Our client is a leading financial services firm serving a diverse clientele, including individual investors, businesses, and institutional clients. The firm operates across multiple financial sectors, including Insurance, Wealth Management, Banking, and Lending, offering a wide range of financial products and advisory services.

With a strong focus on digital transformation, the firm aimed to enhance customer engagement, streamline operations, and ensure regulatory compliance. It manages extensive client portfolios, risk assessments, and financial transactions while adhering to strict industry regulations.

Challenges

- Client Onboarding Complexity: The firm’s onboarding process relied on manual paperwork, resulting in delays and inefficiencies. Customers faced long waiting periods before their accounts were activated, leading to dissatisfaction and missed business opportunities.

- Regulatory Compliance Issues: Meeting compliance standards such as Know Your Customer (KYC) and Anti-Money Laundering (AML) was challenging due to outdated systems. Manual tracking increases the risk of errors, regulatory breaches, and potential penalties.

- Data Silos Across Departments: Customer data was fragmented across multiple systems, making it difficult for financial advisors and service teams to access a unified view of customer interactions. This disjointed approach hindered personalized service and operational efficiency.

- Inefficient Case Management: The client’s service teams struggled to handle client inquiries effectively due to the lack of automated case routing. This led to delays in resolving customer issues and impacted overall service quality. Moreover, the approval process for custom financial products was also slow, requiring multiple layers of manual intervention.

- Scalability Concerns: The existing infrastructure lacked the flexibility to scale with the firm’s growing customer base and expanding service offerings. As transaction volumes increased, system performance and efficiency were at risk of degradation.

Reason for Collaboration:

As the financial services firm faced significant challenges in client onboarding, compliance management, and data fragmentation, which impacted operational efficiency and customer experience.

Thus, to overcome these issues, the firm sought a Salesforce AppExchange solution to automate onboarding, enhance compliance accuracy, and unify customer data. They collaborated with us to develop a scalable, AI-powered solution that streamlined operations, improved service quality, and ensured seamless integration with core financial systems.

Solution

To address the firm’s challenges and enhance operational efficiency, we designed a scalable, AI-powered Salesforce AppExchange solution tailored for the financial services industry. This solution utilizes core capabilities of Financial Services Cloud (FSC) such as automated client onboarding, compliance-ready data models, and unified client data views, to enhance operational efficiency and elevate the customer experience.

- Automated Client Onboarding: A custom Salesforce AppExchange application was developed to automate the onboarding process. Digital KYC verification allowed customers to submit documents electronically, expediting the verification process. AI-driven risk assessment helped prioritize high-risk cases while accelerating approvals for low-risk customers.

- Compliance Automation: The solution integrated pre-configured workflows for KYC, AML, and financial reporting to ensure regulatory compliance. Automated tracking and alerts reduced manual oversight, lowering the risk of non-compliance.

- 360-Degree Customer View: A centralized data platform was implemented to unify customer information across all departments. This helped their financial advisors gain real-time access to customer portfolios, allowing them to provide tailored recommendations and improve engagement.

- AI-Driven Case Management: AI-powered case routing assigned inquiries based on urgency and agent expertise. Omni-channel support was introduced, enabling seamless customer interactions via email, chat, and phone. SLA tracking and automated escalation mechanisms ensured timely issue resolution.

- Optimized Pricing and Approval Workflows: Our developers implemented automated approval workflows to streamline pricing approvals. The solution reduced bottlenecks, enabling sales teams to generate quotes quickly and efficiently.

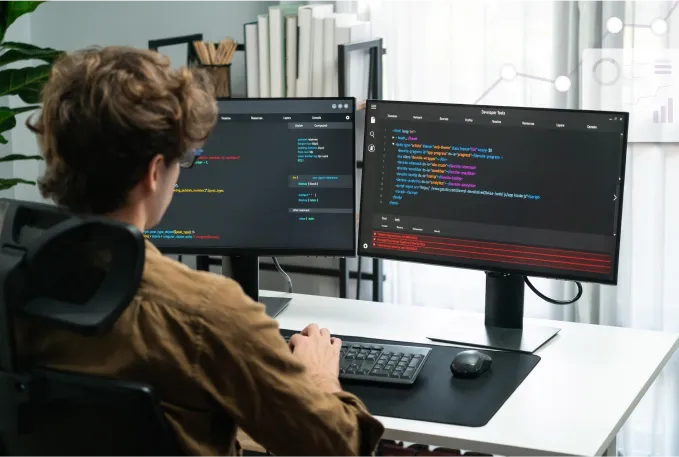

- Scalable, Secure Infrastructure: The solution was built using Lightning Web Components (LWC) for a modern user experience. MuleSoft integration enabled seamless connectivity with external banking, insurance, and investment platforms. Role-based access controls ensured data security while allowing authorized users to retrieve necessary information.

Benefits

- The customer onboarding process became seamless and faster.

- The automated tracking helps meet the compliance and regulatory standards.

- Unified data enabled better personalized service and customer engagement.

- The approval speeds and the case resolution process have significantly improved.