Top 25 Biggest Salesforce Acquisitions and Their Impact

Table of Contents

Salesforce’s acquisition strategy shows a clear pattern over time: using targeted acquisitions to strengthen parts of the platform where customers need more capability. Whether it is the $27.7 billion acquisition of Slack or the $15.7 billion Tableau deal, each move is well-strategized to close gaps and build a better customer experience.

What matters most is not how many companies Salesforce has acquired, but how each acquisition fits into the platform as a whole.

We’ve curated a detailed list of all Salesforce acquisitions that has created a huge impact in the ecosystem. The selection is based on publicly disclosed information, what makes them strategic fit and how it is taking Salesforce one-step ahead in the enterprise software market.

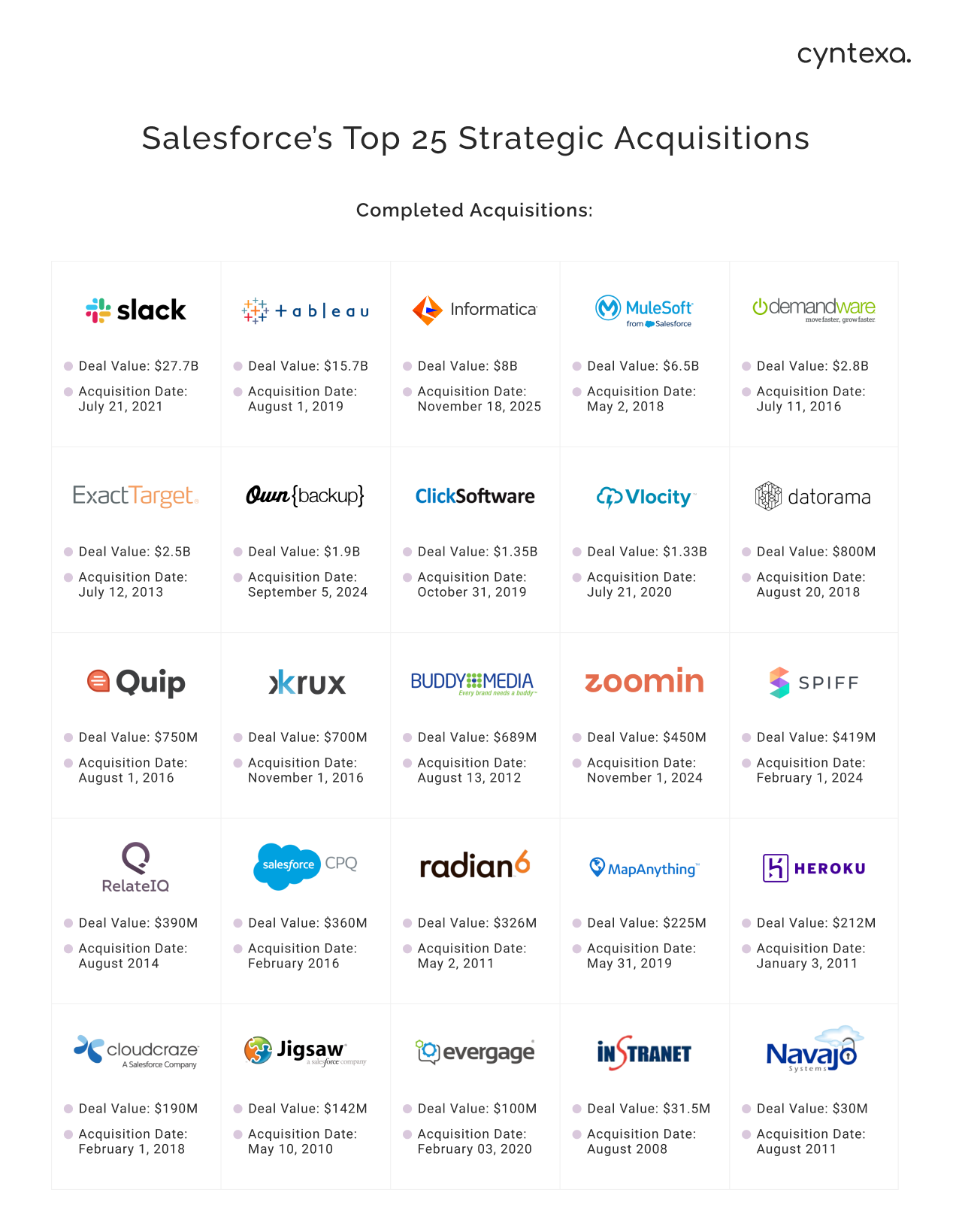

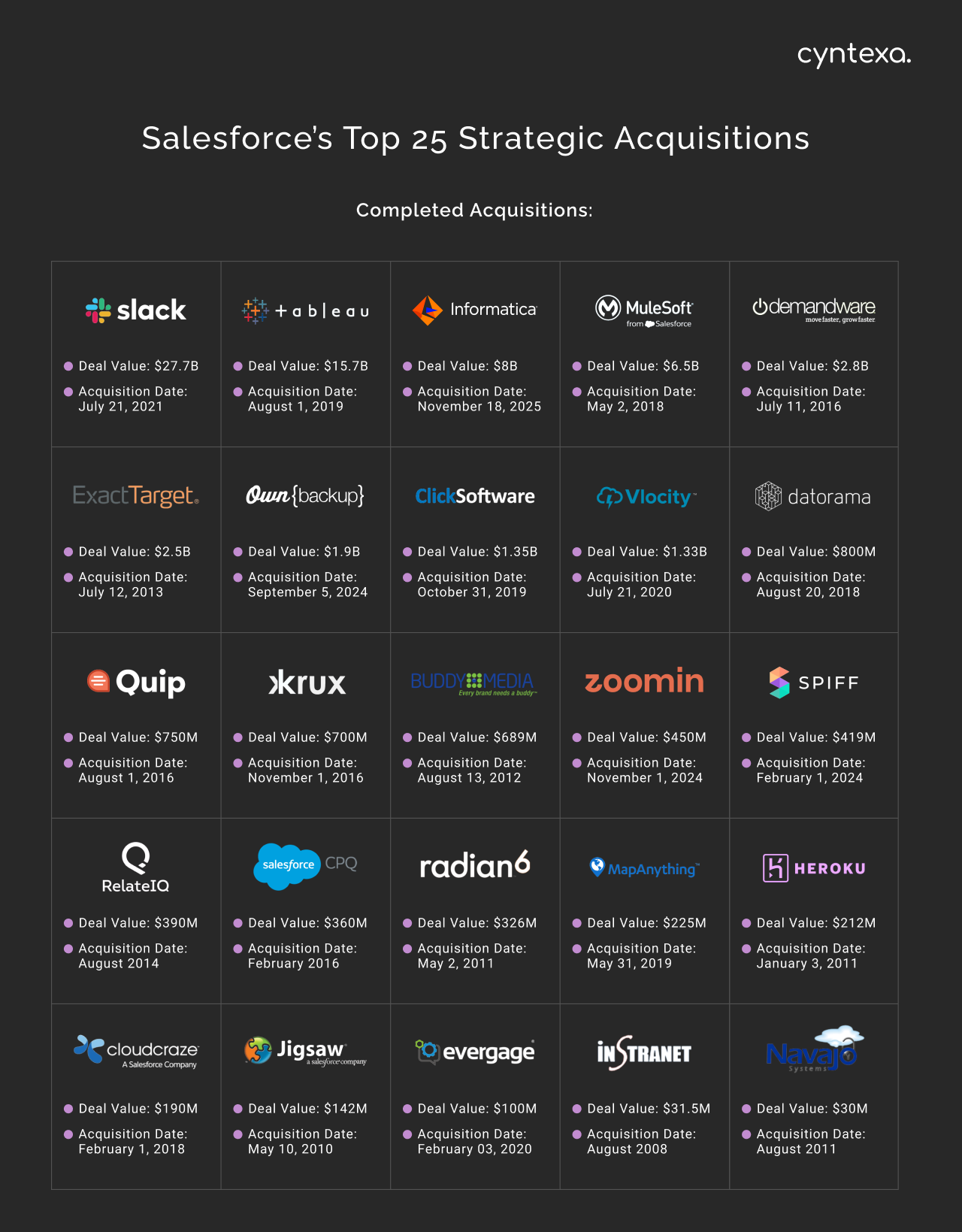

Salesforce Acquisitions List: Top 25 Companies Acquired by Salesforce

Salesforce has invested in more than 70+ acquisitions till 2026 and the following is the list of Salesforce acquired companies:

- Slack – $27.7B, July 21, 2021

- Tableau – $15.7B, August 1, 2019

- Informatica – $8B, November 18, 2025

- MuleSoft – $6.5B, May 2, 2018

- Demandware – $2.8B, July 11, 2016

- ExactTarget – $2.5B, July 12, 2013

- Own (OwnBackup) – $1.9B, September 5, 2024

- ClickSoftware – $1.35B, October 31, 2019

- Vlocity – $1.33B, July 21, 2020

- Datorama – $800M, August 20, 2018

- Quip – $750M, August 1, 2016

- Krux – $700M, November 1, 2016

- Buddy Media – $689M, August 13, 2012

- Zoomin – $450M, November 1, 2024.

- Spiff – $419M, February 1, 2024

- RelateIQ – $390M, August 2014

- SteelBrick (Salesforce CPQ) – ~$360M, February 2, 2016

- Radian6 – $326M, May 2, 2011

- MapAnything – $225M, May 31, 2019

- Heroku – $212M, January 3, 2011

- CloudCraze (B2B Commerce) – $190M, February 1, 2018

- Jigsaw (Data.com) – $142M, May 10, 2010

- Evergage (Marketing Cloud Personalization) – $100M, February 6, 2020

- InStranet – $31.5M, August 2008

- Navajo Systems – $30M, August 2011

1. Slack

- Deal Announcement: December 1, 2020

- Acquisition Year: July 21, 2021

- Deal Value: $27.7 billion

Why did Salesforce acquire Slack?

Salesforce Slack acquisition was aimed to add a strong collaboration layer that could work smoothly with CRM data and enterprise workflows. That time Salesforce positioned Slack as the foundation of a “digital headquarters”, highlighting the growing need for real-time collaboration in remote and distributed work environments.

The intent was not simply to introduce messaging into Salesforce, but to bring conversations closer to customer data and decision-making, connecting employees, customers, and partners around a shared business context.

What Changed After Salesforce Acquired Slack?

Slack enhances Salesforce’s offerings by providing real-time communication and collaboration tools. Key Salesforce Slack integration includes:

- Sales Cloud: Digital Deal Rooms and Daily Briefs.

- Service Cloud: Swarming and Expert Finder.

- Marketing Cloud: Intelligent insights from Datorama and Tableau.

These integrations enabled teams to receive alerts, coordinate actions, and collaborate around customer data within Slack, helping surface relevant context from Salesforce Customer 360 in real time.

Over time, Slack settled into the role of a contextual collaboration layer, supporting coordination and execution around Customer 360 insights without replacing Lightning Experience or core CRM functionality.

Slack’s Role in the AI Era

With Salesforce continuous efforts towards building AI-driven and agent-based workflows, Slack got a little more attention. Today, Slack increasingly acts as the human-in-the-loop interface for Salesforce AI and Agentforce, sharing insights, alerts, and recommendations generated by AI systems.

Rather than serving as a CRM interface, Slack functions as a collaboration nervous system, linking people, data, and AI-driven actions across the Salesforce platform.

Outcomes and Evolution

After acquisition, Slack delivered the most value in areas that required speed and coordination, mainly in service collaboration, internal alignment, and cross-functional response.

Many people still ask this one question: what changed after Salesforce bought Slack? Slack evolved from being framed as a front-end replacement to serving as a collaborative element that improved Salesforce workflows. However, adoption as a primary interface for structured CRM work remained limited, specially for data entry and reporting.

2. Tableau

- Deal Announcement: June 10, 2019

- Acquisition Completion: Completed on August 1, 2019

- Deal Value: $15.7 billion

The Salesforce Tableau Acquisition was one of Salesforce’s largest investments in enterprise analytics. Salesforce acquired Tableau with an intent of taking analytics across the platform to the next level. Another reason was to make customer and business data easy to visualize, explained and shared in ways that go beyond standard CRM reporting.

Why Did Salesforce Buy Tableau?

Earlier, many enterprise customers used Salesforce for customer data, but relied on separate BI tools for getting analysis of huge data. Salesforce had Einstein Analytics, but it wasn’t good enough for high-end enterprise BI needs. We could conclude three main reasons, why Salesforce bought Tableau:

- To add a best-in-class analytics platform rather than build BI from scratch

- To serve analytics teams and executives who already worked in Tableau

- To support analytics that extend beyond CRM into broader enterprise data.

What Happened to Tableau After Acquisition?

A common question is what happened to Tableau after Salesforce acquired it. Tableau continued to operate as a standalone analytics platform, serving analysts and business teams, while Salesforce refined its in-platform analytics strategy.

What Changed After Salesforce Acquired Tableau?

Post Salesforce Tableau acquisition, Tableau continued to operate as an open, multi-cloud analytics platform, while Salesforce focused on embedding analytics more deeply across its CRM ecosystem. Tableau remains Salesforce’s primary solution for enterprise-grade data visualization and exploratory analytics across diverse data sources, including Salesforce Data Cloud.

At the same time, Salesforce evolved its native analytics capabilities, from Einstein Analytics to CRM Analytics to deliver operational insights directly within Salesforce workflows. Rather than pulling the move of merging these products, Salesforce kept Tableau and CRM Analytics as separate offerings: Tableau for broad, flexible analysis and CRM analytics for in-context, action-driven insights, allowing organizations to analyze data and act on it where work happens.

Tableau’s Role in the AI Era

In Salesforce’s current AI and data direction, Tableau matters because trusted analytics still plays a central role in decision-making. As Salesforce expands Data Cloud, AI, and Agentforce, Tableau supports:

- Governed analytics on unified datasets

- Faster distribution of insights across teams

- Clear reporting that can support AI-driven actions and business decisions

Outcome and Evolution

The Tableau acquisition was built for long-term platform depth. Over time, Tableau strengthened Salesforce’s enterprise analytics credibility, while CRM Analytics matured as the in-workflow layer and Data Cloud became a foundation for connecting data, analytics, and AI.

3. Informatica

Deal Announcement: May 27, 2025

Acquisition Year: November 18, 2025

Deal Value: $8.0 billion

Why did Salesforce buy Informatica?

Salesforce Informatica acquisition reflects a strategic decision that strengthens its enterprise data foundation for the AI era. Informatica is a leader in cloud data management, including data cataloging, integration, governance, quality, metadata management, and master data management. This acquisition brought capabilities to Salesforce’s AI and CRM platform and built a more complete, trusted data infrastructure for AI-driven workflows and insights.

Marc Benioff. CEO of Salesforce, mentioned that the acquisition brings together the world’s leading AI CRM with an AI-powered data management platform, enabling enterprises to deploy AI agents safely, responsibly, and at scale across the modern enterprise.

What Changed After Salesforce Acquired Informatica?

Since the Information acquisition, Salesforce has embedded Informatica’s capabilities into its platform:

- Initial phase: Informatica continues to operate as a cloud-first data management solution while planning deeper integration with Salesforce’s core services.

- Data platform alignment: Informatica’s rich data catalog, integration, governance and metadata tools are being integrated into Salesforce’s Data Cloud to ensure that enterprise data is unified, trusted, and actionable.

- Enterprise Governance: Informatica’s tools help enterprises meet compliance, audit, and policy requirements by making data lineage and transformations transparent and reliable across systems.

- Cross-platform synergy: Informatica’s data capabilities are designed to enhance MuleSoft integration flows and support downstream analytics in platforms like Tableau, improving the overall unified enterprise data ecosystem.

Outcomes and Evolution

As Salesforce continues its AI-driven evolution, Informatica’s integration is expanding the company’s ability to operate on verified and governed data:

- Informatica strengthens Data Cloud, helping unify and clarify data from across systems for analytics, AI, and operational use.

- AI-driven automation and analytics draw on trusted data, reducing the risk of inaccuracies and enhancing decision confidence.

- Agentforce workflows can now interpret and act on enterprise data with greater context and governance, improving reliability and compliance.

- Enterprises in regulated industries benefit from improved data transparency and governance, helping ensure that AI outputs meet audit and policy requirements.

- Informatica continues to evolve as part of Salesforce’s broader data strategy, reinforcing the platform’s ability to deliver responsible and explainable AI outcomes.

Today, Informatica supports Salesforce’s goal of making AI both powerful and trustworthy by providing the data foundation that enterprise-scale AI and automation depend on.

4. MuleSoft

- Deal Announcement: March 20, 2018

- Acquisition Completion: Completed on May 2, 2018

- Deal Value: $6.5 billion

Why did Salesforce acquire MuleSoft?

Salesforce MuleSoft Acquisition was not about adding another product in the portfolio. It was a deliberate move to solve a structural limitation that restricted Salesforce’s enterprise adoption: integration at scale.

Another reason why Salesforce acquired MuleSoft is to address enterprise complexity. Earlier, Salesforce was a strong player in terms of system of engagement but was too much dependent on custom integrations to connect with ERP systems, legacy platforms and data lakes. MuleSoft’s Anypoint Platform brought a mature, API-led integration layer that allowed Salesforce to orchestrate data and processes across the enterprise.

This acquisition transformed Customer 360 from a vision into an executable architecture, especially for large, regulated organizations.

What Changed After Salesforce Acquired MuleSoft

Following the MuleSoft acquisition, Anypoint Platform became a foundational integration layer within the Salesforce ecosystem. MuleSoft, now fully owned by Salesforce, connects Salesforce clouds with ERP systems, data platforms, identity services, and third-party applications across cloud and on-premise environments.

Over time, Salesforce expanded MuleSoft’s reach beyond IT teams. MuleSoft Composer allowed business users to automate cross-system workflows directly from Salesforce, while IT teams retained governance and control. Today, MuleSoft also plays a critical role in synchronizing enterprise data into Salesforce Data Cloud.

Outcomes and Evolution

Since MuleSoft acquisition, its importance has increased through real enterprise deployments rather than surface-level feature expansion. While MuleSoft continues to work on its own roadmap and go-to-market motion, it has become a core part of Salesforce’s platform architecture, especially in the AI era.

- MuleSoft acts as the execution layer for Agentforce, enabling AI agents to trigger workflows and APIs securely.

- It governs how AI interacts with systems of record, enforcing identity, security, and audit controls.

- MuleSoft enables AI-initiated workflows while reducing operational and compliance risk.

- It plays a critical role in Data Cloud by enabling trusted, real-time data movement across ERP, commerce, and core systems.

- MuleSoft supports Customer 360 by connecting fragmented enterprise data into usable, governed flows.

- Its value is most evident in regulated industries where controlled automation is essential.

From an insider perspective, MuleSoft is not just one of Salesforce’s biggest acquisitions by impact, it acts as the platform layer that turns agent-driven automation into an enterprise-ready capability.

5. Demandware

- Deal Announcement: June 1, 2016

- Acquisition Year: Completed on July 11, 2016

- Deal Value: $2.8 billion

Why did Salesforce buy Demandware?

Salesforce Demandware acquisition enabled Salesforce’s entry into digital commerce as a core platform capability. Before Demandware, Salesforce supported how businesses engage with customers, make sales and serve customers, but when it comes to commercial transactions, they didn’t have anything inside their CRM.

Demandware made it happen by turning into Salesforce Commerce Cloud, enabling brands to deliver personalized shopping experiences across digital and physical channels. Not only has Salesforce entered the B2C commerce market with an enterprise-ready solution that offers scalability, performance and global reach, but connects commerce activity directly with marketing, service, and sales data. In doing so, Customer 360 expanded from understanding customers to supporting how revenue is actually created.

What Changed After Salesforce Acquired Demandware?

Since Demandware was acquired by Salesforce, Commerce Cloud has evolved from a standalone commerce product into a connected, intelligence-ready part of the Salesforce platform.

- 2016–2018: Reintroduced as Salesforce Commerce Cloud, retaining Demandware’s cloud-native architecture while aligning with Salesforce identity, security, and data standards.

- 2019–2021: Expanded support for omnichannel commerce, headless architectures, APIs, and global deployments—allowing brands to decouple front-end experiences from backend systems.

- 2022–2023: Strengthened integration with Marketing Cloud, Service Cloud, and Order Management, linking commerce activity with engagement and service workflows.

- 2024–2025: Became a core contributor to Data Cloud, supplying high-quality transactional and behavioral signals for analytics and personalization.

- AI era: Enabled Agentforce to act on commerce signals, supporting agent-assisted buying, proactive service, and automated revenue workflows.

Outcomes and Evolution

Since the acquisition, Salesforce Commerce Cloud has attracted major brands like L’Oréal and Lands’ End and impressed them with its groundbreaking innovations like headless commerce, SFRA, omnichannel, order management system, AI-powered personalization and much more.

- Retailers adopted headless commerce and omnichannel models without being constrained by legacy front-end systems.

- AI-powered personalization now informs product discovery, promotions, and customer journeys in real time.

- Commerce data feeds Data Cloud, creating a richer understanding of customer intent and behavior.

- Agentforce uses commerce signals to trigger service actions, sales follow-ups, and guided buying experiences.

- In enterprise environments, commerce activity is directly connected to engagement and revenue workflows.

Today, Commerce Cloud supports how customer intent is captured, interpreted, and acted on across the Salesforce platform.

6. ExactTarget

- Announcement Date: June 4, 2013

- Acquisition Completion: July 12, 2013

- Deal Value: Approximately $2.5 billion

Strategic Intent

After establishing Sales Cloud and Service Cloud, Salesforce faced a clear gap: it could support sales and service teams, but it did not yet give marketers a native way to engage customers across channels. The acquisition of ExactTarget was intended to serve this concern.

ExactTarget brought enterprise-grade marketing automation into the Salesforce ecosystem, enabling consistent engagement across email, mobile, social, and web. This move allowed Salesforce to build what later became Salesforce Marketing Cloud, giving marketers a first-class platform that connected engagement activity with CRM data. The acquisition also reflected Salesforce’s growing focus on CMOs, recognizing marketing as a core driver of customer relationships rather than a disconnected function.

Salesforce Marketing Cloud was designed to support both B2C and B2B use cases. B2C teams focused on high-volume, real-time engagement, while B2B marketing evolved around account-based programs, later formalized through Account Engagement.

What Changed After Salesforce Acquired ExactTarget?

ExactTarget became the foundation of Salesforce marketing cloud and expanded through a series of integrations and consolidations:

- Marketing automation core: ExactTarget’s campaign execution and journey capabilities formed the backbone of Marketing Cloud.

- Social marketing expansion: Salesforce combined ExactTarget with Radian6 (listening), Buddy Media (publishing), and Social.com (advertising), creating a broader social marketing capability.

- CRM alignment: Marketing data began flowing into Salesforce CRM, allowing sales and service teams to see engagement history alongside customer records.

- AI-driven optimization: With the introduction of Einstein AI, marketing teams gained tools for personalization, send-time optimization, content recommendations, and behavioral targeting.

Over time, these integrations shifted marketing from isolated campaigns to coordinated, data-informed engagement across the customer lifecycle.

Outcomes and Evolution

The ExactTarget acquisition reshaped Salesforce’s role in marketing technology:

- Enabled multi-channel engagement within the Salesforce platform

- Reduced silos between marketing, sales, and service teams

- Improved personalization through behavior-based insights and AI models

- Supported real-time segmentation and automated journeys as data volumes grew

As Salesforce’s data and AI strategy matured, Marketing Cloud began working more closely with Data Cloud (now Data 360), allowing marketers to activate unified customer profiles rather than rely on fragmented datasets. This evolution moved marketing from broadcast-driven execution toward more responsive, insight-led engagement.

7. Own

- Deal Announcement: September 5, 2024

- Acquisition Year: November 18, 2024

- Deal Value: Estimation is $1.9 billion in cash, net of the value of the approximately 10% of outstanding shares currently owned by Salesforce.

Why did Salesforce acquire Own?

Salesforce Own acquisition talks about a clear platform-level priority, i.e., customer data must be protected, recoverable and governed as Salesforce scales automation and AI.

Before this deal, Salesforce offered strong security controls, governance tools, and compliance frameworks. However, enterprise-grade backup, recovery, and long-term data resilience lived largely outside the core platform. As data volumes increase, and agent-driven workflows become more central to business operations, that separation introduces operational and trust risk.

By bringing Own (formerly OwnBackup) into the Salesforce ecosystem, Salesforce makes data protection a native platform responsibility, covering how data is secured, recovered, archived, and governed across Salesforce environments. This move aligns with Salesforce’s long-standing belief that trust is not an add-on, but a foundation, especially in data-driven and automated enterprises.

What Changed After Salesforce Acquired Own?

Once completed, Own became a core part of Salesforce’s data protection and governance architecture.

- Enterprise backup and recovery: Own adds native-grade backup, restore, and disaster recovery capabilities designed specifically for Salesforce data models and metadata.

- Data archiving and performance optimization: Customers can archive historical data out of production orgs while maintaining accessibility and compliance.

- Cross-application coverage: Own supports data protection across Salesforce and connected enterprise environments, including cloud platforms commonly used alongside Salesforce.

- Security and compliance alignment: The acquisition strengthens Salesforce offerings such as Salesforce Backup, Data Mask, and Shield, extending governance beyond prevention into recovery.

- AI readiness: Reliable data recovery and integrity become critical as automation and agent-based workflows operate at scale.

Outcomes and Evolution

With the acquisition now complete, Own is fully embedded into Salesforce’s trust and data resilience strategy.

- Data protection is now a native platform capability, covering backup, recovery, archiving, and retention across Salesforce environments.

- Enterprise resilience has moved inside the platform, reducing reliance on external tooling for mission-critical data recovery.

- Compliance and audit readiness are strengthened through consistent data governance and recoverability.

- Agentforce and automated workflows operate with greater confidence, supported by assured data integrity and restore paths.

- Customer trust is reinforced, as data availability and recovery are treated as core platform responsibilities, not optional extensions.

This acquisition quietly closes a critical gap. As Salesforce expands AI-driven and autonomous execution, Own ensures the platform can move fast without compromising data safety, continuity, or trust.

8. ClickSoftware

- Acquisition Announcement Date: August 7, 2019

- Deal Completion Date: October 31, 2019

- Purchase Price: $1.35 billion

Why did Salesforce acquire ClickSoftware?

Salesforce ClickSoftware acquisition was another move to make field service execution as part of the Service Cloud platform. As customer service expanded beyond digital channels, Salesforce customers increasingly needed to serve requirements for on-site/on field work, technicians, assets, schedules, and service commitments in real-world conditions.

ClickSoftware brought all of it bundled in one software, curated to address the requirements like proven scheduling, optimization and workforce management for large, distributed field teams. By integrating these capabilities, Salesforce connected customer requests, service agreements, and field execution into a single system of record and built a separate product known as Salesforce Field Service.

This acquisition enabled Salesforce to support the full service lifecycle, from case creation to on-site resolution, within the platform, aligning service delivery with rising expectations for speed, coordination, and reliability.

What Changed After Salesforce Acquired ClickSoftware?

Following the acquisition, ClickSoftware’s technology became foundational to Salesforce Field Service (formerly Field Service Lightning).

- Intelligent scheduling and optimization: ClickSoftware’s algorithms power appointment booking, technician matching, and route optimization based on skills, availability, and service commitments.

- Connected service execution: Field schedules link directly to cases, assets, work orders, and service contracts within Service Cloud.

- Real-time operational adjustments: Dispatchers can update schedules dynamically as conditions change, with visibility across service teams.

- Event-driven service: Integration with asset and IoT data supports proactive service actions when issues are detected.

- Platform alignment: Field service operations run within Salesforce’s security, identity, and data model.

Outcomes and Evolution

- ClickSoftware now operates as the scheduling and optimization engine within Salesforce Field Service (SFS).

- Salesforce has centralized all field service innovation within a unified platform experience.

- Standalone ClickSoftware products are scheduled for End-of-Life by December 31, 2026, with customers transitioning to Salesforce Field Service.

- This consolidation ensures consistent security, scalability, and access to ongoing platform enhancements.

- ClickSoftware no longer exists as a separate product; its capabilities are fully embedded within Salesforce’s service operations.

This acquisition made field service a first-class part of Salesforce’s service strategy. By embedding ClickSoftware’s scheduling and optimization capabilities directly into the platform, Salesforce ensured that service commitments created in Service Cloud could be planned, dispatched, and delivered through one connected system, without juggling with separate tools.

9. Vlocity

- Acquisition Date: February 26, 2020

- Deal Completion Date: July 21, 2020

- Purchase Price: $1.33 billion

Strategic Intent

Salesforce acquired Vlocity to make industry context a native part of the platform. Before Vlocity, Salesforce delivered strong CRM capabilities, but organizations often had to heavily customize the platform to meet industry-specific regulations, data models, and operational workflows.

Vlocity, built natively on Salesforce, provided preconfigured industry solutions for communications, media, insurance, utilities, and public services. By acquiring Vlocity, Salesforce enabled customers to adopt CRM with industry logic already in place, reducing complexity and accelerating adoption across different Industry clouds.

What Changed After Salesforce Acquired Vlocity?

After Vlocity was acquired by Salesforce, it was rebranded as Salesforce Industries, reflecting its expanded role within the platform.

- 2020–2021: Vlocity’s industry data models, workflows, and UI components were integrated into Salesforce’s core architecture, enabling faster deployment of vertical-specific solutions.

- 2021–2023: Salesforce launched and expanded multiple Industry Clouds using Vlocity’s frameworks, including:

- Communications Cloud,

- Media Cloud,

- Energy & Utilities Cloud,

- Insurance Cloud,

- Public Sector Solutions,

- Financial Services Cloud,

- Health Cloud,

- Consumer Goods Cloud,

- Manufacturing Cloud,

- Automotive Cloud,

- Nonprofit Cloud, and

- Sustainability Cloud.

Each designed with industry-specific data models, workflows, and regulatory context built in from the start.

Outcomes and Evolution

As Salesforce moved toward AI-driven and agent-based workflows, Vlocity’s impact became more pronounced.

- Industry Clouds now provide structured, domain-specific data models that Agentforce can operate within safely.

- Agentforce uses industry logic to recommend and automate actions that respect regulatory and operational constraints.

- Vertical workflows, such as service orders, policy management, or eligibility processing, are now AI-assisted rather than manually driven.

- Industry context reduces risk by ensuring AI actions remain aligned with industry rules and real-world processes.

Internally, the Vlocity acquisition changed how Salesforce builds products. Industry depth is no longer treated as an add-on, it is designed into the platform from the start. Now, Salesforce Industries act as the operating framework that allows Agentforce to deliver automation that is practical, compliant, and scalable across complex industries.

10. Datorama

- Deal Announcement: July 16, 2018.

- Deal Completion Date: August 20, 2018.

- Deal Value: $800 million

Why did Salesforce acquire Datorama?

Before Datorama, marketing teams had no shortage of data, but very little agreement on truth. Performance lived across ad platforms, analytics tools, and spreadsheets, each telling a different story. Measurement was slow, manual, and often disconnected from revenue outcomes.

Salesforce acquired Datorama to address this concern on the platform level. Datorama specialized in ingesting large volumes of marketing data, standardizing it, and making it usable without heavy technical effort. Bringing this capability into Salesforce meant marketing decisions could be grounded in consistent, comparable data, not stitched-together reports.

The acquisition signaled a shift: marketing performance would be treated with the same rigor as sales and service metrics.

What Changed After Salesforce Acquired Datorama?

Post-acquisition, Datorama became the intelligence layer underneath Salesforce’s marketing analytics. Instead of acting as a standalone reporting tool, it was positioned to:

- Normalize data from advertising, engagement, and analytics sources into a common structure

- Automate performance reporting across regions, channels, and brands

- Connect marketing metrics with Salesforce data models used by sales and service teams

- Reduce dependence on external BI tools for marketing-specific analysis

- Prepare marketing data for advanced analytics and AI-driven use cases

Over time, Datorama was reintroduced as Marketing Cloud Intelligence, reflecting its role as a core capability rather than a separate product.

Outcomes and Evolution

Marketing teams gained a clearer view of performance, not just activity. Performance intelligence could now travel across the Salesforce platform, supporting better alignment between marketing investment, customer engagement, and downstream business impact.

This acquisition was less about adding features and more about enforcing discipline. Datorama gave Salesforce a way to make marketing data trustworthy at scale so intelligence could move closer to execution without introducing noise or guesswork.

11. Quip

- Deal Announcement: July 30, 2016.

- Deal Completion Date: August 1, 2016

- Purchase Price: $750 million, consisting of cash and stock.

Strategic Intent

Salesforce’s acquisition of Quip was driven by the need to modernize document processing and improve collaboration within its ecosystem. Referred to as a “living document platform”, Quip integrates documents, spreadsheets, and communication tools, allowing teams to work more efficiently.

Technological Integration

Following is how Quip get amalgamated into Salesforce’s offerings:

- Bi-Directional Sync: This feature allows CRM data to be integrated directly into Quip documents, allowing information to be more accessible and actionable.

- Live Apps: Users can embed calendars, checklists, videos and other interactive elements within documents, resulting in real-time collaboration.

- Salesforce Anywhere: In 2021, Quip was rebranded as Salesforce Anywhere, emphasizing enhanced collaboration features that allow users to chat and receive real-time alerts while working on shared records.

Outcomes and Milestones

By becoming one of the key components in the Salesforce ecosystem, Quip has helped users manage projects and collaborate seamlessly across teams.

The platform has attracted a growing user base, with its capabilities being leveraged by organizations seeking to enhance productivity in remote and hybrid work environments.

12. Krux

- Deal Announcement: October 3, 2016.

- Deal Completion Date: November 1, 2016.

- Deal Value: $700 million, paid in cash and stock.

Strategic Intent

This Salesforce Krux acquisition happened to cater critical requirements pertaining to Marketing Cloud offerings, which is to be precise in Data Management Platforms (DMPs). Salesforce recognized the need for advanced audience management and data integration capabilities. By merging Krux’s potential with Marketing Cloud, Salesforce introduced a tool that leverages customer data and external interaction data, resulting in significant improvements in personalization and engagement strategies.

Technological Integration

Right after the acquisition, Krux was rebranded as Salesforce DMP, which later evolved as Audience Studio in Marketing Cloud, offering marketers power-packed data management tools that help with:

- Enhanced Customer Profiles: By consolidating customer data from multiple sources, marketers can gain deeper insights into consumer behaviour.

- Cross-Channel Engagement: Audience Studio enables brands to manage customer journeys across various digital channels, ensuring a cohesive experience.

- Targeted Campaigns: Marketers can identify new prospects who share attributes with existing customers, driving more relevant messaging and brand experiences.

Outcomes and Evolution

The integration has allowed businesses to tap into Krux’s extensive global reach and machine-driven segmentation for better targeting.

13. Buddy Media (Social Publishing & Engagement)

Deal Announcement: June 4, 2012

Acquisition Completion: August 13, 2012

Deal Value: $689 million

Why did Salesforce buy Buddy Media?

Salesforce acquired Buddy Media to help businesses actively engage with customers on social channels, not just listen to them.

At the time, brands were increasingly using platforms like Facebook and Twitter to run campaigns, publish content, and interact with audiences. But these efforts were often disconnected from CRM systems and customer data. Buddy Media addressed that gap by giving marketing teams tools to manage social publishing, campaigns, and engagement in a structured way.

Together with Radian6, Buddy Media allowed Salesforce to cover both sides of social engagement: listening to conversations and participating in them. This expanded Customer 360 beyond traditional channels and brought social engagement into everyday marketing and service workflows.

What Changed After Salesforce Acquired Buddy Media?

Following the acquisition, Buddy Media became a key part of Salesforce’s social capabilities:

- 2012–2013: Buddy Media was integrated into Salesforce’s marketing stack as the social publishing and campaign execution layer.

- 2013–2014: Combined with Radian6 to form Salesforce Social Studio, unifying listening, publishing, and engagement.

- 2015–2018: Social Studio supported coordinated brand publishing, content calendars, and audience engagement across teams.

- Later years: Salesforce refined its approach to social engagement as platforms and data strategies evolved, consolidating tools and focus areas.

Outcomes and Evolution

The Buddy Media acquisition helped Salesforce customers move from awareness to action on social platforms:

- Marketing teams gained structured tools to plan, publish, and manage social content.

- Social engagement became measurable and tied back to customer records.

- Brands could coordinate marketing, service, and communications teams around shared social data.

- Customer 360 expanded to include outbound engagement, not just inbound signals.

Over time, while Social Studio was retired, the operational knowledge gained from Buddy Media shaped how Salesforce approached digital engagement and cross-channel orchestration.

Running campaigns, managing content, and responding at scale requires governance, workflows, and alignment with customer data. That thinking later showed up across Marketing Cloud, journey orchestration, and AI-driven engagement models.

Buddy Media helped Salesforce understand how brands operate in public digital spaces and how CRM must support that reality.

14. Zoomin

- Deal Announcement: September 24, 2024.

- Deal Completion Date: Set to close in January 2025.

- Purchase Price: $450 million.

Why did Salesforce acquire Krux?

The Salesforce Krux acquisition was driven by a clear need, help marketers understand and activate audiences using data, not assumptions. At the time, marketing teams relied heavily on fragmented third-party data and disconnected audience tools. Salesforce needed a way to bring audience intelligence closer to CRM and marketing execution.

Krux, a leading Data Management Platform (DMP), enabled large-scale audience segmentation by unifying behavioral, demographic, and engagement data. By acquiring Krux, Salesforce strengthened Marketing Cloud with the ability to identify, segment, and activate audiences across channels, marking an early step toward data-driven personalization at scale.

Technological Integration

Krux was folded into Marketing Cloud as Audience Studio, becoming Salesforce’s system for audience intelligence. Its role was clear:

- 2016–2018: Krux was rebranded as Salesforce DMP, providing marketers with centralized audience segmentation and activation.

- 2019–2022: The platform evolved into Marketing Cloud Audience Studio, supporting cross-channel targeting and lookalike modeling.

- Shift in data strategy: As the industry moved away from third-party cookies, Salesforce reduced emphasis on standalone DMPs.

- Platform transition: Audience Studio was retired, with core capabilities absorbed into Salesforce’s broader data architecture.

Outcomes and Evolution

Krux changed how Salesforce approached marketing data. Instead of treating audience data as disposable campaign fuel, Salesforce began treating it as a governed platform asset. Segmentation improved. Activation became more consistent. Measurement got clearer.

Over time, the standalone DMP model faded. But Krux’s core ideas: identity resolution, audience governance, and data-driven activation, now live inside Salesforce’s modern data and marketing architecture.

15. Spiff

- Deal Announcement: December 2023

- Deal Completion Date: February 2024

- Deal Value: $419 million

Why did Salesforce acquire Spiff?

In modern sales organizations, compensation has more impact on an agent’s behavior than dashboards do. Salesforce acquired Spiff to bring that reality into the platform, where selling, forecasting, and execution already happen.

Before the acquisition, incentive compensation often lived outside CRM, managed through spreadsheets or disconnected systems. This created delays, disputes, and misalignment between sales performance and financial accountability. Spiff changed that by making commissions visible, explainable, and trusted, while deals are still in motion.

The Spiff acquisition by Salesforce reflects a simple belief: if compensation drives outcomes, it should live inside the same system that tracks revenue.

What Changed After Salesforce Acquired Spiff?

2023 – Early 2024: Platform Alignment

Spiff’s data model was aligned with Sales Cloud objects such as opportunities, forecasts, quotas, and revenue records.

2024 – Native Sales Cloud Integration

Spiff became the system of record for incentive compensation inside Sales Cloud, giving reps live visibility into commissions and payouts tied to pipeline movement.

2024 – 2025: Revenue Operations Enablement: Compensation logic connected directly with forecasting, performance tracking, and revenue execution reducing manual reconciliation and spreadsheet dependency.

AI Era – Incentive-Aware Execution

As Salesforce expanded AI and Agentforce, Spiff began serving as the incentive context layer ensuring AI-driven recommendations align with how teams are paid, not just what accelerates pipeline.

Outcomes and Evolution

Spiff isn’t positioned as “another sales add-on.” Inside Salesforce, it’s treated as revenue infrastructure. The goal isn’t just to calculate commissions faster, it’s to ensure that how people are paid reinforces how the business wants to grow. This is less about automation, and more about alignment.

16. RelateIQ (Relationship Intelligence to Sales Intelligence)

- Deal Announcement: July 11, 2014

- Acquisition Completion: August 2014

- Deal Value: ~$390 million (approximately $350M in shares + $40M cash)

Why did Salesforce buy RelateIQ?

Salesforce acquired RelateIQ to bring relationship intelligence into the heart of CRM. At the time, most CRM systems captured structured records but missed the real signals that define business relationships emails, meetings, and ongoing interactions that shape deals.

RelateIQ specializes in analyzing large volumes of communication data to surface insights about relationship strength, engagement patterns, and deal momentum. By acquiring RelateIQ, Salesforce aimed to reduce manual data entry while giving sales teams clearer visibility into how relationships were actually progressing.

The acquisition reflected Salesforce’s growing belief that CRM should observe how people work and provide intelligence automatically, rather than relying on constant user input.

What Changed After Salesforce Acquired Buddy RelateIQ?

After the acquisition, RelateIQ’s technology became a building block for Salesforce’s sales intelligence capabilities:

- 2014 – 2015: RelateIQ was rebranded as SalesforceIQ, offering automated insights based on email and calendar activity.

- 2015 – 2017: SalesforceIQ capabilities were integrated into Sales Cloud, influencing activity capture and engagement tracking.

- Later years: The standalone SalesforceIQ brand was retired, but its underlying concepts were absorbed into Sales Cloud and Salesforce’s broader AI roadmap.

- Role in AI: Relationship intelligence ideas pioneered by RelateIQ now inform Einstein-driven insights and agent-assisted sales workflows.

Outcomes and Evolution

RelateIQ played a quiet but important role in shaping modern Salesforce experiences:

- Reduced dependency on manual CRM updates.

- Improved understanding of relationship health and deal activity.

- Influenced Salesforce’s approach to automated data capture.

- Laid groundwork for AI-driven sales insights and recommendations.

While the RelateIQ and SalesforceIQ brands no longer exist, the core capability using data to understand relationships remains embedded across Salesforce’s AI-powered CRM features.

Today, RelateIQ’s legacy lives on inside Sales Cloud, Einstein, and agent-driven experiences quietly shaping how Salesforce helps teams build and maintain stronger customer relationships.

17. Steelbrick (Salesforce CPQ)

- Deal Announcement: February 2, 2016

- Acquisition Completion: April 30, 2016

- Deal Value: $360 million

Why Did Salesforce Buy Steelbrick?

The reason Salesforce acquired Steelbrick was to address a critical gap in Salesforce’s revenue lifecycle. Before Steelbrick, Salesforce excelled at managing sales pipelines and customer relationships, but complex pricing, configuration, and quoting workflows often lived outside the CRM.

With the Salesforce Steelbrick acquisition, Salesforce got Configure-Price-Quote (CPQ) capabilities directly into the Sales Cloud. This allowed sales teams to generate accurate quotes, enforce pricing rules, manage complex product bundles, and accelerate deal cycles, right inside the CRM. Steelbrick quickly became Salesforce CPQ, forming the backbone of Salesforce’s quote to cash motion for enterprise sales teams.

What Changed After Salesforce Acquired Steelbrick?

After Steelbrick was acquired by Salesforce, CPQ became a core component of Sales Cloud for organizations with complex pricing and product structures.

- Salesforce CPQ was well-integrated with Sales Cloud, Billing, and later Revenue Cloud, enabling end-to-end revenue workflows.

- The product became widely adopted in industries with subscription models, usage-based pricing, and complex approvals.

- Over time, Salesforce recognized architectural limits in the managed-package CPQ model, especially as revenue operations became more automated, API-driven, and AI-assisted.

Current Update on CPQ’s Positioning

Salesforce didn’t retire CPQ fully, and moved it into a transition phase.

- Salesforce CPQ has reached End of Sale (EOS), which means new customers can no longer purchase legacy CPQ licenses.

- Existing customers can continue using and renewing CPQ, with support maintained for the coming future.

- Active innovation on legacy CPQ has slowed as Salesforce shifts strategic investment towards Revenue Cloud.

Viewing it as a bigger picture, this is not a depreciation driven by failure, but by evolution. Salesforce is moving away from managed-package architectures towards native, platform-level revenue services.

How will CPQ contribute to the Revenue Cloud and AI?

Currently, CPQs functionality lives in the Salesforce ecosystem, but within a broader, more flexible framework.

- Revenue Cloud has become Salesforce’s strategic quote-to-cash platform, expanding beyond traditional CPQ into pricing, billing, contracts, and revenue lifecycle management.

- AI-driven workflows and Agentforce require more composable, API-first execution layers than legacy CPQ could support.

- CPQ’s concepts (pricing rules, product configuration, approvals) are being re-architected as native services rather than standalone packages.

Steelbrick was a foundational acquisition that helped Salesforce own the revenue moment. While Salesforce CPQ is no longer the long-term product direction, its impact lives on through Revenue Cloud and AI-driven revenue workflows.

18. Radian6 (Social Listening to Service & Marketing Intelligence)

- Deal Announcement: March 30, 2011

- Acquisition Completion: May 2, 2011

- Deal Value: ~$326 million

Why did Salesforce buy Radian6?

Salesforce acquired Radian6 to help businesses understand what customers were saying about them in public digital spaces. At the time, important customer conversations were happening on social media, blogs, and online forums, outside traditional CRM systems.

Radian6 gave Salesforce the ability to listen to those conversations in real time. This helped businesses spot issues early, understand customer sentiment, and respond faster. The acquisition extended Customer 360 beyond direct interactions and into the broader digital world where opinions and influence were being shaped.

Simply put, Salesforce recognized that customer data was no longer limited to forms and transactions—it also lived in open conversations.

What Changed After Salesforce Acquired Radian6?

After the acquisition, Salesforce gradually brought Radian6 into its service and marketing platform:

- 2011–2012: Radian6 became Salesforce’s core social listening tool, tracking brand and customer conversations across the web.

- 2012–2014: Integration with Service Cloud allowed teams to turn social posts into service cases and respond through standard workflows.

- 2014–2016: Radian6 and Buddy Media were combined into Social Studio, unifying listening, publishing, and engagement.

- 2017–2020: The focus shifted from monitoring volume to managing meaningful customer engagement.

- Later years: Salesforce streamlined its social tools as customer data strategies evolved, while retaining the underlying intelligence concepts.

Outcomes and Evolution

The Radian6 acquisition helped reshape how Salesforce customers engaged with their audiences:

- Social channels became part of everyday service and support operations.

- Businesses gained earlier visibility into customer concerns and brand perception.

- Public conversations were captured and managed alongside CRM data.

- Customer 360 expanded to include external sentiment, not just owned data.

Even though Social Studio was eventually retired, the idea of listening to customers everywhere stayed key for Salesforce.

Radian6 was not just about social media. It helped Salesforce learn how to understand real-time customer signals and manage large amounts of unstructured data.

Many of today’s real-time insights and AI-driven tools at Salesforce were built on what they learned from Radian6.

19. MapAnything

- Deal Announcement: April 17, 2019.

- Deal Completion Date: May 31, 2019.

- Deal Value: $225 million

Why did Salesforce acquire MapAnything?

Salesforce acquired MapAnything to solve a practical problem: CRM data without location context limits how field teams work. Sales and service teams knew who to engage, but not always where to go next or how to prioritize time in the field.

MapAnything added spatial awareness to CRM. It allowed Salesforce to place accounts, leads, assets, and opportunities onto a live geographic layer, helping teams plan visits, manage territories, and make smarter decisions based on proximity and coverage. This made Salesforce more usable for teams whose work happens outside the office.

What Changed After Salesforce Acquired MapAnything?

After the acquisition, MapAnything was fully folded into Salesforce and became Salesforce Maps, a native platform capability:

- Embedded mapping: Customer, lead, and asset locations surface directly inside CRM records.

- Territory planning: Sales leaders visualize coverage gaps and rebalance territories with geographic clarity.

- Route planning: Field reps reduce travel time by optimizing daily routes within Salesforce.

- Location-based automation: Geofencing enables workflows to respond to where work is happening.

- Mobile-first execution: Mapping capabilities extend naturally to Salesforce mobile experiences.

Outcomes and Evolution

MapAnything no longer operates independently. Its technology lives entirely within Salesforce Maps.

This acquisition was about realism. Salesforce recognized that field execution depends on geography, not dashboards alone. Salesforce Maps now works quietly in the background, helping teams decide where to spend time, how to move through territories, and how to act faster with location as context, not complexity.

20. Heroku

- Deal Announcement: December 8, 2010.

- Deal Completion Date: January 3, 2011.

- Acquisition Price: $212 million

Why did Salesforce acquire Heroku?

Salesforce acquired Heroku at a moment when customer systems were expanding beyond CRM screens. Businesses wanted to launch lightweight apps, services, and integrations that could move fast, without being limited by rigid platform models.

Heroku provided that flexibility. It gave Salesforce a way to support modern application development while keeping customer data connected to the core platform. The intent behind the Salesforce Heroku acquisition was straightforward: allow teams to build quickly, experiment safely, and still rely on Salesforce as the system of record.

Heroku wasn’t brought in to replace platform development. It was brought in to absorb everything that didn’t belong inside CRM, but still needed to work with it.

What Changed After Salesforce Acquired Heroku?

2011–2013: Extending Salesforce Beyond CRM Boundaries

Heroku became the environment for customer-facing apps, internal tools, and early mobile workloads that needed speed over structure.

2014–2017: Operationalizing Data Access

With Heroku Connect, Salesforce enabled direct, governed data synchronization between custom apps and CRM objects, without stressing developers with complex integration layers.

2018–2020: Enterprise Adoption Without Lock-In

Salesforce aligned Heroku with enterprise identity, security, and compliance standards, making it accessible for regulated use cases while preserving developer independence.

2021–2023: Embedded Application Experiences

Heroku AppLink reduces back and forth between custom apps and Salesforce users, allowing applications to appear naturally inside Salesforce workflows.

2024–2025: Supporting Event-Driven and AI-Linked Systems

With capabilities like Heroku Vibes and Heroku AI platform, it kept supporting event-driven architectures along with responding to Salesforce signals and powering AI-adjacent services, agents, and microservices.

Outcomes and Evolution

Rather than pushing everything into Salesforce clouds, Heroku allows Salesforce to stay adaptable.

Heroku gives Salesforce flexibility without disrupting the core platform. It provides a space where teams can experiment, build custom services, and support specialized requirements while staying connected to trusted Salesforce data.

21. CloudCraze (Salesforce B2B Commerce)

Deal Announcement: May 1, 2018

Acquisition Completion: June 18, 2018

Deal Value: $190 million, paid in cash and stock awards

Why did Salesforce buy CloudCraze?

CloudCraze provided a native Salesforce-platform B2B commerce solution built on Lightning and fully integrated with Salesforce data and workflows. This helped remove the disconnect many B2B companies faced between their commerce systems and customer records, allowing Salesforce to offer a unified commerce experience across business models.

CloudCraze provided a native Salesforce-platform B2B ecosystem. While Salesforce sorted its B2C commerce strategy with demandware, many customers still needed a commerce solution tailored to simplify complex B2B buying models, including account-based pricing, multi-channel ordering, contract pricing, and deep integration with CRM and ERP systems.

What Changed After Salesforce Acquired CloudCraze

Since CloudCraze joined the Salesforce ecosystem, it has evolved into Salesforce B2B Commerce Cloud. Here is the journey of CloudCraze in becoming a Salesforce product:

- 2018–2019: Rebranded as Salesforce B2B Commerce, running natively on the Salesforce platform and leveraging core services such as identity, security, and Lightning UI.

- 2020–2021: Expanded support for complex B2B models, including contract pricing, bulk ordering, product catalogs, and multi-site experiences tightly integrated with Sales Cloud and Service Cloud.

- 2022–2023: Deepened integrations with Order Management, CPQ/Revenue Cloud, and Data Cloud, enabling unified lifecycle commerce and richer customer data flows.

- 2024–2025: B2B Commerce became a key source of buying intent, feeding transactional and behavioral signals into personalization engines and analytics.

- AI: Enabled Agentforce and Einstein AI to trigger recommendations, automate reorder suggestions, and anticipate procurement needs based on commerce behavior.

Where is CloudCraze now in the Salesforce ecosystem?

With time, CloudCraze, now Salesforce B2B Commerce Cloud, has enabled companies to modernize how they sell to businesses online:

- B2B sellers moved on from disconnected legacy storefronts toward experiences that are integrated with CRM and service data.

- Buyers gained self-service ordering, contract pricing visibility, and personalized catalog experiences.

- Commerce data feeds into Data Cloud, helping power analytics, segmentation, and automated engagement.

- AI-driven personalization and Agentforce enable proactive engagement, such as automated reorder prompts, pricing suggestions, and service follow-ups.

- Integration with Revenue Cloud, Order Management, and CPQ provides a more complete quote-to-cash and post-purchase experience.

Together, this has positioned Salesforce B2B Commerce as a platform where transactions and relationships operate side by side, embedded directly into sales, service, and revenue workflows.

22. Jigsaw (Salesforce Data Services to Data.com)

Deal Announcement: April 21, 2010

Acquisition Completion: May 10, 2010

Deal Value: $142 million in cash, plus potential earn-outs

Why did Salesforce buy Jigsaw?

Salesforce Jigsaw acquisition brought reliable business contact and company data directly into CRM. Simultaneously, sales teams often relied on separate data vendors or manual research to find accurate contact information, which slowed the prospecting process and increased data inconsistencies.

Jigsaw operated a crowd-sourced, Wikipedia-style business data platform, where users contributed and validated contact and firmographic information in real time. By acquiring Jigsaw, Salesforce entered the cloud-based business data services market and took CRM to the next level with richer, more current prospect data.

This move extended Salesforce beyond managing customer relationships to improving the quality of the data behind those relationships.

What Changed After Salesforce Acquired Jigsaw

After the acquisition, Jigsaw became a core part of Salesforce’s data enrichment capabilities:

- 2010–2012: Jigsaw was integrated into Salesforce and rebranded as Data.com, enabling users to enrich leads and contacts directly within CRM.

- Crowd-sourced accuracy: The contribution model helped keep contact data fresh and validated by the community.

- Sales productivity: Sales teams could discover, update, and maintain prospect data without leaving Salesforce.

- Cross-cloud use: Enriched data supported sales, service, and marketing workflows.

- Platform evolution: Over time, Salesforce moved from crowdsourced data toward automated enrichment and broader data partnerships.

Outcomes and Evolution

The Jigsaw acquisition delivered clear operational value:

- Faster prospecting with fewer manual research steps.

- Improved data completeness and consistency across CRM records.

- Better targeting and segmentation for sales and marketing teams.

- Reduced duplication and cleaner account and contact data.

As data strategies evolved, Salesforce retired Data.com, but the underlying lesson remained: data quality is foundational to CRM effectiveness.

23. Salesforce Evergage (Marketing Cloud Personalization)

- Deal Announcement:

- Acquisition Completion: February 03, 2020

- Deal Value: $100 million

Why did Salesforce acquire Evergage?

Salesforce acquired Evergage to strengthen how brands deliver real-time, individualized customer experiences. At the time, Marketing Cloud was effective for campaigns and automation, but customers want more control on what happens in the moment, when someone visits a site, opens an app or interacts with a brand digitally.

Evergage brought real-time behavioral tracking and personalization that could respond instantly to customer actions. This allowed Salesforce to move beyond scheduled messaging and support experiences that adapt as customers engage. Over time, Evergage became the foundation for what is now known as Marketing Cloud Personalization, extending Customer 360 from understanding customers to responding to them in real time.

How Evergage evolved inside Salesforce

After the acquisition, Evergage’s technology was steadily woven into the Salesforce platform:

- Initially reintroduced as Marketing Cloud Interaction Studio, focused on real-time profiles and behavioral signals

- Gradually connected with Journey Builder and Email Studio, allowing personalization to influence automated journeys

- Later integrated with Data Cloud, enriching profiles with cross-channel interaction data

- Repositioned as Marketing Cloud Personalization, reflecting its role as a core experience layer rather than a standalone tool

- In the AI era, its signals now support AI-driven recommendations and agent-assisted interactions across marketing, commerce, and service

What changed after the acquisition?

Since Evergage became part of Salesforce:

- Personalization shifted from rule-based segments to behavior-driven experiences.

- Customer interaction data became a shared input for Data Cloud and AI decisioning.

- Marketing journeys became more responsive to real-time intent.

- AI and Agentforce workflows gained richer context for guiding next actions.

- Brands moved closer to delivering consistent, relevant experiences across channels.

Marketing and digital teams began reacting to customer behavior as it happened, rather than planning engagement around assumptions and schedules.

24. InStranet (Service Cloud Knowledge)

Deal Announcement: August 20, 2008

Acquisition Completion: August 4, 2008

Deal Value: ~$31.5 million

Why did Salesforce buy InStranet?

Salesforce acquired InStranet to strengthen the knowledge foundation of customer service inside CRM. At the time, customer support teams, especially in B2C call centers, relied heavily on disconnected knowledge bases, documents, and internal systems that slowed down issue resolution.

InStranet specialized in enterprise knowledge management, with technology designed to deliver fast, relevant answers to agents while they were actively supporting customers. By bringing InStranet into Salesforce CRM, Salesforce aimed to help service agents find the right information quickly, reduce handling time, and improve the overall service experience.

For Salesforce, this acquisition addressed a critical gap: service efficiency depended not just on case tracking, but on how effectively knowledge could be captured, searched, and reused.

What Changed After Salesforce Acquired InStranet

After the acquisition, InStranet’s technology became foundational to Salesforce’s service capabilities:

- 2008–2010: InStranet’s knowledge base technology was integrated into Salesforce’s customer service offerings.

- Early Service Cloud era: The acquisition helped power Service Cloud Knowledge, enabling agents to surface relevant answers during live interactions.

- Search relevance: Improved indexing and relevance ranking allowed agents to find accurate information faster.

- Knowledge reuse: Support organizations could create, manage, and reuse articles across channels.

- Platform evolution: Core concepts from InStranet shaped Salesforce’s long-term approach to service knowledge management.

Outcomes and Evolution

The InStranet acquisition delivered practical, measurable improvements for service teams:

- Faster issue resolution for call center agents.

- Reduced average handle time through better knowledge access.

- More consistent answers across support channels.

- Stronger self-service and assisted service experiences.

At the time, this was one of Salesforce’s largest acquisitions and a clear signal that service quality and agent productivity were strategic priorities.

InStranet was an early but important building block. Internally, it reinforced the idea that great service depends on how well knowledge flows, not just how cases are logged.

25. Navajo System

Deal Announcement: August 2011

Acquisition Completion: August 2011

Deal Value: ~$30 million

Why did Salesforce buy Navajo Systems?

Salesforce acquired Navajo Systems to strengthen cloud security and data protection across its SaaS platform. As more sensitive enterprise data moved into Salesforce, customers needed stronger guarantees that data would remain protected—not just in transit, but at rest as well.

Navajo Systems specialized in Virtual Private SaaS (VPS) encryption, allowing organizations to encrypt data stored in the cloud while retaining control over encryption keys. By bringing this capability in-house, Salesforce addressed growing enterprise concerns around data privacy, compliance, and trust.

This acquisition reflected Salesforce’s early recognition that security must be built into the platform, not layered on later.

What Changed After Salesforce Acquired Navajo Systems

After the acquisition, Navajo Systems’ technology influenced Salesforce’s security architecture:

- Data-at-rest encryption: Navajo’s VPS model helped strengthen Salesforce’s approach to encrypting stored customer data.

- Enterprise trust: Enabled Salesforce to better meet security expectations in regulated industries.

- Platform security evolution: Encryption and data protection became shared services across Salesforce clouds.

- Foundation for future security layers: Informed Salesforce’s long-term roadmap for data governance and protection.

Outcomes and Evolution

The Navajo Systems acquisition delivered long-term strategic value:

- Improved data protection for enterprise customers.

- Increased confidence for organizations moving sensitive workloads to Salesforce.

- Strengthened Salesforce’s position in security- and compliance-driven markets.

- Laid groundwork for later investments in platform trust, encryption, and governance.

Navajo Systems marked an important internal milestone. It was Salesforce’s first acquisition in Israel, directly leading to the establishment of Salesforce’s R&D presence in Tel Aviv. Beyond the technology itself, the acquisition brought deep security expertise into the organization at a time when cloud trust was still being earned.

These are some prominent Salesforce acquisitions till now. You can refer to the official Salesforce acquisitions news to keep up to date with all mergers.

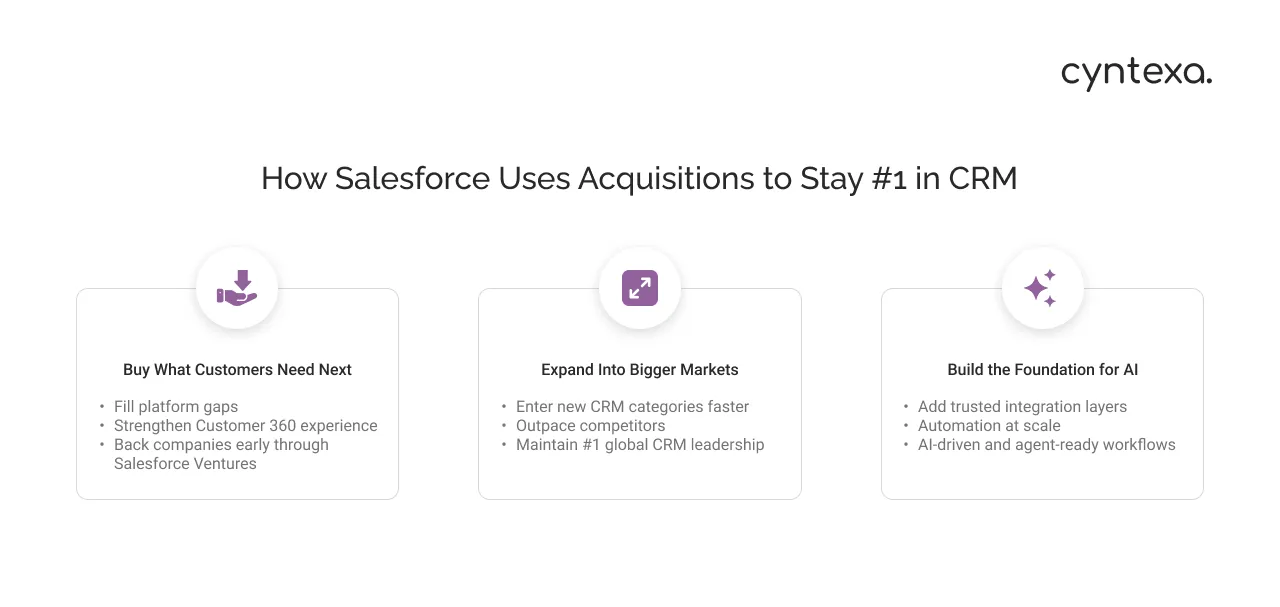

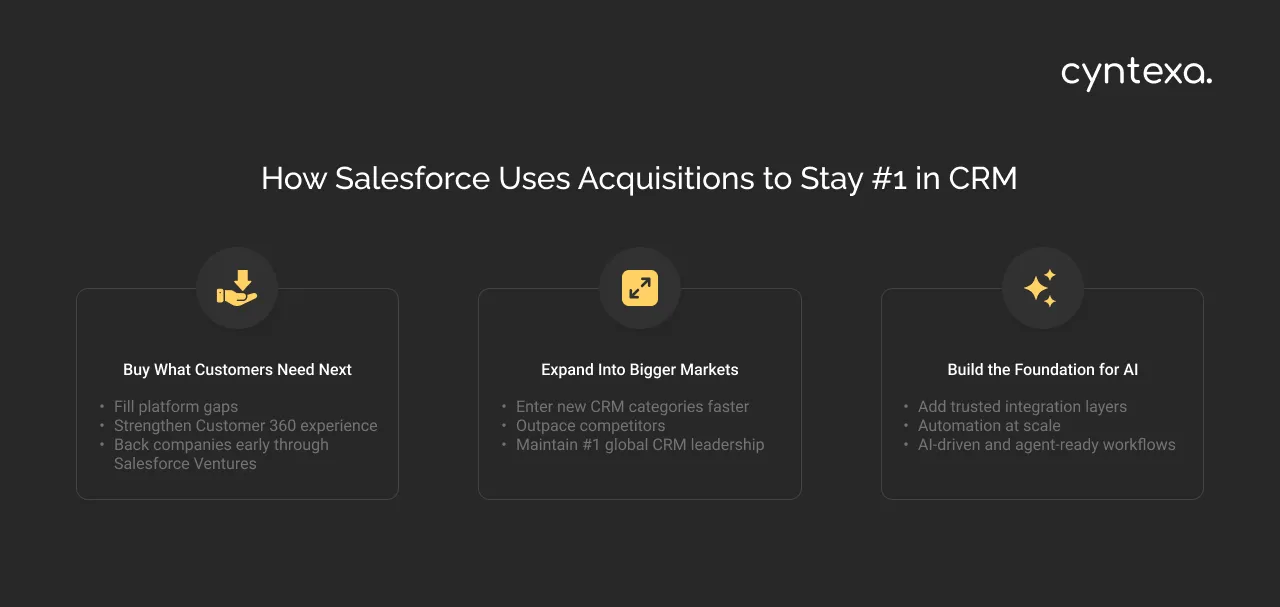

To truly understand how Salesforce manages to maintain its competitive edge in the CRM market, we need to explore its acquisition strategy.

Salesforce Acquisition Strategy: How It Maintains CRM Leadership

Salesforce’s acquisitions strategy is a dynamic and calculated move that does not simply mean adding new products but would create an all-inclusive ecosystem where businesses can seamlessly navigate all their operations.

Let’s demystify the core of Salesforce acquisition strategy:

1. Strategic Fit and Customer Value

Salesforce targets acquisitions that align with its long-term vision of improving customer engagement. These companies help Salesforce deliver more value through better tools and services.

Salesforce also uses Salesforce ventures to invest early. Since 2018, nearly 28% of acquired companies were previously backed by Salesforce, showing a “try before buy” approach allowing Salesforce to identify an opportunity to know whether the company is part of their ecosystem and thus commit fully to the acquisition of the company.

2. Market Expansion and Competitive Advantage

Next in consideration, we have market impact. Salesforce acquisitions are not solely targeted to expand its portfolio but are a strategic move to reshape the CRM landscape. By acquiring companies that are into constant innovation in what they bring on board, Salesforce has been outpacing the competition.

Salesforce holds a 21.8% CRM market share, more than its four largest competitors combined. IDC has ranked Salesforce as the #1 CRM leader for 11 straight years. Apparently, Salesforce left Microsoft and Oracle behind at 5.9% and 3.5%, respectively, due to its integration of advanced technologies into customer engagement and operational efficiency.

3. Innovation in Technology and Data Platforms

Salesforce acquisitions often add advanced technology allowing businesses to leverage those tools and optimize operations to build more meaningful terms with customers.

For example:

- MuleSoft improved integration across apps and data systems.

- Own Company ($1.9B) enhances data protection capabilities and is an increasingly essential component of customer trust in the contemporary digital environment.

These innovations support real-time insights, automation, and AI-driven decision-making.

As we enter the next ten years, Salesforce will continue to innovate through the purchase of other companies. The addition of AI and machine learning to its products will likely create better CRM solutions than before, which can predict what customers want and handle routine tasks automatically.

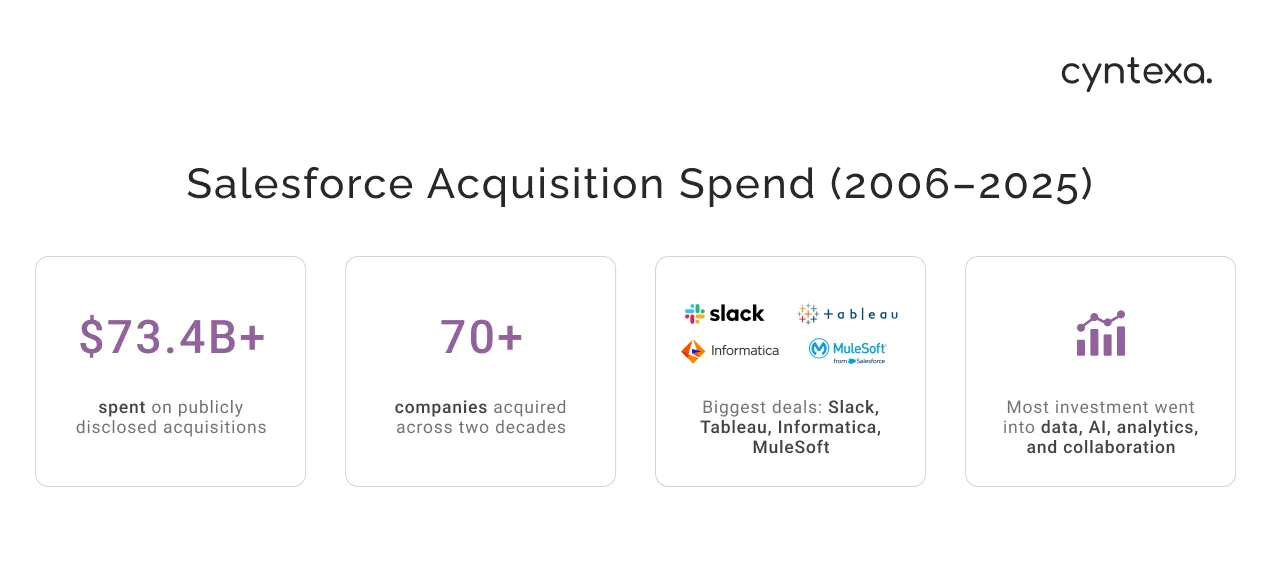

How Much Has Salesforce Spent on Acquisitions Between 2006 and 2025?

Salesforce has spent over $73.4 billion on acquisitions between 2006 and 2025, based on publicly disclosed deal values. This makes Salesforce one of the most aggressive acquirers in the enterprise software and CRM industry.

This total is not fully complete because Salesforce has made many smaller acquisitions where the financial terms were not announced.

Key Acquisition Details:

Salesforce has completed 70+ acquisitions to grow beyond traditional CRM, with a focus on analytics, data management, collaboration, commerce, and AI. Most of the disclosed spending comes from a small number of large, strategic deals. Here is the breakdown of the major and most impactful Salesforce acquisitions till now:

Largest and Most Impactful Salesforce Acquisitions

| Year | Acquisition | Deal Value | Strategic area |

|---|---|---|---|

| 2010 | Heroku | $212M | Developer platform |

| 2011 | Radian6 | $326M | Social listening |

| 2012 | Buddy Media | $689M | Social marketing |

| 2013 | ExactTarget | ~$2.5B | Marketing Cloud |

| 2016 | Demandware | ~$2.8B | Commerce Cloud |

| 2018 | MuleSoft | ~$6.5B | Integration & APIs |

| 2019 | Tableau | ~$15.7B | Analytics & BI |

| 2021 | Slack | ~$27.7B | Collaboration / Digital HQ |

| 2024 | Own Company | ~$1.9B | Data protection & resilience |

| 2024 | Spiff | ~$419M | Revenue operations |

| 2024 | Zoomin | ~$450M | Knowledge intelligence |

| 2025 | Informatica | ~$8.0B | Data management & governance |

What Does Salesforce’s $73.4B Acquisition Spend Mean?

The average deal size appears high largely because of a small number of very large acquisitions. In reality, most Salesforce acquisitions were smaller, often focused on specific technologies or teams, with deal values that were not made available or accessible for all.

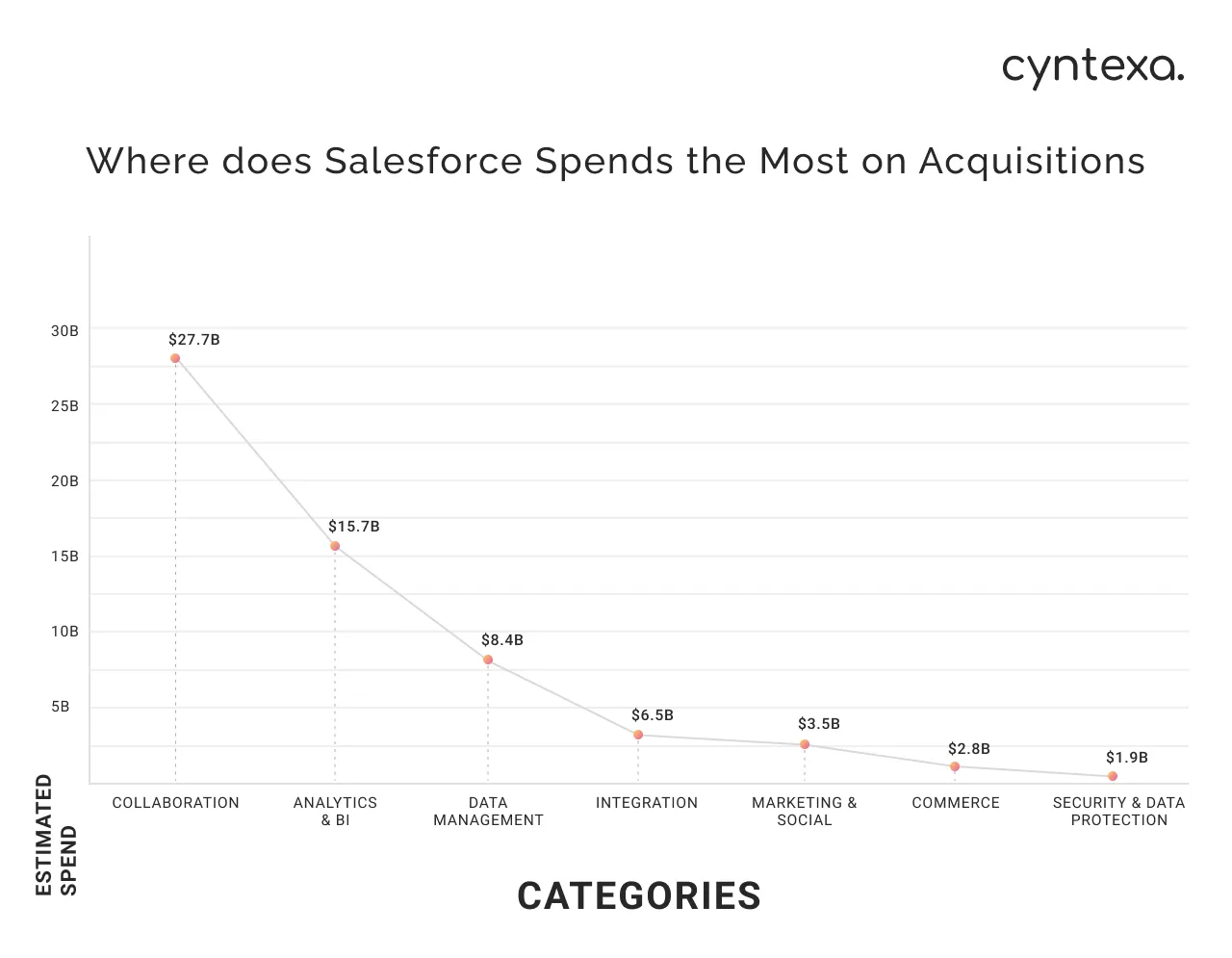

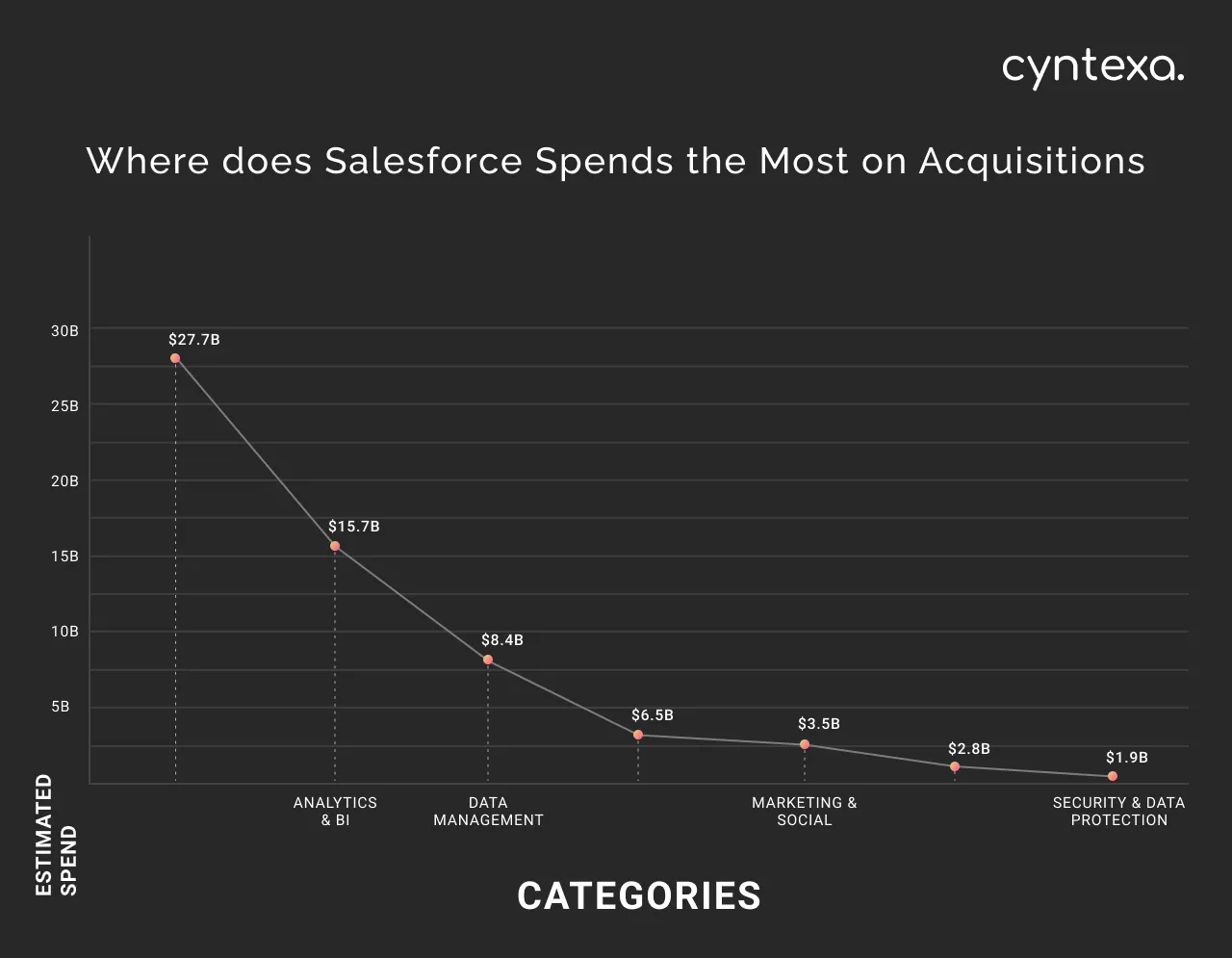

Where Does Salesforce Spend the Most on Acquisitions?

Salesforce acquisition spending is distributed in a few key areas, intended to strengthen the core platform. Most of the disclosed investment is bifurcated into collaboration, data management, data analytics and integration, where a small number of high-valuation deals account for the majority of total spend.

Salesforce Acquisition Spend by Category

| Category | Major acquisitions | Estimated spend |

| Collaboration | Slack | ~$27.7B |

| Data analytics & BI | Tableau | ~$15.7B |

| Data management & governance | Informatica; Zoomin | ~$8.45B |

| Integration | MuleSoft | ~$6.5B |

| Marketing & social | ExactTarget; Buddy Media; Radian6 | ~$3.52B |

| Commerce | Demandware | ~$2.8B |

| Security & data protection | Own Company | ~$1.9B |

| Revenue operations | Spiff | ~$419M |

| Platform / developer | Heroku | ~$212M |

Key Takeaways from Salesforce’s Spending Pattern:

- The largest share of spending is in collaboration and analytics, led by the Slack and Tableau acquisitions.

- Investments in data management and integration helped Salesforce to move towards trusted, enterprise-scale AI.

- Commerce, marketing, security, and revenue operations acquisitions are counted smaller but targeted to fill specific platform needs.

- Developer-focused acquisitions tend to be lower in deal size but supported Salesforce in offering long-term platform extensibility.

Most of Salesforce’s acquisition spend goes toward expanding core capabilities that bring people, data, and systems together.

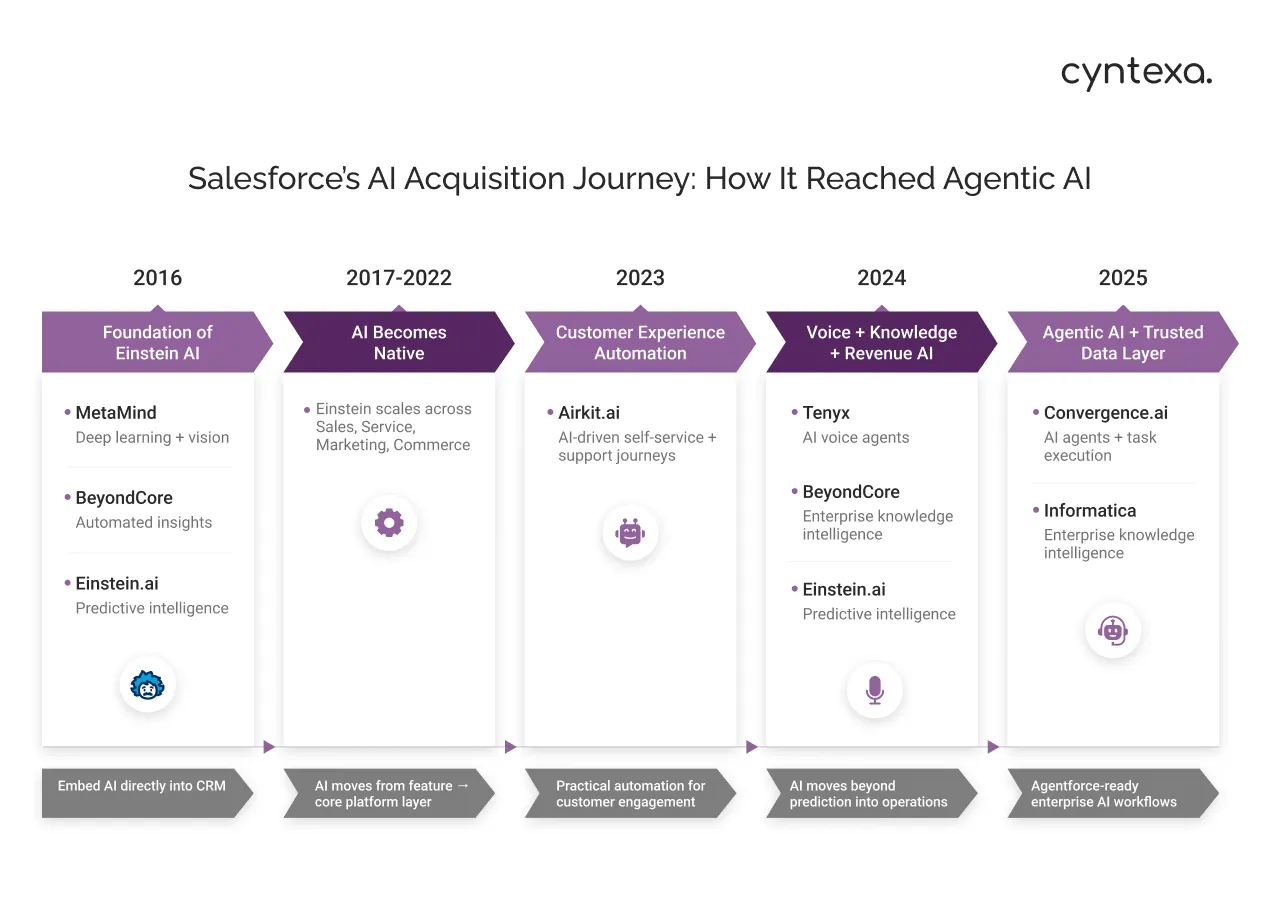

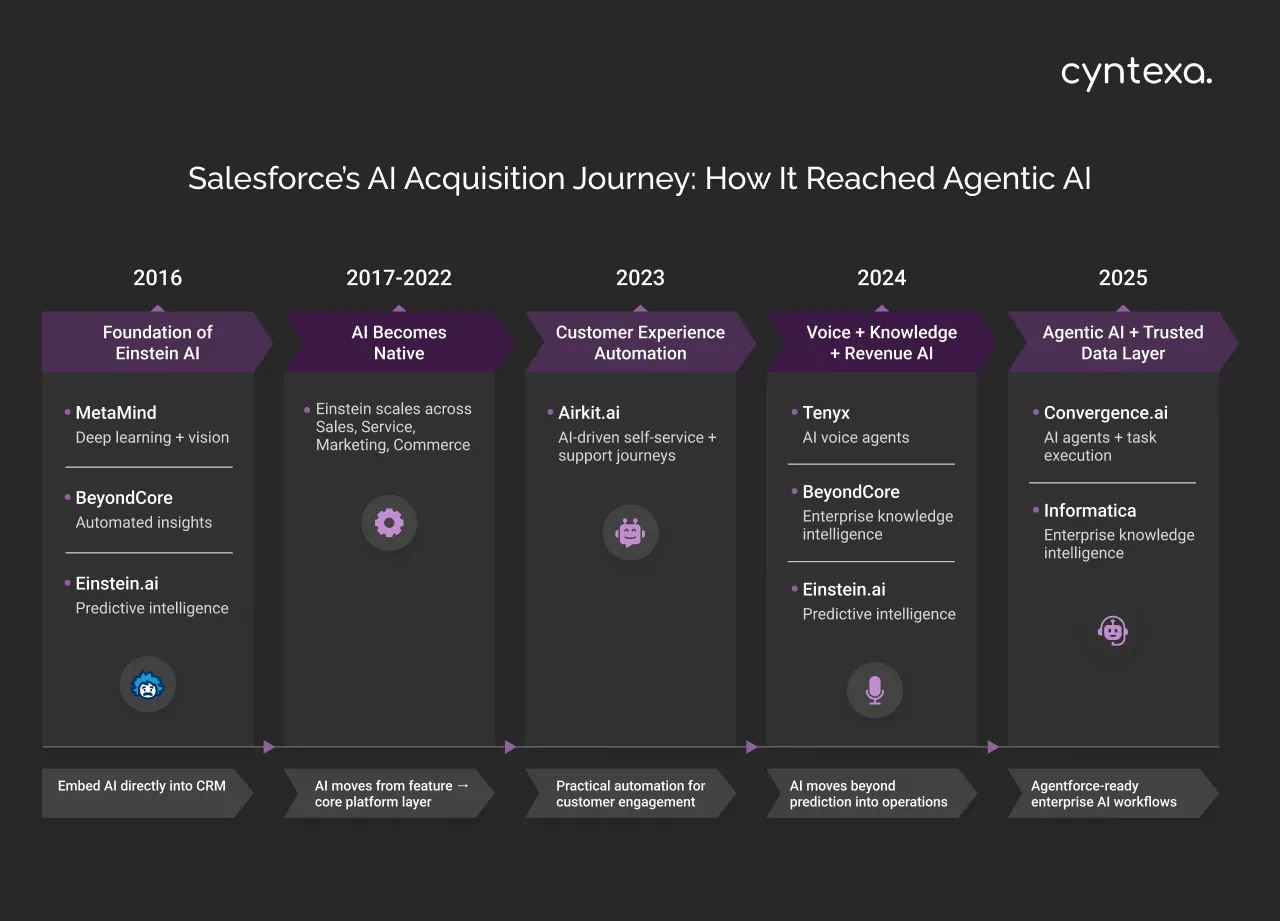

Salesforce’s AI Acquisition Journey: How It Reached Agentic AI

Salesforce has taken a clear and focused path in artificial intelligence. Instead of buying AI companies to create separate products, Salesforce has acquired AI capabilities that strengthen its core platform. Another purpose was to help customers apply AI in practical ways, grounded in trusted data and designed to work at enterprise scale.

Salesforce AI Acquisitions Timeline

1. The First Step: Creating Einstein AI (2016)

Salesforce began its AI journey in 2016 with three key acquisitions that became the foundation of Einstein:

- MetaMind – deep learning and computer vision

- BeyondCore – automated business insight

- Einstein.ai – predictive email intelligence

These early acquisitions helped Salesforce embed AI directly into CRM, rather than treating it as an add-on.

2. The Next Phase: Making AI a Native CRM Feature (2017–2022)

Between 2017 and 2022, Salesforce focused less on acquisitions and more on scaling Einstein across Sales, Service, Marketing, and Commerce, turning AI into a native platform capability rather than a separate product.

3. Expanding Into Customer Experience Automation (2023)

- In 2023, Salesforce acquired Airkit.ai to support AI-driven customer experience applications.

- This acquisition made it easier for businesses to build self-service tools, automated support journeys, and AI-powered engagement workflows.

4. Moving Beyond Predictions Into Voice and Knowledge AI (2024)

In 2024, Salesforce expanded AI into more real-time and operational areas:

- Tenyx ($14.8 Million) – AI voice agents

- Zoomin – enterprise knowledge intelligence

- Spiff – AI-assisted incentive and revenue operations

These moves expanded AI beyond prediction into conversation, knowledge access, and operational decision-making.

5. The Shift to Agentic AI and Trusted Data (2025)

By 2025, Salesforce’s acquisitions clearly reflected its move toward agent-based automation:

- Convergence.ai (terms undisclosed) – AI agents and task execution

- Informatica – data integration, governance, and quality

Together, these deals support Salesforce’s goal of building agentic AI workflows powered by trusted, governed business data.

Salesforce AI-Focused Acquisitions (Summary Table)

| AI startup | Year | Primary AI focus | Platform impact |

|---|---|---|---|

| MetaMind | 2016 | Deep learning, vision | Foundation of Einstein AI |

| BeyondCore | 2016 | Augmented analytics | Automated insights for business users |

| Einstein.ai | 2016 | Predictive NLP | Strengthened Einstein predictions |

| Airkit.ai | 2023 | AI-driven CX apps | Faster self-service automation |

| Tenyx | 2024 | Voice AI | Contact center automation |

| Zoomin | 2024 | Knowledge intelligence | AI-ready enterprise content |

| Spiff | 2024 | Revenue intelligence | AI-powered sales ops |

| Convergence.ai | 2025 | Agentic AI | Task execution via AI agents |

| Informatica | 2025 | Data governance | Trusted data for enterprise AI |

How Salesforce’s Acquisition Strategy Compares to Other CRM Leaders?

Enterprise CRM leaders don’t just compete on features. They compete on how they grow their platforms, how quickly they can add new capabilities, and how easily customers can adopt them. Salesforce, Microsoft, Oracle, and Adobe each follow a distinct acquisition philosophy shaped by their core strengths and long-term strategy.

Salesforce grows primarily through strategic acquisitions that expand platform capabilities, while Microsoft relies on ecosystem integration, Oracle on suite consolidation, and Adobe on experience-led expansion.

These strategies reflect different views on where customer value is created and how enterprise platforms should evolve.

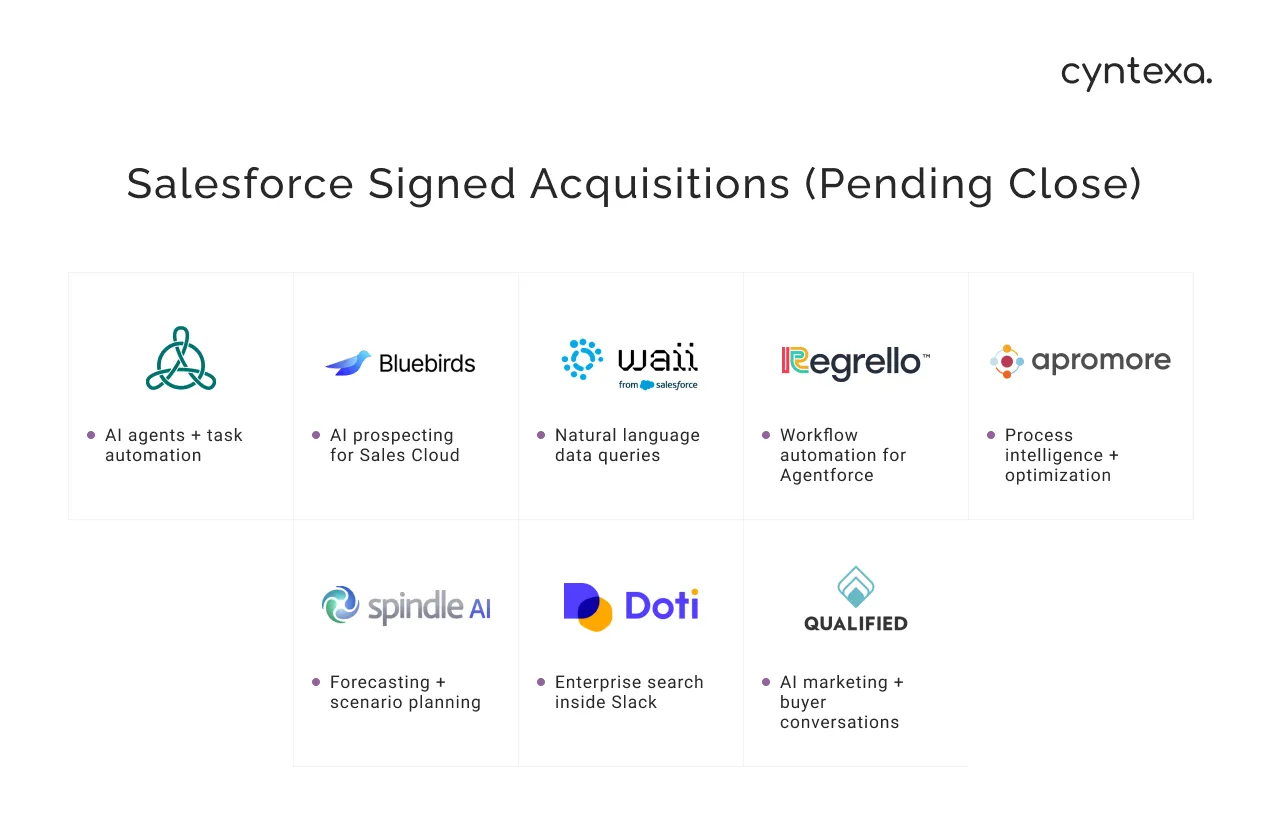

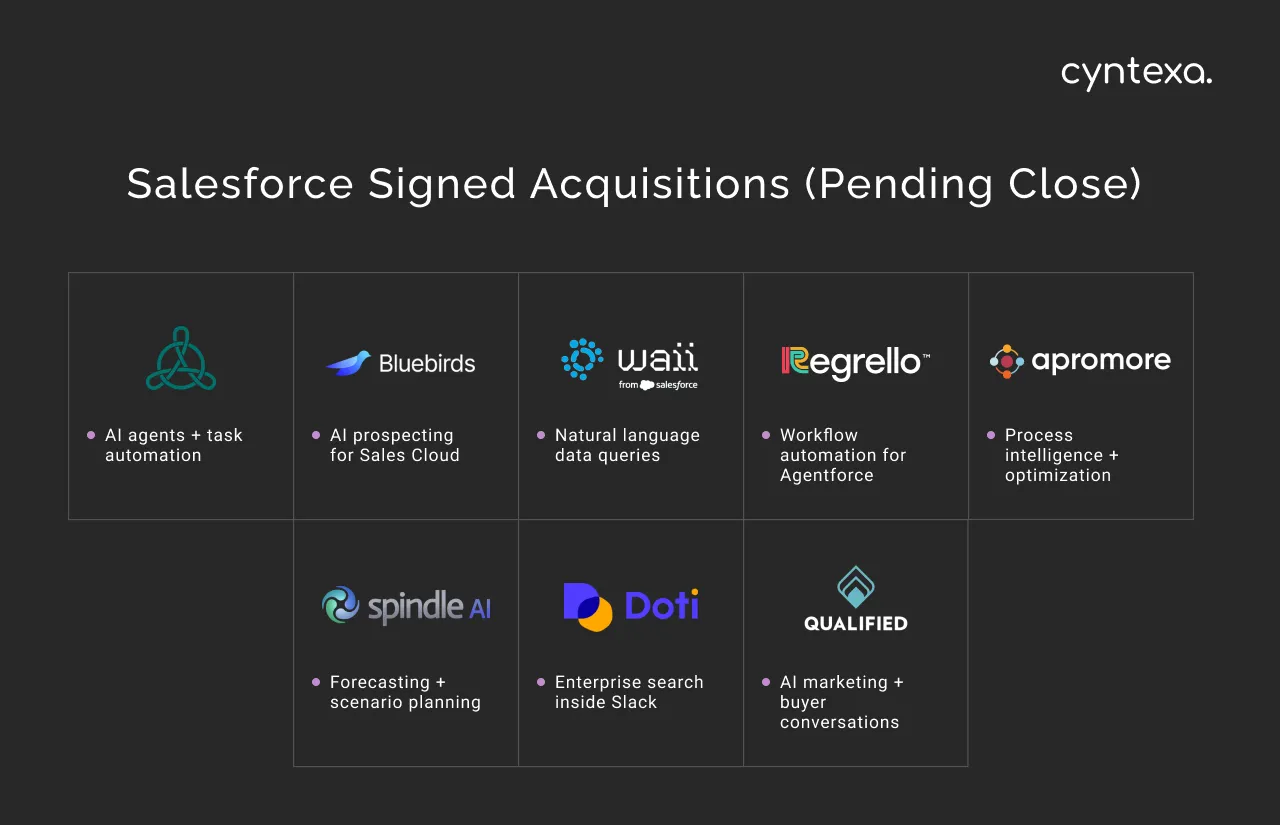

Salesforce Signed (Not Yet Closed) Acquisitions Timeline

Salesforce has signed agreements to acquire several AI and automation companies. These deals have not closed yet and remain subject to regulatory approval and customary conditions.

Together, they support Salesforce’s long-term strategy around Agentic AI, Agentforce, workflow automation, analytics, process intelligence, and marketing AI.

2025 Signed Acquisition Agreements

1. May 15, 2025 – Convergence.ai (expected close in 2025/26)

Convergence.ai builds adaptive AI agents that can execute complex, multi-step workflows across digital environments. Salesforce expects it to play a key role in advancing its Agentforce strategy by enabling more autonomous AI agents.

2. July 31, 2025 – Bluebirds (expected close in FY2026)

Bluebirds offers an AI-powered prospecting and lead intelligence platform to help sales teams identify and engage high-potential leads. Salesforce plans to integrate it into Sales Cloud and Agentforce to accelerate early-stage selling.

3. August 7, 2025 – Waii (expected close FY2026)

Waii provides a natural language-to-SQL platform that allows users to ask questions in plain language and generate accurate queries. This supports easier, more intuitive data exploration across Salesforce.

4. August 18, 2025 – Regrello (expected close Q3 FY2026)

Regrello is an AI-native workflow automation platform designed to turn business data into agent-driven workflows. Salesforce aims to connect it with Agentforce and Slack to automate complex processes.

5. October 9, 2025 – Apromore (expected close late 2025 / early 2026)

Apromore delivers process intelligence and optimization software, supporting process mining, simulation, and root-cause analysis. Its tools help enterprises improve operational visibility and workflow efficiency.

6. November 7, 2025 – Spindle AI (expected close FY2026)

Spindle AI focuses on agent-based analytics and scenario modeling, combining machine learning with forecasting and optimization. Salesforce expects it to enhance Agentforce insights and performance planning.

7. November 13, 2025 – Doti (expected close FY2026)

Doti delivers agent-based enterprise search and knowledge discovery, designed to surface connected insights across large data environments. It fits naturally with Slack as a conversational interface.

8. December 17, 2025 – Qualified (expected close FY2027)