The Ultimate Guide For Salesforce Financial Services Cloud Implementation

Table of Contents

Imagine a customer walking into your bank and being greeted by a friendly representative who remembers your name and financial goals perfectly. Within a few seconds, they access their information, hear out their request, and provide an insightful solution.

“Well, this is a much better experience than I’d be having with them.” this is what’s going to trigger that customer.

Now, picture the delivery of this same level of personalization and efficient services to every single person who walks through the door. Let me take you into a secret vault behind this: They did this with Salesforce Financial Services Cloud.

Today’s customers expect seamless digital experience, personalized advice, and innovative and easily accessible tools that empower them to make informed decisions. Isn’t it natural when the money (sorry, finance) is involved?

The question then becomes: how can your financial institution keep pace with these evolving trends and provide the exceptional experience your customers deserve?

Salesforce financial services cloud is the answer, and how its capabilities are going to elevate the challenging situation financial service providers are facing is all included in this guide. Ready to explore more? Let’s get going.

→ Click here to download our free guide to Salesforce Financial Services Cloud Implementation [Download Now].

What is Salesforce Financial Services Cloud?

Salesforce Financial Services Cloud is a cloud-based platform and another fantastic offering from Salesforce designed for financial service providers. It offers an integrated and comprehensive solution that is customizable for each kind of financial institution.

The Financial Services cloud encompasses robust customer relationship management tools, enabling businesses to understand the customers better and serve with a hyper-personalized experience.

Emphasizing regulatory compliance and security, this cloud ensures financial organizations operate within industry regulations, safeguarding sensitive financial data.

Why Salesforce Financial Services Cloud?

1. Digital Transformation:

Open the App, Scan the QR code, & Pay. That’s how easy it got with Digital transformation in the financial sector. The extensive use of technology like blockchain and AI and the introduction of mobile banking, chatbots, and AI-powered recommendations have surpassed customers’ expectations.

This revolutionized operations and customer interactions and improved conveniences and accessibility for customers associated with financial institutions. Further, cross-platform data integration and automation have facilitated more paths toward efficiency and reduction in errors.

2. Data Analytics and AI:

Gone are those days when banks were totally dependent on intuition and experience. By leveraging AI to process vast amounts of data and extract advanced analytics, financial institutions are predicting spending habits, identifying future trends, and offering personalized financial advice.

For instance, a bank might analyze your spending data and suggest a budgeting tool or a savings plan based on your financial goals.

3. Open Banking:

When customers can easily share their financial information securely with third-party providers through APIs, then why would they juggle between multiple banks to compare investment options?

Open banking is something that provides customers access to innovative financial products and services, not limiting them to traditional institutions. Open banking facilitates collaboration and innovation and fosters a more competitive landscape, potentially benefiting consumers. DBS Bank in Singapore uses AI to analyze transaction patterns and identify potential fraud, averting losses exceeding $100 million in 2023.

4. Personalized Financial Experiences:

Consider this example: you log in to your bank application and receive personalized advice tailored to your financial goals. Well, this is happening today, a reality driven by AI and data analytics. It analyzes your spending habits, risk tolerance capabilities, and income and suggests customized investment options accordingly. It also tailors financial plans and targets products that fit best with your current financial status.

This shift towards personalized experiences creates a win-win scenario. It makes customers feel empowered and in control of their finances, simultaneously benefitting institutions from increased customer engagement and loyalty.

5. Cybersecurity and Data Privacy:

Bank of America recently spent $1 billion in strengthening its cybersecurity initiatives, data protection, and preventing cyberattacks. This is a large amount of money banks are investing in ensuring robust security measures to safeguard sensitive information and maintain trust. Financial Services Cloud is designed to adhere to data privacy regulations, following relevant data privacy regulations like GDPR and CCPA to protect customer data privacy.

Who is Salesforce Financial Services Cloud For?

Salesforce Financial Services Cloud caters to the different needs of various financial players within the industry:

1. Wealth Management Firms:

Financial advisors and wealth managers get a comprehensive view of clients, such as financial profiles, risk tolerance, and investment goals. This allows them to streamline financial planning, offer personalized investment strategies, and deliver exceptional client services.

2. Retail and Commercial Banks:

Banks that offer retail and commercial banking services can enhance customer engagement through personalized communications and omnichannel experiences via the Financial Services Cloud. It streamlines banking operations, simplifies loan application and account management processes, and empowers banks to offer personalized financial products and services tailored to individual customer needs.

3. Insurance Companies:

Insurance professionals can leverage the Financial Services cloud to manage customer relationships, automate tasks such as policy renewals, and streamline claims processes. This allows them to provide personalized insurance solutions and offer efficient customer support.

4. Asset Management Companies:

Asset managers gain valuable insights into client portfolios through advanced data analysis tools. This facilitates optimizing investment strategies, making data-driven decisions, and improving collaboration within teams for better portfolio management.

5. Financial Advisors and Planners:

Individual financial advisors and planners can enhance their efficiency by managing client relationships and automating routine tasks within the platform. This frees up valuable time to focus on providing personalized financial advice and building stronger client relationships.

6. Credit Unions:

Credit unions can leverage the cloud to enhance member engagement through personalized communications and targeted promotions. They can also streamline lending processes and offer personalized financial services to cater to members’ unique needs.

7. Hedge Funds and Private Equity Firms:

Hedge fund managers can manage investor relationships, monitor portfolios in real time, and make data-driven investment decisions using the platform’s advanced analytics capabilities. Private equity professionals can streamline deal management, track portfolio performance, and enhance communication with investors using collaborative tools offered by the cloud.

8. Financial Technology (Fintech) Companies:

Fintech firms can leverage the cloud to enhance customer experiences by offering innovative financial solutions and personalized services. The platform facilitates integration with existing systems, ensuring smooth data flow and operational efficiency. Additionally, it enables compliance with industry regulations through built-in security features and data management tools.

9. Brokerage Firms:

Brokerage firms can manage client relationships more effectively, streamline trading processes, and provide real-time insights into market trends for their clients. This empowers investors to make informed investment decisions and navigate the dynamic market landscape.

Salesforce Financial Services Cloud: Features

Salesforce Financial Services Cloud goes beyond a one-size-fits-all approach. It equips financial institutions with a range of features designed to boost efficiency, enhance customer engagement, and empower informed decision-making across various roles and departments. Here’s a closer look:

1. Role-Specific Functionality:

Financial Services Cloud offers role-based consoles, taking you one level up from generic interfaces. Service, insurance, wealth management, and banking consoles are some of the consoles that you can tailor as per your unique needs and workflows of different user groups, making the user experience precise and efficient.

2. Smart Lead Management:

When lead management meets the power of automation, taking care of customer interests, it promises suitable leads are falling in the funnel of the right advisors. FSC’s Einstein Scoring and Routing further streamline this process, automatically qualifying leads and assigning them to relevant professionals, maximizing conversion opportunities.

Regarding the referral system, the cloud offers convenient tracking and rewards to top referrers via dashboards, reports, email notifications, and messages. It builds a community of loyal customers and strengthens the power of word-of-mouth marketing.

3. Holistic Relationship Management:

This functionality provides a comprehensive view of all your clients by segmenting them into related accounts using Relationship Groups. These custom objects, like households or businesses, allow you to combine financial information, providing a complete picture of your client’s financial landscape.

4. Personalized Engagement:

You can capture and display personal or business milestones on client profiles using the Events and Milestones feature. This functionality allows personalized engagement by acknowledging meaningful life or business events.

5. Actionable Relationship Center (ARC):

ARC provides financial advisors, bankers, and investment bankers with a clear understanding of complex client relationships. It offers insights into household members, account history, deals, and executive information, all in one centralized location.

6. Interest-Based Targeting:

Internet-based targeting allows users to go beyond basic client information with customizable tags. Capture specific needs and interests, categorize them for easy reporting, and leverage these insights to personalize interactions and tailor services to your client’s unique preferences.

7. Streamlined Processes:

Users can automate repeatable tasks and enhance collaboration with Action Plans. Create templates with prioritized and assigned tasks for onboarding new clients, managing accounts, or fulfilling other specific processes. This ensures consistent and compliant execution of critical workflows.

8. Effortless Document Management:

Financial Services Cloud simplifies document workflows by defining document types, creating checklists for customer files, and tracking them through an approval process. This allows customers to upload and track documents seamlessly, ensuring a smooth and efficient document submission and approval process.

By harnessing these powerful features, Salesforce Financial Services Cloud empowers financial institutions to work smarter, not harder, providing an exceptional experience for both their employees and clients.

Is Financial Services Cloud Capable Of Shielding Confidential Financial Data?

When the world is going digital, even in the finance sector, keeping every bit of customer’s data is your utmost priority. However, not every tool is going to promise you bottleneck security, but Salesforce Financial Services Cloud ensures data security through a robust architecture and comprehensive safeguards:

1. Uncompromised Encryption with Salesforce Shield:

How it will make you feel better to have your client’s information secured by military-grade encryption. Salesforce Shield is embedded with the Salesforce financial services cloud and guards data at rest and in transit, ensuring accessibility to authorized users only. This layer of protection helps avoid the risk of unauthorized access and data breaches.

2. Granular Control with Access Controls:

Only some people need to access every piece of information in your database. Financial Services Cloud empowers you to manage access controls at very granular levels. With the help of role-based access controls (RBAC) and permission sets, you can easily manage user access. It helps you authorize individuals to access specific client data, safeguarding sensitive information.

3. Data Residency: Maintaining Local Compliance:

Data residency regulations are different in different territories, making it difficult for a business to keep each one of them into consideration while handling clients manually across regions. With FSC, you can manage data residency compliances, specifying the location of client data. This flexibility helps ensure compliance with regional regulations, fostering trust and transparency with your clients.

4. Prepared for the Unexpected: Incident Response:

The more security data needs, the more it is prone to cyber threats. But who says you have to worry about when you are working with the Financial Services cloud? It maintains incident response protocols. In instances of unfortunate security breaches, these protocols take out the shield, guaranteeing prompt and decisive actions and minimizing potential impact on your data and your client’s information.

5. Validating Trust: Compliance Certifications:

If you are in a dilemma about whether or not Salesforce FSC adheres to the highest global security standards like SOC 2 Type II and ISO 27001 certifications, then here is the reality. It follows all the necessary compliances involving third-party audits verifying the platform’s commitment to robust security practices and data protection measures. These certifications offer independent validation of the platform’s security posture, fostering trust and confidence with clients and regulators.

By employing these comprehensive safeguards, Salesforce Financial Services Cloud empowers you to prioritize the security of your client data, fostering trust, ensuring compliance, and enabling you to focus on delivering exceptional financial services with peace of mind.

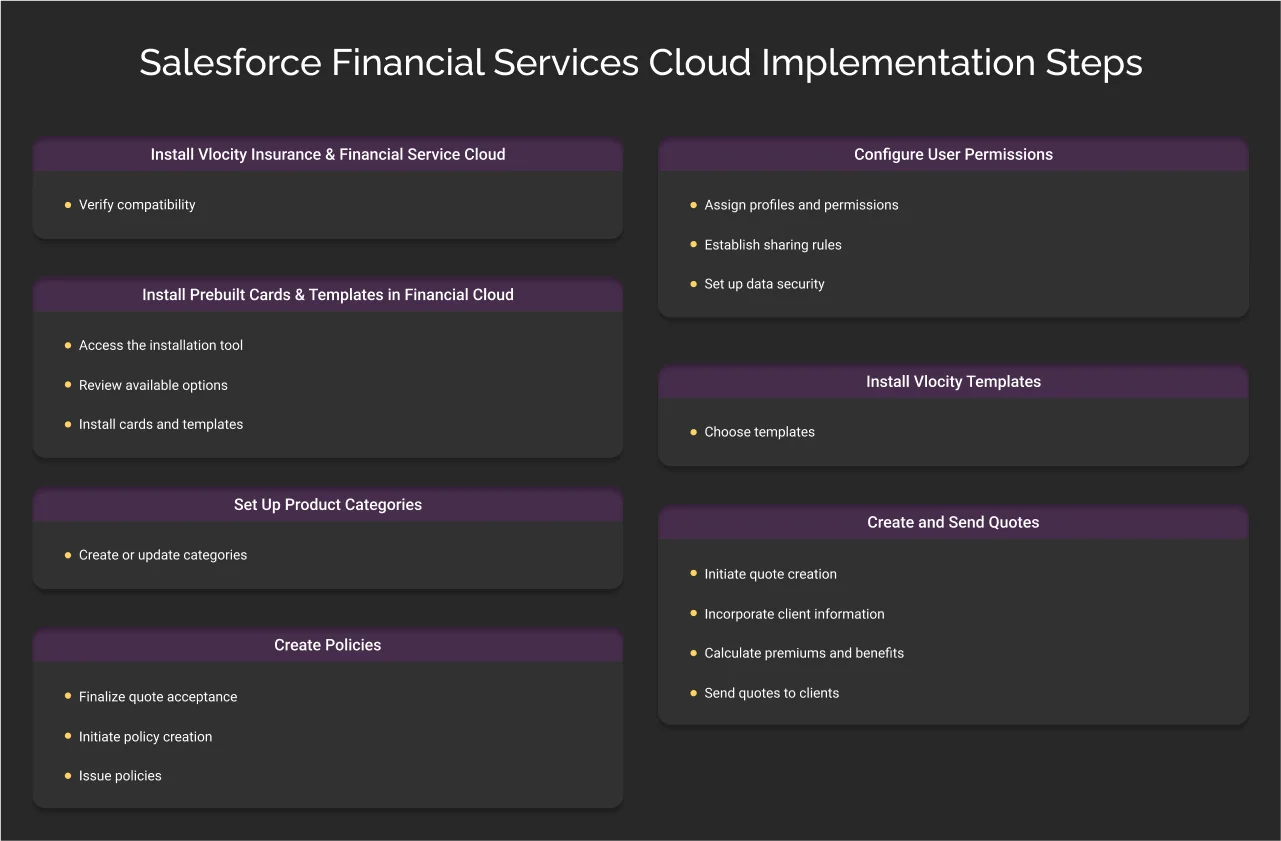

Salesforce Financial Services Cloud Implementation Steps

Following are the guided steps for successfully implementing Salesforce Financial Services Cloud:

1. Install Vlocity Insurance and Financial Services Cloud:

- Verify compatibility: Ensure your Salesforce org meets the technical requirements for Vlocity Insurance and Financial Services Cloud.

2. Configure User Permissions:

- Assign profiles and permissions: Grant appropriate access to objects, fields, and features based on user roles and responsibilities.

- Establish sharing rules: Determine how records and data will be shared among users and teams.

- Set up data security: Implement measures to protect sensitive information and comply with regulations.

3. Install Prebuilt Cards and Templates in Financial Cloud:

- Access the installation tool: Use the Vlocity OmniScript Designer or a similar tool to manage card and template installations.

- Review available options: Consider business needs and user requirements when selecting cards and templates.

- Install cards and templates: The installation process might vary depending on whether you use CPQ or a different configuration.

4. Install Vlocity Templates:

- Choose templates: Select the templates that align with your business processes and requirements.

5. Set Up Product Categories:

- Create or update categories: You can create or update your product in the eligible and underwriting category based on the product life cycle.

6. Create and Send Quotes:

- Initiate quote creation: Use the appropriate tools and processes within Vlocity Insurance to create quotes.

- Incorporate client information: Gather and input accurate information, including risk factors and coverage needs.

- Calculate premiums and benefits: Leverage the Vlocity rating engine to determine appropriate premiums and coverage levels.

- Send quotes to clients: Send generated quotes for review and approval.

7. Create Policies:

- Finalize quote acceptance: Ensure client acceptance of the quote terms and conditions.

- Initiate policy creation: Use Vlocity Insurance to generate the policy document, incorporating agreed-upon terms and coverage details.

- Issue policies: Issue the completed policy to the client, ensuring compliance with regulatory requirements.

Additional Considerations:

- Data migration: If necessary, migrate existing insurance data into Vlocity Insurance to ensure continuity of operations.

- Integration with other systems: Configure integrations with other systems, such as billing, claims, or customer relationship management (CRM), as needed.

- Testing and validation: Thoroughly test all configurations and processes before deploying to production environments.

- Ongoing maintenance and updates: Regularly apply updates and patches to maintain system security and functionality.

Salesforce Financial Services Cloud Benefits

The financial industry thrives on optimized operations and enhanced customer experiences. To achieve these goals, institutions need more than just efficient sales; they need strategic advantages. Here’s how Salesforce Financial Services Cloud empowers banks and insurance companies to gain a competitive edge:

1. Enhanced Collaboration and Shared Knowledge:

Financial Services Cloud fosters an elevated collaborative environment by making communication and information sharing between teams easy. It helps in reducing data siloes, providing you with a unified and consistent experience in terms of customer service. It brings all the relevant information together, from past financial records to interaction history, to anyone who needs it. This results in improved coordination and a boost in customer service.

2. Holistic Customer View for Personalized Service:

FSC shares a 360-degree view of your customers, centralizing all customer data, including financial history, past interactions, and preferences. This provides a holistic understanding to your teams so that they can anticipate customer needs, personalize offers, and foster closer relationships on time.

3. Streamlined Operations and Increased Efficiency:

It gives all the space to your teams by automating tedious, mundane tasks and simplifying processes like data entry, document generation, or compliance checks. It can automate anything that’s cutting down the productivity and strategic thinking ability of your people.

4. Data-Driven Decisions for Optimal Outcomes:

This Salesforce offering equips you with powerful data analytics and reporting functionalities. These intelligent tools transform raw information into actionable insights, making the identification of trends, optimizing strategies, and allocating resources less hectic. This data-driven approach facilitates informed decision-making, leading to improved business performance.

5. Seamless Compliance with Regulatory Requirements:

With the ever-changing regulatory requirements in the finance sector, compliance always tops the chart in case of priority. FSC simplifies this process by offering built-in compliance tools that enable you to automate compliance checks, track and document your activities, and generate reports for regulatory authorities, ensuring your organization stays compliant with ease.

By leveraging the capabilities of Salesforce Financial Services Cloud, your financial institution can gain a competitive edge, enhance efficiency, and cultivate deeper relationships with your customers, ultimately paving the way for sustainable growth and success.

Salesforce Financial Services Cloud Implementation: Real-World Use Cases

Case: Transforming Finance: A Global Leader Streamlines Operations with Salesforce CRM and Financial Services Cloud

The client is a global leader in the finance sector and has embarked on a transformative journey to revamp their banking and loan services. Recognizing the need for technological advancement, the company sought to implement Salesforce CRM and Salesforce Financial Services Cloud to streamline operations, enhance customer engagement, and boost overall service efficiency. The goal was to integrate advanced CRM capabilities with sophisticated loan management processes.

Problems faced:

Manual and Disconnected Lead Management

The client’s lead management could have been more efficient due to a manual and uncoordinated process. Gathering leads from multiple sources, such as direct entries and Facebook API, with a unified system led to better management. This disjointed approach resulted in challenges tracking customer interactions, causing missed opportunities and reduced engagement. The manual process also increased the risk of errors in lead data, complicating the sales pipeline.

Inefficient Preliminary Data Collection

The preliminary data collection process from potential customers could have been more efficient and cohesive. Sales Representatives and Field Operations Executives utilized different systems for gathering customer information, leading to disjointed and incomplete data capture. This lack of standardization not only risked inaccuracies but also created barriers to understanding customer needs and preferences. The inconsistent data collection negatively impacted the quality of customer insights for the sales teams, hampering effective customer relationship management.

Complex Loan Application and Approval Processes:

The client’s loan application and approval processes were complex and time-consuming, causing inconvenience for customers. Lengthy and cumbersome procedures, coupled with a lack of streamlined workflows and integration between stages, resulted in delays and inefficiencies. These complexities impeded the company’s ability to swiftly process loan applications, causing dissatisfaction and potential business loss.

Solution Offered:

For challenges like this, Salesforce Loyalty Management implementation was the ideal solution for them, pertaining precisely to what their system required, and our team did like this:

Optimized Lead Management System

To streamline lead management challenges, Salesforce CRM was integrated into the client’s Finance operations. This centralized platform efficiently handles leads from diverse sources, automating the process for seamless tracking and improved customer data accuracy. This automation reduces time and resources previously spent on manual lead handling, enhancing overall productivity and lead conversion rates.

Web Form Integration for Data Collection

Custom web forms were integrated into Salesforce CRM for efficient preliminary data collection. User-friendly and standardized across the organization, these forms enable Sales Representatives and Field Operations Executives to capture customer data consistently. Integrating these web forms into Salesforce eliminates data fragmentation, enhancing accuracy and completeness.

Automated Loan Application Process

Complex loan processes were simplified by implementing an automated system in Salesforce. This streamlined the entire workflow, from application to approval, with automated checks to expedite pre-qualification. This improved operational efficiency and enhanced the customer experience with faster loan processing times.

Result: Our efforts have led to

- Enhanced Lead Management by 35%

- Improved Data Collection Efficiency by 30%

- Streamlined Loan Processing by 40%

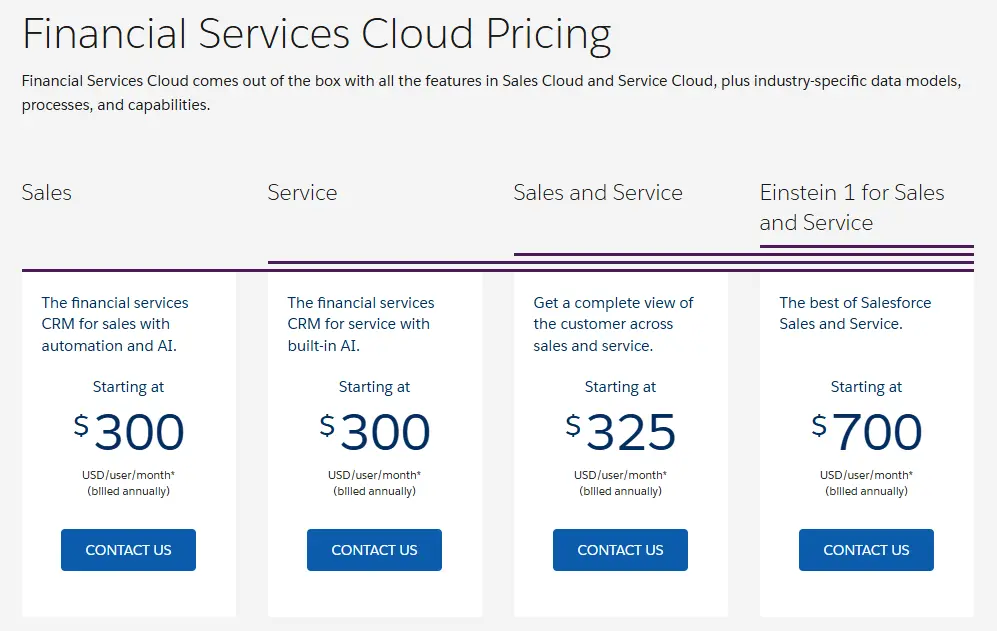

Salesforce Financial Services Cloud Pricing

Choosing the optimal Salesforce financial services cloud pricing depends entirely on your specific requirements. You can seek assistance from a Salesforce financial cloud consultant who can assist you in determining the most suitable pricing model for your needs:

Final Take

Businesses across the globe are experiencing mind-blowing results with Salesforce Financial Services Cloud implementation. Accenture recent research found that financial service providers using cloud solutions witnessed a 20% surge in customer satisfaction, highlighting the growing interest of businesses in cloud-based solutions.

Financial Services Cloud is at the forefront of playing a pivotal role in shaping the future of finance. Its continuous innovation, coupled with the ever-evolving financial patterns, presents exciting opportunities for businesses to embrace new technologies, personalize customer experiences, and stay ahead of the curve.

Cyntexa, as your trusted Salesforce implementation partner, is here to customize and integrate Salesforce Financial Services Cloud seamlessly into your existing systems, ensuring you maximize the platform’s potential.

Don’t Worry, We Got You Covered!

Get The Expert curated eGuide straight to your inbox and get going with the Salesforce Excellence.

Frequently Asked Questions

The Financial Service Cloud Salesforce Data Model is a structured format that defines how data is equipped and organized within the Financial Service Cloud platform. The data model includes objects and relationships that allow financial institutions to manage client information, financial accounts, interactions, and compliance data in a structured and compliant manner.

Salesforce Financial Services Cloud architecture refers to the underlying framework and design of the platform. It encompasses various components such as data storage, security, user interfaces, integrations, and scalability. The architecture is built to meet the complex needs of financial institutions, providing a secure and customizable environment for managing client relationships, financial accounts, and regulatory compliance.

Financial Services Cloud is not just a wealth management tool; it's a comprehensive customer relationship management (CRM) platform tailored specifically for the financial services industry. It enables financial institutions to manage all aspects of client relationships, including banking, insurance, financial planning, and regulatory compliance, in a single unified platform.

Financial Services Cloud is Salesforce's specialized solution for financial institutions, focusing on managing client relationships, financial accounts, and compliance, while Sales Cloud is a more general CRM for various industries.