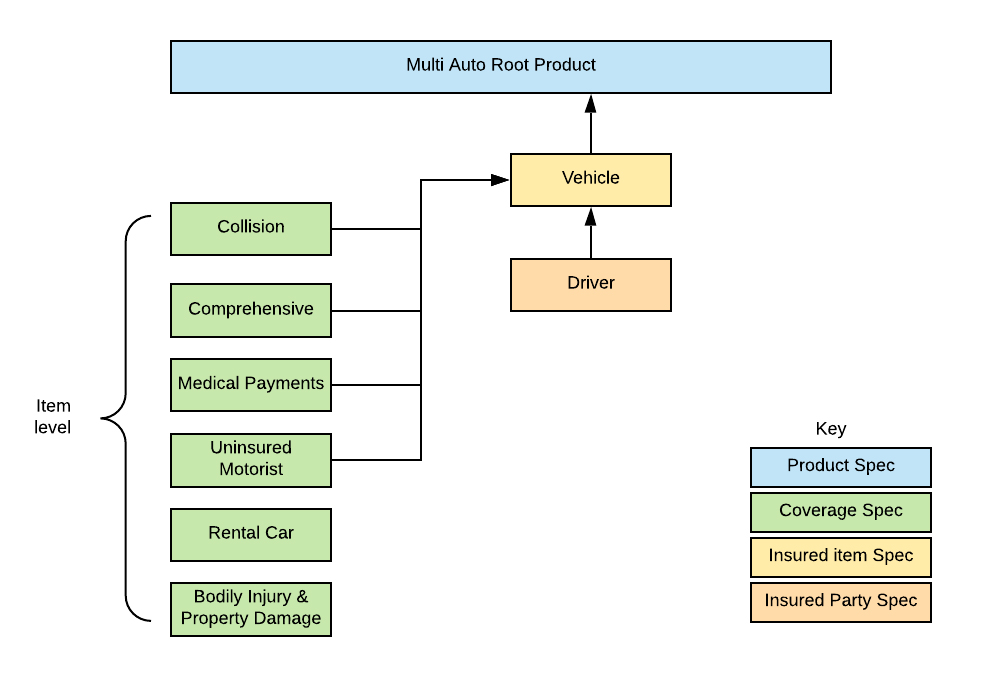

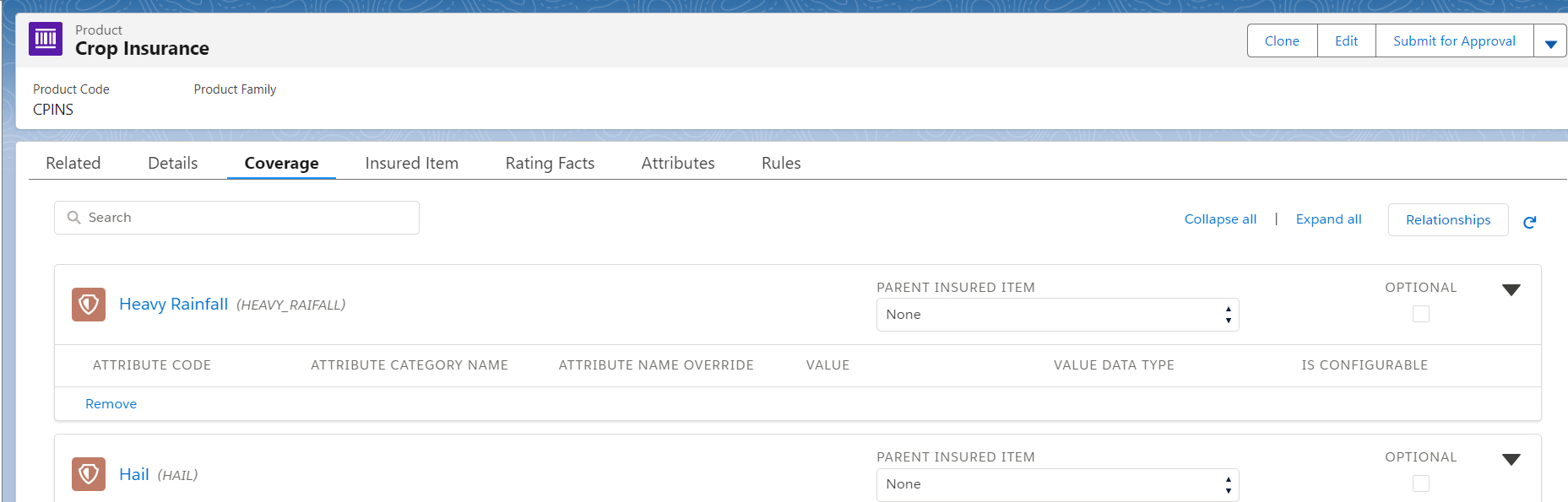

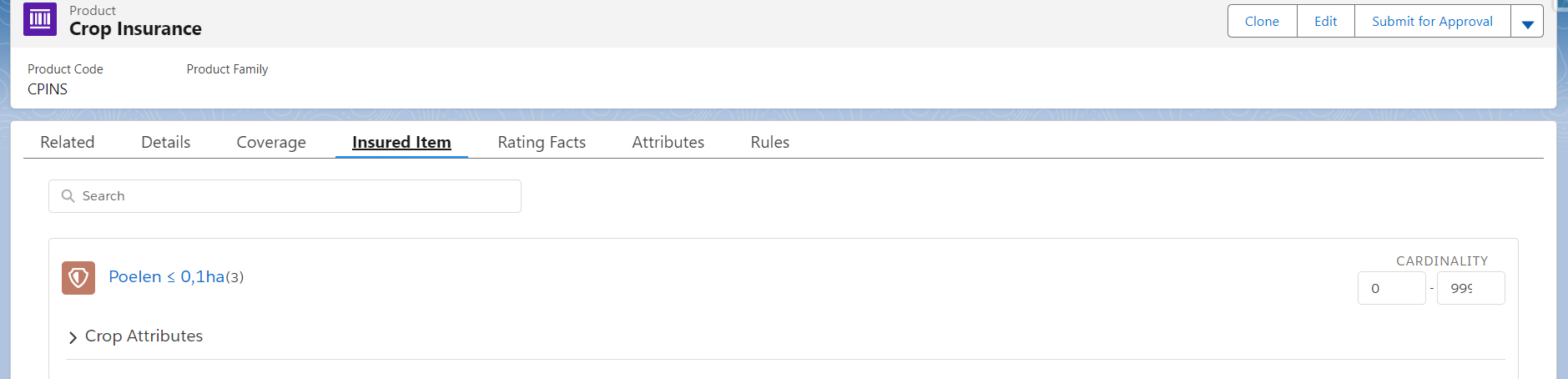

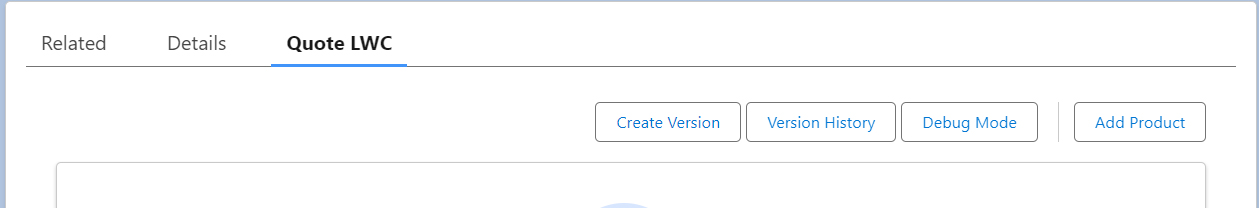

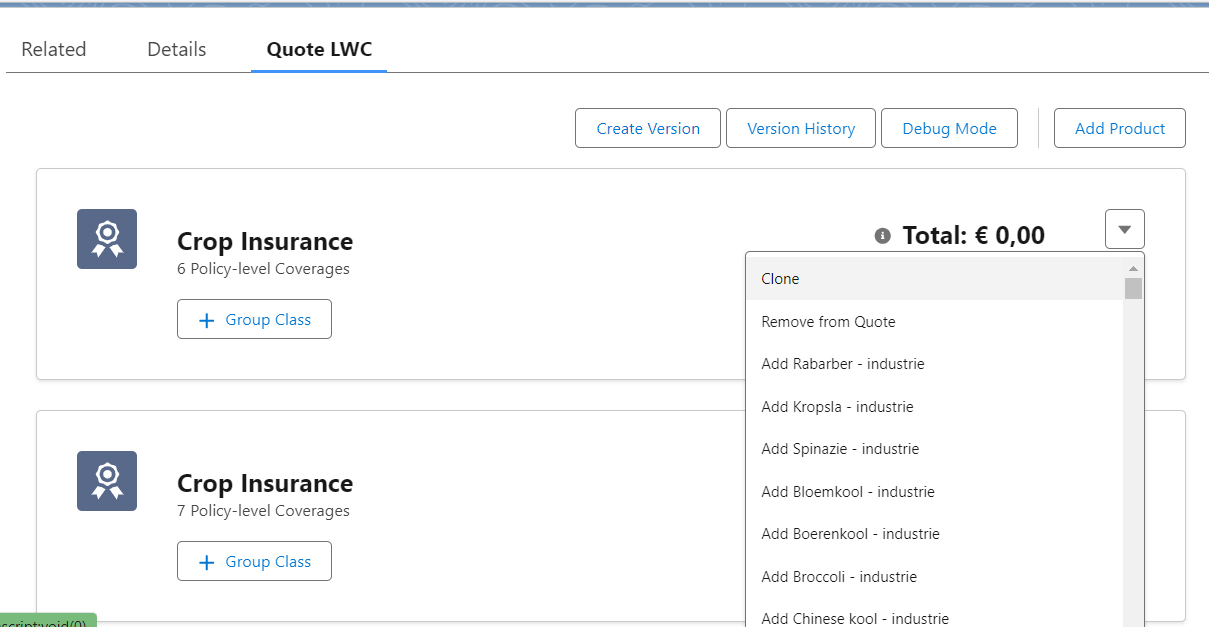

After configuring all product-related settings, your product will be structured as follows:

Note: Insurance coverage refers to the protection of an individual or entity against potential risks. It can include various types such as auto insurance, life insurance, or specialized options like hole-in-one insurance. Coverage ensures financial security against unforeseen events and is issued by insurers based on specific terms and conditions.

Note: In insurance, the insured item refers to the specific object, property, person, or entity protected by a policy. It could be a car, house, valuable possessions, a person’s life, health, or even business operations. Essentially, it’s what the insurance policy is designed to safeguard against potential risks or losses.

For instance, in auto insurance, the insured item is the vehicle, while in life insurance, it’s the insured person’s life. Identifying the insured item is key to understanding the scope of coverage and the protection provided by the policy.

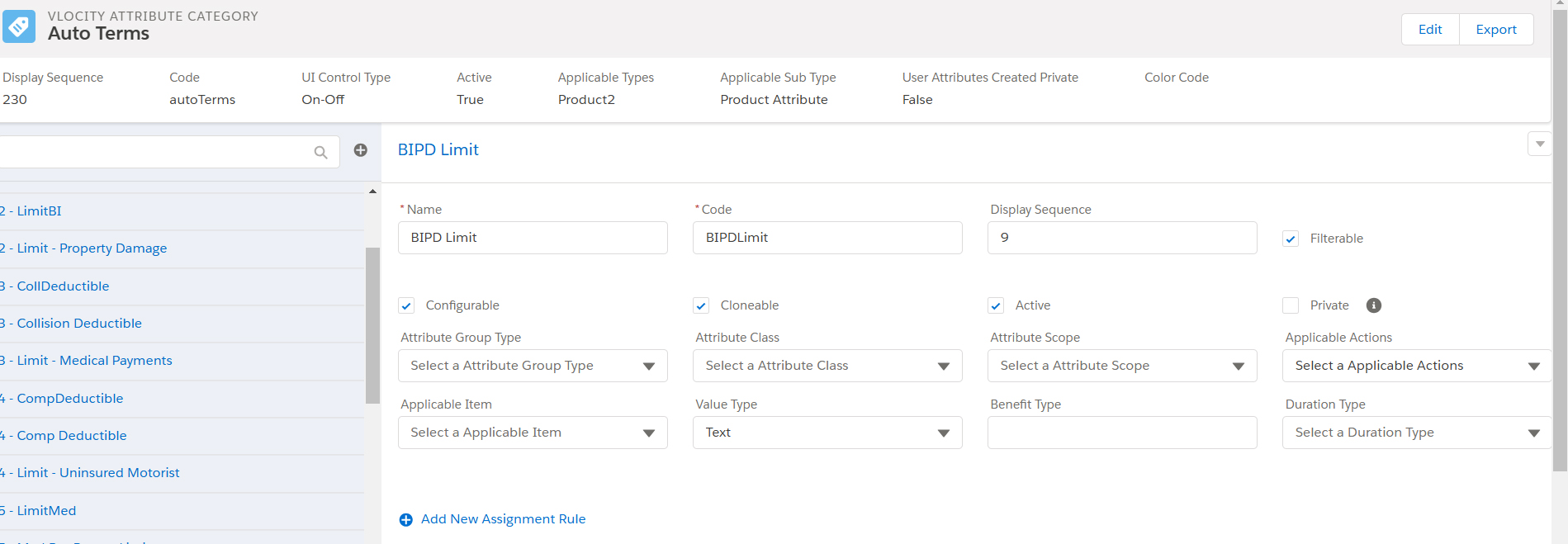

Attributes play a crucial role in insurance by storing essential information about insurance products. Instead of creating multiple fields (columns) for various details—risk assessment, premium calculation, and insured product rating—attributes provide a scalable way to manage metadata without exceeding system limits.

For instance, attributes like model, value, make, and colour in vehicle insurance help assess risk and determine premiums. Similarly, in crop insurance, attributes such as yield, area, season, geolocation, and historical pandemic data contribute to risk evaluation.

For more details on attribute configuration, refer to the Attribute configuration.

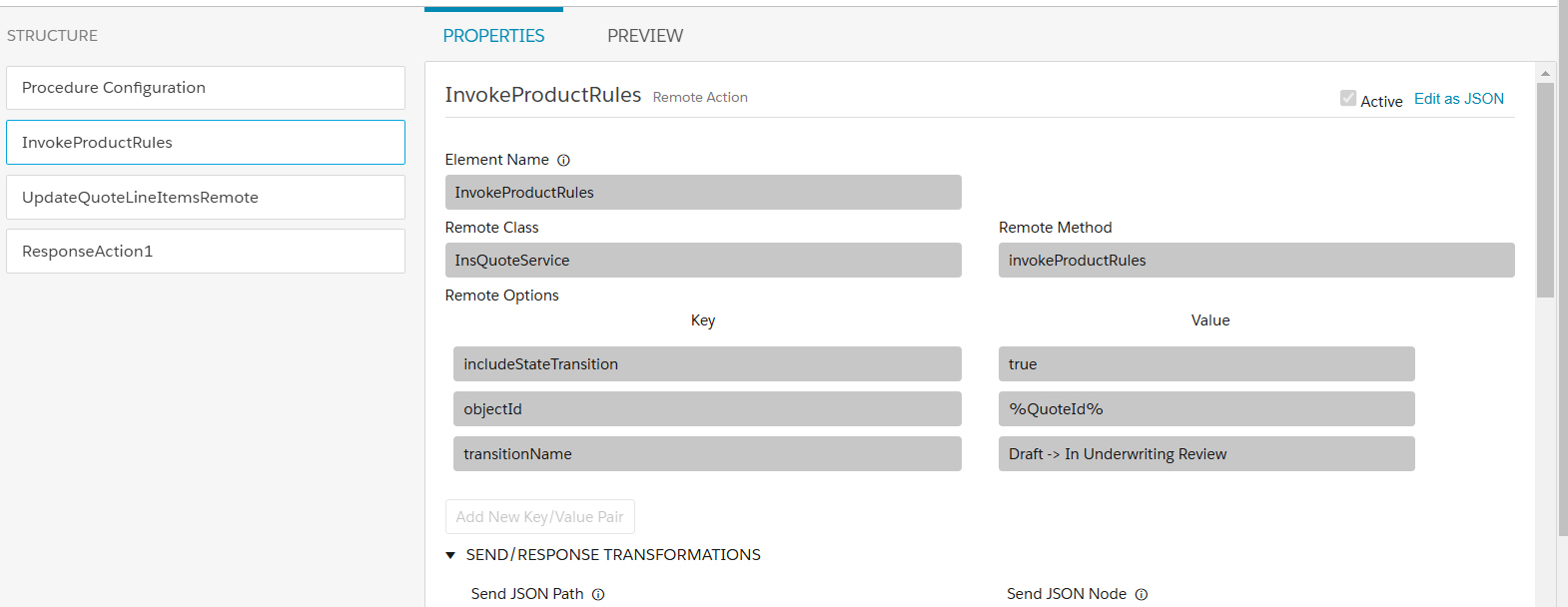

The Underwriting Rule Engine in Salesforce enables insurers to define and enforce underwriting rules efficiently. These rules establish criteria such as risk factors, eligibility, coverage limits, and pricing guidelines. The system automates rule evaluation, ensuring consistency and accuracy in underwriting decisions.

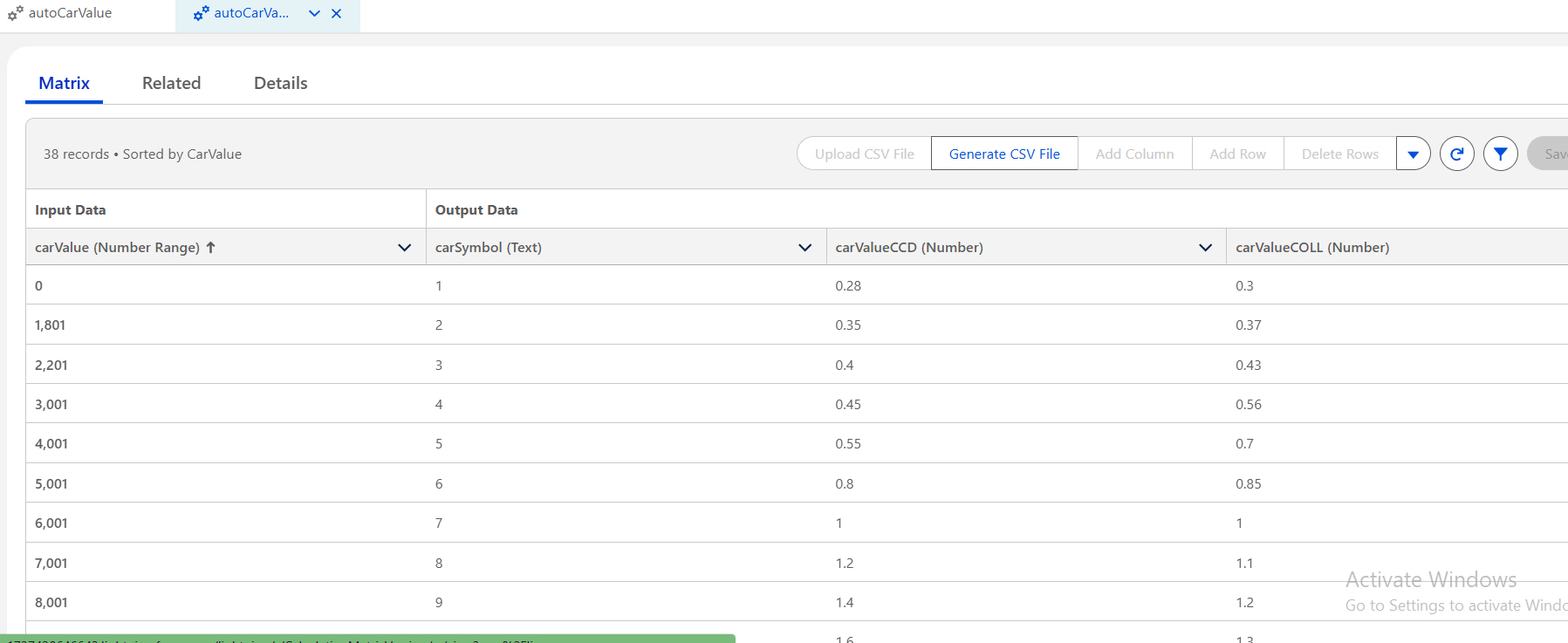

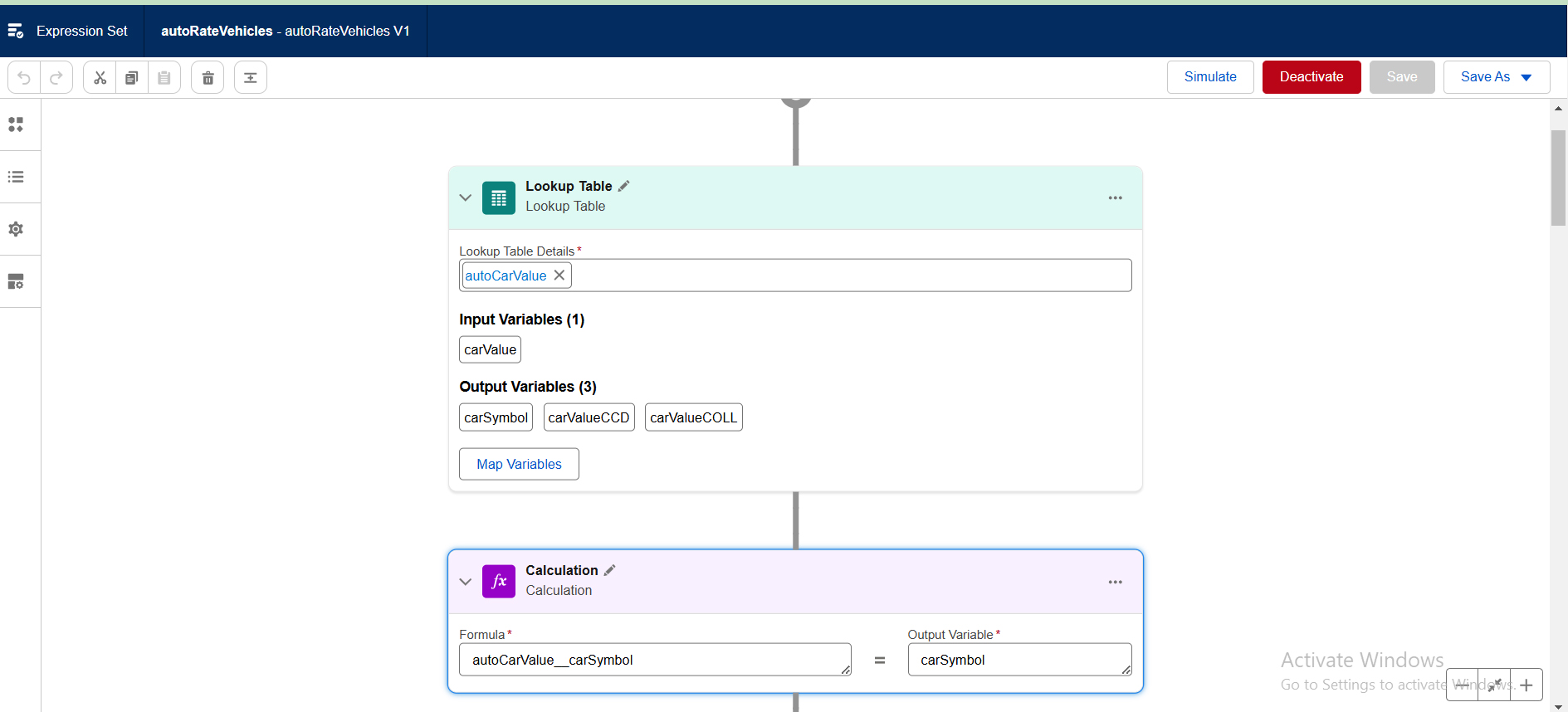

Lookup tables (decision matrices) rate products based on predefined inputs, helping in premium calculations and pricing adjustments.

Go to App Launcher > Business Rule Engine > Lookup Table > New (Decision Matrix).

Insurers can automate premium determinations, risk assessments, and complex product calculations by leveraging lookup tables and calculation functions.

Note: – Limitations of the Business Rule Engine

While BRE provides powerful decision-making capabilities, it comes with certain limitations. Some restrictions can be adjusted by referring to BRE limitations. Ensure you evaluate these constraints before implementing extensive rule configurations.

An insurance quote is the estimated cost of a policy based on the information provided to the insurer and the selected coverage. You typically receive an insurance quote when shopping for new coverage.

Underwriting rules evaluate insured items to ensure they meet the required criteria before processing the quote.

To run underwriting rules for a quote, use the following class and method:

This function checks whether the quote line item passes or fails the underwriting process. For more details on Underwriting Product Rules, refer to the Underwriting Product Rules.

Two data models are available for policy creation—one provided by Vlocity and another by the FSC Insurance data model, which includes additional objects from the Vlocity + FSC (vlocity_ins_fsc) package called the “Insurance Extension Package.”

To create a policy, Salesforce provides standard product classes. Refer to the link for policy creation services: Insurance Policy Services

This service class accepts policy JSON and generates a policy along with its related records, including:

Policy, Quote documents can be generated in 2 ways:

To successfully deploy the insurance solution, follow these key steps:

Now you have successfully implemented Salesforce Financial Services Cloud.

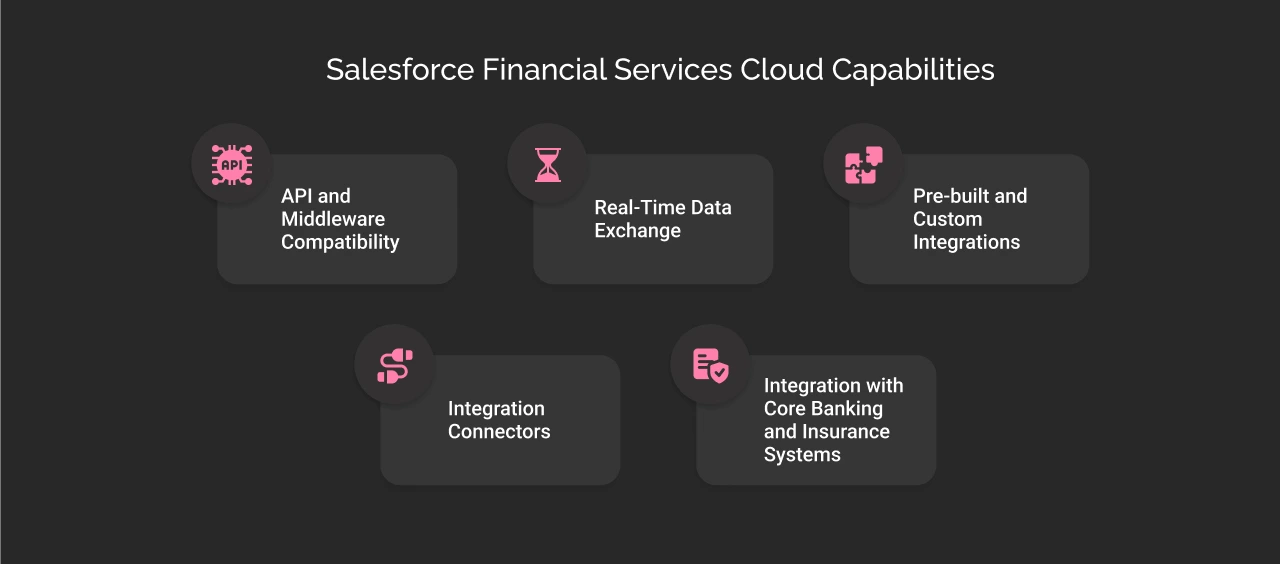

Salesforce Financial Services Cloud is designed to connect seamlessly with various external systems, thereby enhancing operational efficiency and customer experience. Here’s a closer look at its integration capabilities:

The solution offers REST and SOAP APIs, empowering developers to build custom integrations that facilitate smooth data exchanges with platforms such as core banking systems or portfolio management tools. Security is ensured through OAuth 2.0, which supports secure and compliant data transfers.

With the acquisition of MuleSoft in 2018, integration options have expanded significantly. MuleSoft provides a comprehensive platform for connecting applications, data, and devices across cloud and on-premises environments. Its pre-built connectors and support for a wide range of protocols simplify the process, enabling real-time data flow while reducing complexity.

The platform supports an event-driven approach, so when a customer updates their profile, the change can instantly trigger updates across connected systems.

Its streaming APIs allow for continuous, real-time data transmission, which is particularly beneficial for applications that require immediate updates—such as portfolio management or transaction notifications.

The Salesforce AppExchange marketplace features a range of ready-made integrations tailored for the financial services sector. These solutions address everyday needs like compliance management and customer onboarding and can be installed and configured quickly.

The cloud solution supports custom development for organizations with unique requirements through tools like Apex and Visualforce. In addition, Salesforce’s extensive partner ecosystem—including consulting firms and independent software vendors can assist with creating integrations that meet specific business needs.

Using pre-built templates, MuleSoft’s vast array of connectors facilitates integration with diverse systems—from databases to messaging platforms and cloud services. For systems without dedicated connectors, generic options such as HTTP or FTP are available to ensure reliable connectivity.

The platform enables a unified view of customer data by connecting with core banking and insurance systems like mobile apps, net banking portals, etc. This unified perspective is essential for delivering personalized services and enhancing customer engagement.

These integrations are designed to adhere to strict regulatory requirements while maintaining high data security standards, ensuring that sensitive customer information is always well protected.

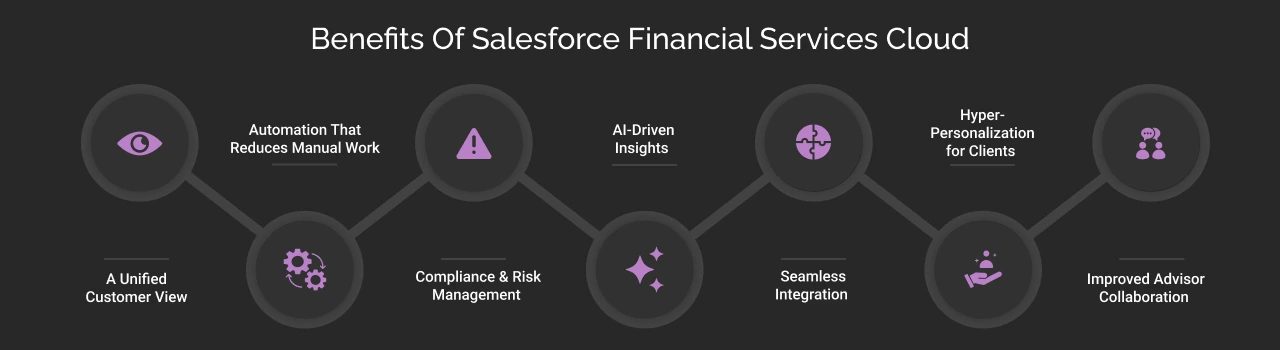

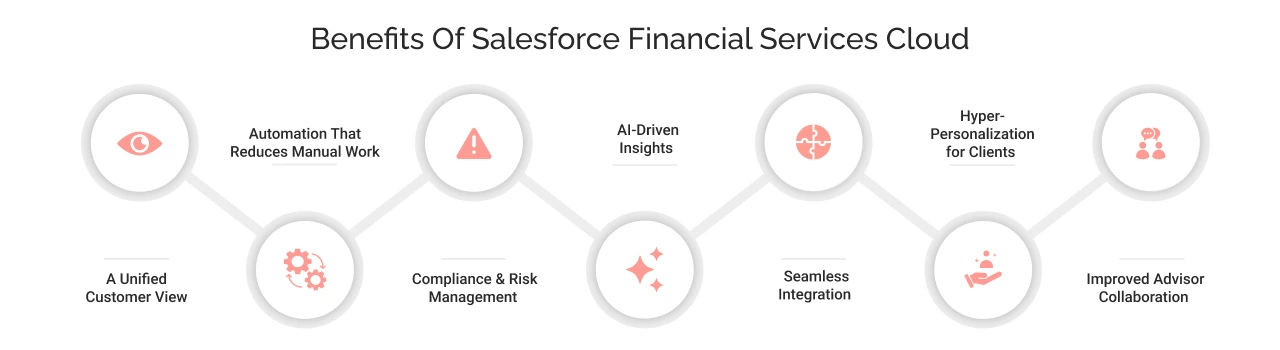

Salesforce Financial Services Cloud is popular for being a revolutionary platform for financial institutions, improving customer interactions and enhancing compliance management.

But is it truly worth the investment, or is it just another overhyped CRM platform with a financial branding? While skeptics argue that its costs and complexity may outweigh its benefits, here’s why FSC still holds a strong case for financial firms looking to stay competitive.

One of FSC’s most significant selling points is its 360-degree customer view, allowing financial advisors, bankers, and insurers to access real-time customer data from a single dashboard. While many argue that any robust CRM can achieve this, what sets FSC apart is its industry-specific data models and built-in integrations with financial data sources. Unlike generic CRMs, it offers relationship mapping, client goals tracking, and wealth insights, helping firms personalise their services at scale.

On one hand, FSC eliminates redundant manual processes, such as data entry, document approvals, and compliance checks, saving countless hours for advisors and banking professionals. However, automation also requires extensive configuration and training to align with a firm’s unique operational needs. Still, for organizations willing to invest in proper implementation, the efficiency gains far outweigh the initial setup challenges.

Regulatory compliance is one of the pain points in the financial sector. Financial services cloud provides built-in tools for automated compliance tracking, audit trails, and data security, making it easier for firms to adhere to industry regulations. While some argue that compliance software can be integrated into other CRMs at a lower cost, Salesforce’s pre-built compliance features reduce the risk of human errors and regulatory fines, making it a compelling choice for risk-conscious financial institutions.

Salesforce Einstein for finance acts as a differentiator, providing predictive analytics, next-best-action recommendations, and client sentiment analysis. It’s said that AI-driven insights are only as good as the data fed into them. However, firms leveraging FSC’s AI capabilities can identify client needs faster, proactively offer financial products, and even detect potential churn before it happens.

Salesforce’s ecosystem is vast, and FSC integrates with multiple third-party financial tools. It includes integration with core banking systems, wealth management platforms, loan servicing software and other Salesforce clouds. However, integrating FSC with legacy systems can be time-consuming and require additional middleware solutions. Yet, once correctly set up, this integration eliminates data silos and enables cross-departmental collaboration.

In the financial services industry, generic client interactions no longer cut it. Customers expect highly tailored experiences based on financial goals, risk profiles, and spending behaviors. Salesforce Financial Services Cloud (FSC) delivers hyper-personalization by leveraging AI-driven insights to track financial goals, investment histories, and client life events. Unlike traditional CRMs, FSC allows advisors to map multi-client relationships, such as family wealth structures, enabling firms to offer customized financial planning and wealth management solutions.

One of the biggest challenges financial institutions face is fragmented communication between teams. FSC eliminates departmental silos by creating a unified workspace where advisors, relationship managers, and customer service representatives can collaborate in real time. Whether tracking client interactions, setting up follow-ups, or sharing critical financial insights, it ensures that all team members are on the same page. With a centralized view of client history and economic data, advisors can seamlessly transition cases without duplication or inefficiencies.

While some argue that FSC requires significant investment and configuration, its extensive benefits—ranging from AI-driven insights, automation, and compliance to omnichannel engagement and fraud prevention—make it a high-value choice for financial institutions.

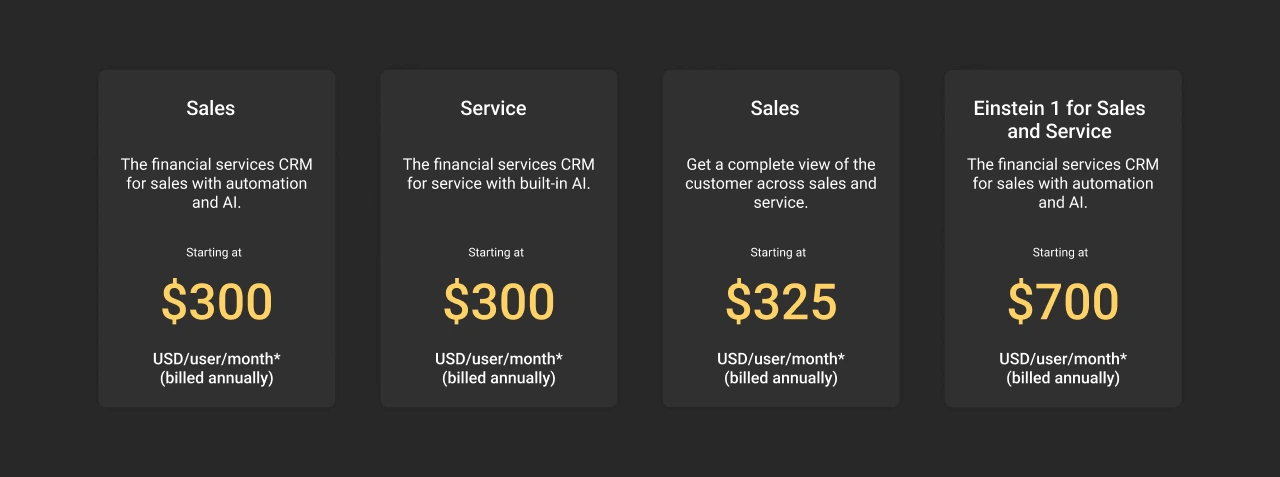

Salesforce Financial Services Cloud follows a pay-as-you-go model with different prices based on the needs of a business, user types, and add-on features.

The pricing depends on the type of user license. Some may offer complete access to all the functionalities, while others may give access to some specific tools only.

FSC offers additional features like AI insights, industry configurations, and business intelligence reporting that users can buy separately as add-ons.

Here is the detailed pricing for Financial Services Cloud:

Considering there are multiple licenses, you should take Salesforce financial services cloud consulting from an expert who can guide you towards the right license and maximize your investment.

The way people manage their finances is changing, and so are their expectations from financial service providers. Clients want more than just transactions; they seek personalized advice, proactive service, and reliable digital experiences. That’s where Salesforce Financial Services Cloud makes all the difference.

Whether you’re a wealth manager looking to build deeper client relationships, a banker aiming for better portfolio management, or an insurance provider streamlining claims, Financial Services Cloud helps you deliver faster, smarter, and more personalized financial services.

As your Salesforce Implementation Partner, we understand that every financial business has unique needs. That’s why we help you customize and integrate Salesforce FSC in a way that works best for you.

Want to see how FSC can transform your business? Let’s chat! Schedule a free consultation today.

Don’t Worry, We Got You Covered!

Get The Expert curated eGuide straight to your inbox and get going with the Salesforce Excellence.

AUTHOR

Service Cloud, Salesforce Managed Packages

With over 5 years of experience, Shubham specialize in curating solutions on Salesforce Service Cloud, Nonprofit Cloud, Consumer Goods Cloud, Managed Packages, and ServiceNow ITSM. He designs and implements end-to-end service solutions that improve operational workflows and ensure seamless integration across enterprise systems. Shubham’s expertise lies in creating secure, efficient, and agile platforms tailored to unique business needs.

Join Our Newsletter. Get Your Daily Dose Of Search Know-How

The Financial Service Cloud Salesforce Data Model is a structured format that defines how data is equipped and organized within the Financial Service Cloud platform. The data model includes objects and relationships that allow financial institutions to manage client information, financial accounts, interactions, and compliance data in a structured and compliant manner.

Salesforce Financial Services Cloud architecture refers to the underlying framework and design of the platform. It encompasses various components such as data storage, security, user interfaces, integrations, and scalability. The architecture is built to meet the complex needs of financial institutions, providing a secure and customizable environment for managing client relationships, financial accounts, and regulatory compliance.

The main difference is that Sales Cloud is for general sales teams, while Financial Services Cloud (FSC) is designed specifically for banks, wealth managers, insurance companies and other financial service providers. Sales Cloud helps businesses track leads, deals, and revenue, making it great for any industry that focuses on selling products or services. FSC, on the other hand, comes with extra tools to manage client relationships, financial accounts, and regulatory requirements. It also helps advisors keep track of households, investments, and life goals to offer better financial planning.

Financial Services Cloud is not just a wealth management tool; it's a comprehensive customer relationship management (CRM) platform tailored specifically for the financial services industry. It enables financial institutions to manage all aspects of client relationships, including banking, insurance, financial planning, and regulatory compliance, in a single unified platform.

Become a next-gen business with us.

Tell us about your idea and we’ll bring it to life. Schedule a FREE consultation today.

Looking for a new career?

View job openings

By submitting, you consent to Cyntexa processing your information in accordance with our Privacy Policy . We take your privacy seriously; opt out of email updates at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Looking for a new career?

View job openings